The Year So Far: Nothing Is Like It Seems

Image Source: Pixabay

Every summer, I like to step back, grab my surfboard, and let the market run its course without me for a bit. But before heading to the beach, I always review how the year is shaping up.

2025 is a perfect reminder of how investing often feels contradictory: everything and nothing is happening at the same time.

Headlines about tariffs, global conflicts, and slowing economies dominate the news. Your neighbor may still be predicting a crash every other week. And yet here we are: the S&P 500 is up about 6% (including dividends) and the TSX 60 has returned more than 9% as of July 1. That’s resilience.

Nothing is Like It Seems

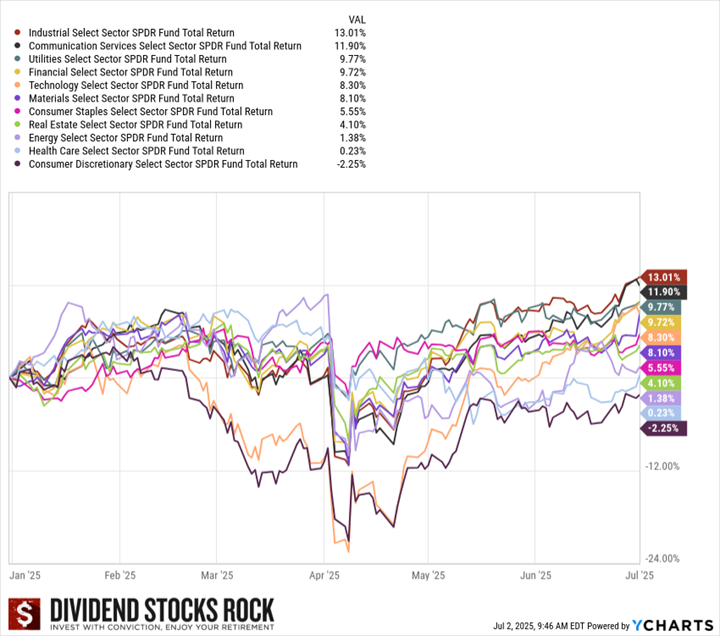

Despite all the noise, markets are holding up—and even thriving in places. In the U.S., Industrials are having a strong run, possibly helped by tariff-related reshuffling. Communications have rebounded, with Meta leading the way and AT&T finally finding its footing. Utilities, left for dead last year, are back in favor. And Financials—banks, insurers, and investment firms—are doing well too.

Meanwhile, the sectors that usually cause headaches continue to do so. Consumer Discretionary has struggled, Health Care is a mixed bag with both winners and disasters (UnitedHealth, anyone?), and Energy is back in the bottom three performers.

(Click on image to enlarge)

2025 Total return by sector.

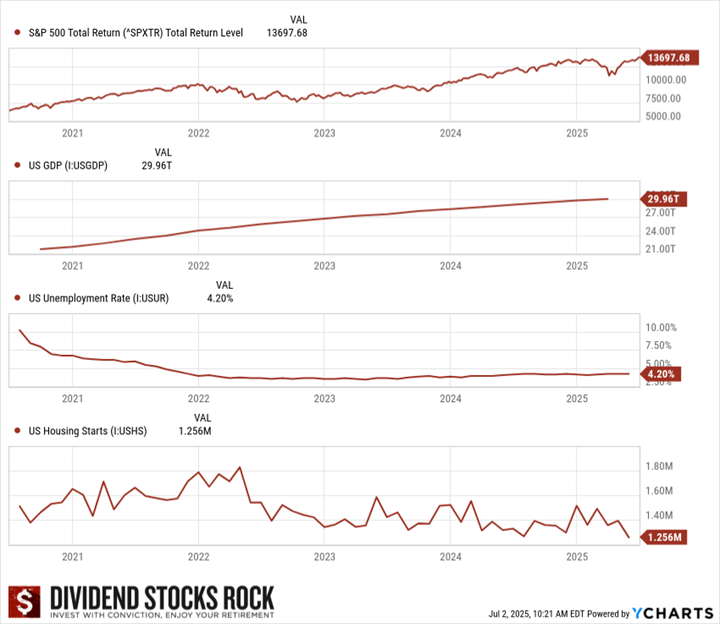

The economic backdrop is just as split. In the U.S., GDP growth is steady, unemployment remains low, but housing starts have slowed. This is hardly the picture of an imminent recession.

(Click on image to enlarge)

Five-year S&P 500 total return, US GDP, US Unemployment, US Housing starts chart.

