MA: Turning Every Transaction Into Growth

Image Source: Unsplash

The world is moving away from cash, and a powerful business is capturing a significant portion of nearly every digital payment made globally. With a model that thrives on volume, scale, and trust, it’s positioned to grow no matter how people choose to pay—credit card, debit, or mobile. Add in strong brand recognition, a global footprint, and value-added services, and you get a company that’s as much a tech play as it is a financial one.

Building the Rails for the Global Economy

Mastercard (MA) is a technology company in the global payments industry. The Company connects consumers, financial institutions, merchants, governments, digital partners, businesses, and other organizations worldwide by enabling electronic payments and making those transactions secure, simple, smart, and accessible.

It provides a range of payment solutions and services under its brands, including Mastercard, Maestro, and Cirrus. Through its proprietary global payments network, it authorizes, clears, and settles transactions. Mastercard also offers automated clearing house (ACH) capabilities, security solutions, business and market insights, and open banking services. Its role is lucrative but straightforward: act as the infrastructure and toll collector for the world’s digital commerce.

MasterCard (MA) Business Highlights from its 2024 Impact Report.

When Scale Meets Innovation

As I often say, it is almost 1/3 financials, 1/3 technology, and 1/3 consumer… and it is reflected in the bull and bear cases.

Bull Case – Network Effects that Keep Growing

Mastercard’s growth engine runs on one of the strongest network effects in the financial world. Every time it adds a merchant, consumer, or issuing bank, the value of its network increases for everyone else involved. This creates a virtuous cycle that makes it incredibly difficult for competitors to take market share. The business is asset-light, which means each new transaction processed comes with minimal additional cost, amplifying margins.

The global shift from cash to electronic payments is far from over—especially in emerging markets where card penetration remains low. Mastercard is well-positioned to lead in these regions, bringing digital payments to millions of first-time users. Cross-border transactions, which generate higher fees, remain a robust growth driver as travel and international commerce recover. Strategic acquisitions in cybersecurity, data analytics, and open banking strengthen its competitive edge while diversifying revenue streams beyond traditional card processing.

Bear Case – No Free Pass in Payments

Despite its advantages, Mastercard operates in an industry that consistently draws the attention of regulators, particularly regarding interchange fees and market dominance. Fee caps in certain countries could compress margins, while the emergence of central bank digital currencies (CBDCs) may disrupt parts of its model if adoption becomes widespread.

Its revenue is directly tied to consumer and business spending—any significant slowdown in economic activity, whether caused by inflation, recessions, or geopolitical tensions, would hurt transaction volumes. Competitive threats from large fintechs, local payment rails, or alternative payment methods like instant bank-to-bank transfers are also increasing. To defend market share, Mastercard sometimes offers higher client incentives, which can pressure short-term profitability. Finally, while lawsuits and antitrust investigations haven’t derailed growth so far, they remain an ongoing risk that could lead to costly settlements or operational changes.

What’s New: MasterCard’s Latest Moves Pay Off

Mastercard’s most recent quarter showed the power of both its core business and its expanding services:

- Revenue up 14% and EPS up 13%, both above expectations.

- Gross dollar volume rose 9% and cross-border volume surged 15%, benefiting from strong travel and e-commerce activity.

- Switched transactions increased 9%, showing broad consumer engagement.

- Value-added services revenue up 16%, fueled by security, digital, and engagement solutions.

- Launched Mastercard Agent Pay, a new agentic payments program.

- Expanded partnerships with Microsoft and OpenAI to strengthen AI-enabled payment capabilities.

The Dividend Triangle in Action: Profits Powering Payouts

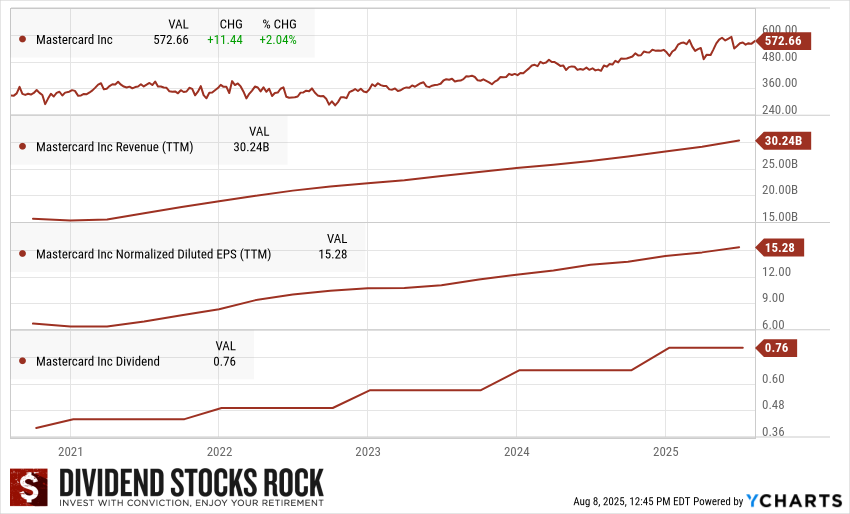

(Click on image to enlarge)

MasterCard (MA) 5-Year Dividend Triangle.

Mastercard’s Dividend Triangle is as strong as it gets for a growth-oriented dividend payer:

- Revenue Growth: Consistent double-digit gains, fueled by volume expansion and service diversification.

- Earnings Growth: High margins and scalable infrastructure drive faster EPS growth than sales.

- Dividend Growth: A smaller payout ratio means plenty of room for continued double-digit dividend hikes.

Final Words: A Tollbooth on the Digital Economy

Mastercard isn’t just a payment processor—it’s an essential part of the world’s financial infrastructure. Its unmatched global reach, strong competitive moat, and push into value-added services make it well-positioned for long-term growth. For investors seeking a blend of innovation, market dominance, and dividend growth potential, it’s hard to find a more compelling player in the financial technology space.

More By This Author:

9 Stocks On My Radar (Buy List)

CASY: Built For Small-Town Dominance

Yield Magic Or Mirage? Harvest Diversified High Income ETF