CASY: Built For Small-Town Dominance

Image Source: Unsplash

Some of the most resilient wealth-building machines are parked just off the highway, where locals grab gas, snacks—and a surprisingly good slice of pizza. In a market obsessed with disruption, one company quietly expands its footprint, sells more hot sandwiches, and keeps raising its dividend like clockwork.

Let’s see what makes this small-town operator a big-time dividend grower.

The Unexpected King of Small Towns

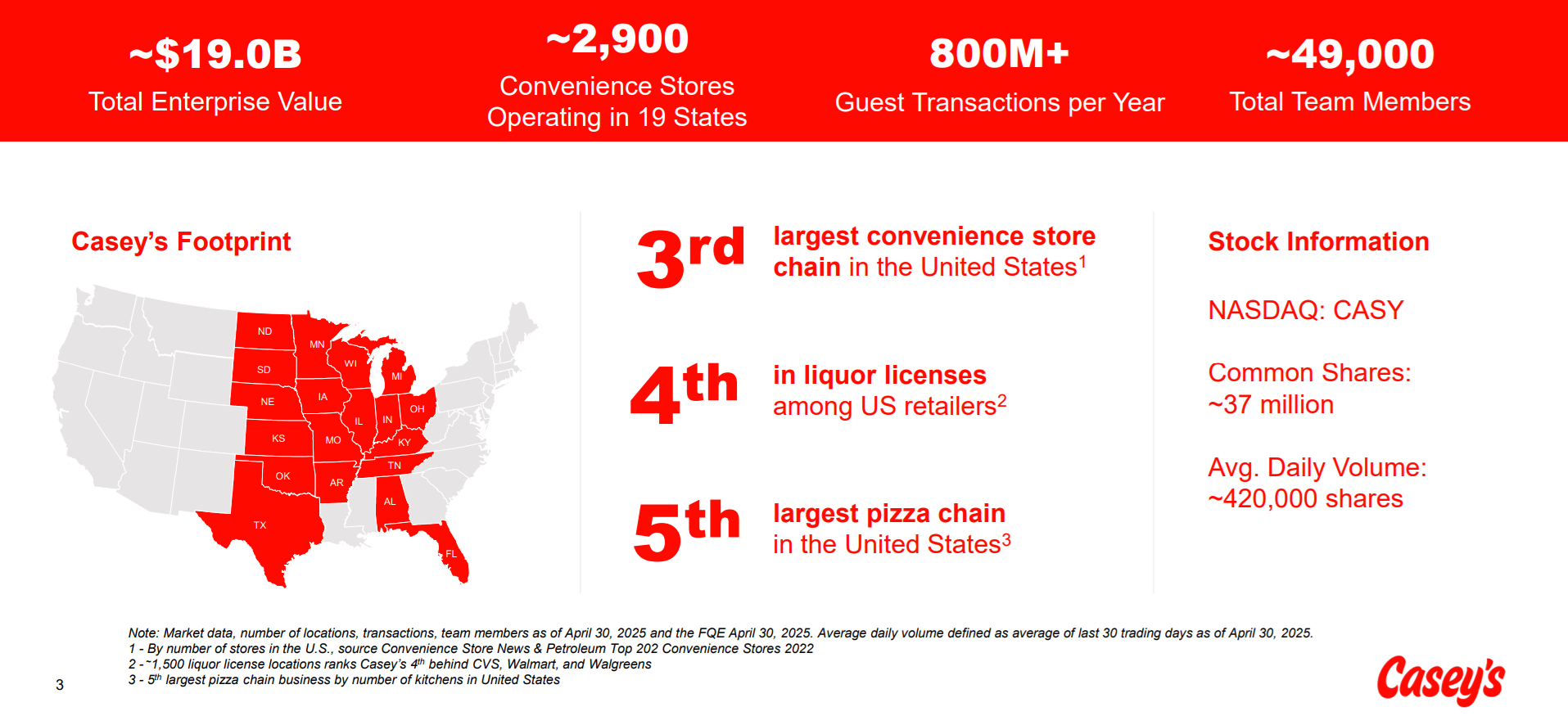

Casey’s General Stores (CASY) operates nearly 3,000 convenience stores across 20 U.S. states, mostly in rural and suburban markets. Each store combines three revenue engines: fuel, grocery, and made-in-store food. That food isn’t just an afterthought—Casey’s pizza and bakery items are famous in their territories and play a crucial role in driving repeat visits.