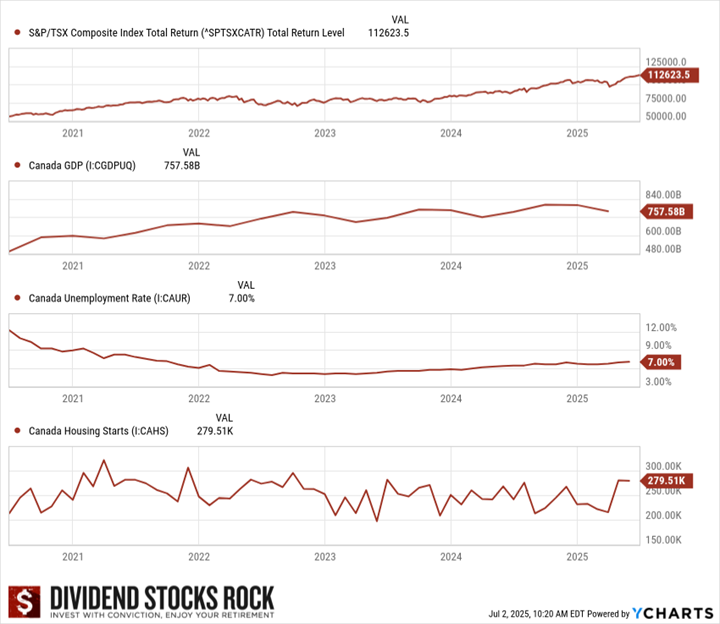

Canada tells a different story, however. GDP growth is cooling, unemployment is ticking up, and businesses are bracing for tariff-related uncertainty. The funny part? Despite that weaker economic data, the TSX is actually outperforming the S&P 500 this year.

(Click on image to enlarge)

Five-year TSX total return, Canada GDP, Canada Unemployment, Canada Housing starts chart.

That’s the paradox of 2025: weak data, strong markets.

What We Can Learn

The past six months prove why you can’t let headlines drive your investment decisions. We’ve lived through dozens of “reasons to sell” in the past two decades—2008’s banking collapse, 2020’s pandemic panic, and rate hikes in 2022. Each time, the market found a way forward.

This year is no different. The market continues to chug along, and dividend investors who stayed the course are once again being rewarded.

Highlights from My Stock Picks

Even though my focus is always on the long-term, I like to check in on how specific names are performing mid-year. Let’s take a quick look at six of them—three in the U.S. and three in Canada.

U.S. Picks

At the beginning of the year, I shared three U.S. undervalued stocks from my Top Stocks picks on my YouTube channel. You can learn more about my reasons for selecting them in the video.

PepsiCo (PEP)

Pepsi is wrestling with a strong dollar, higher tariffs on concentrate and aluminum, and rising operating costs. Management lowered expectations, guiding for flat EPS this year instead of mid-single-digit growth. Still, this is a company built on recurring demand and pricing power. With brands like Doritos and Gatorade, Pepsi remains a dividend growth staple, even in a sluggish year.

Mastercard (MA)

Mastercard continues to deliver double-digit growth. It’s expanding partnerships with Microsoft and OpenAI and rolling out new payment programs. Worries about stablecoins nibbling at the edges haven’t changed the fact that Mastercard and Visa remain the tollbooths of global commerce. For dividend investors, this is the definition of a low-yield, high-growth compounder.

Automatic Data Processing (ADP)

Payroll is boring—but boring is beautiful when it’s reliable. Automatic Data Processing posted high single-digit growth in both revenue and earnings this year and is on track for another healthy dividend increase. Its sticky business model, with customers staying for over a decade, makes Automatic Data Processing one of the most dependable dividend growers you can own.

Canadian Picks

Additionally, I did the same for the Canadian market. Read about the mid-year review after the video.

Stantec (STN)

Stantec is finally getting the love it deserves. Long one of the best Dividend Triangles in Canada, the engineering and design giant is benefiting from global trends in climate adaptation and infrastructure renewal. Revenues, earnings, and dividends are all hitting record highs, and the backlog remains robust.

CCL Industries (CCDBF)

CCL Industries, a global leader in labeling and packaging, stumbled out of the gate in 2025 but is making a comeback. Revenues and earnings are moving higher again, helped by acquisitions, and management announced a sizable share buyback program. Quiet, diversified, and steady—CCL Industries remains one of my favorite Canadian compounders.

Alimentation Couche-Tard (ANCTF)

This one hurts. Couche-Tard is a core holding of mine, but 2025 has been rough. Revenue fell 7.5% and EPS dipped 4.2%, thanks mostly to lower fuel prices and softer demand in the U.S. Merchandise sales were a small bright spot, but uncertainty around a potential 7-Eleven acquisition is clouding the outlook. Long-term, I still believe in the business, but patience will be required.

Final Thoughts: Stay the Course

Halfway through 2025, investors face a strange market: headlines are scary, economic signals are mixed, and yet the indexes are quietly delivering solid returns.

The U.S. is steady, Canada is wobbling, and both stock markets are doing just fine. My U.S. stock picks have been underwhelming, my Canadian ones are stronger, but that’s beside the point.

The real lesson? Don’t let short-term noise shake your conviction. Five years from now, nobody will remember whether GDP grew 2% or 2.2% in Q2 of 2025. What will matter is that you stayed invested, reinvested your dividends, and let compounding work its magic.

More By This Author:

PEP: A Taste Of Resilience In Uncertain TimesProcessing Paychecks, Powering Dividends

Canadian Perspective – July Dividend Income Report