About 60% of revenue comes from fuel, but nearly 70% of profits stem from inside sales, particularly freshly prepared food. This unique blend gives Casey’s pricing power, customer loyalty, and a defensible moat in markets where competition is limited.

Its model is fully company-owned (no franchises), which helps maintain operational control and margin quality. With vertical integration—including its own logistics and bakery operations—Casey’s has better visibility into costs and execution.

(Click on image to enlarge)

Casey’s (CASY) business highlights from its FY25 Q4 presentation.

Pizza, Profits, and Pickups

Bull Case: Where Gas Meets Gourmet

Casey’s is not your average convenience chain. Its real edge lies in blending fuel sales with high-margin, freshly made food. By offering a one-stop shop for gas, groceries, and grab-and-go meals, Casey’s builds sticky customer relationships—especially in areas where dining options are sparse.

Growth has been aggressive but strategic. The company added 270 new stores in fiscal 2025, entered new states like Texas, and continues to roll out digital ordering, mobile app loyalty programs, and kitchen retrofits to boost food margins.

Management is also focused on margin expansion: digital channels are enhancing same-store sales, and backend logistics improvements are lowering per-unit costs. With disciplined acquisitions and organic growth, Casey’s is targeting 4,000+ stores over time.

Bear Case: Growth Has a Cost

As promising as Casey’s model looks, it comes with its own vulnerabilities. A significant portion of traffic is still tied to fuel, which remains volatile and margin-thin. Any disruption in fuel pricing or volume could reduce overall store traffic, hurting inside sales momentum.

Expansion is capital-intensive, especially in lower-density markets where it may take longer to reach profitability. Wage inflation and rising food costs could put pressure on margins if same-store growth doesn’t keep pace. And as national players like Circle K or 7-Eleven inch into second-tier markets, Casey’s dominance in rural zones may erode.

Finally, the stock has outperformed in recent years, raising concerns around valuation and whether expectations are running ahead of fundamentals.

What’s New: 270 New Stores and 14% Dividend Raise

Casey’s latest quarter (2025-06-18) confirmed why it’s one of the most quietly consistent performers in retail:

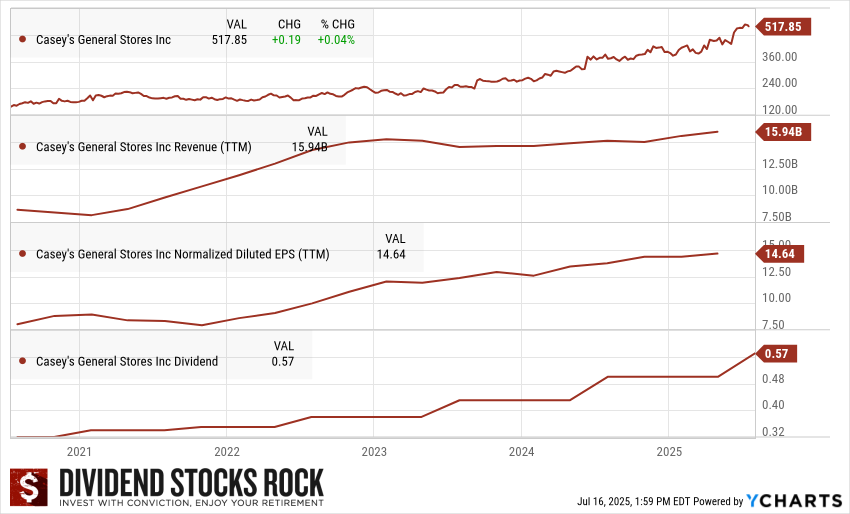

- Revenue rose 11%, while EPS climbed 12% year-over-year

- Same-store inside sales up 1.7%, led by strong bakery and sandwich categories

- Fuel gross profit surged 21.4% to $307.8M

- Dividend increased by 14%

- Store count jumped from 2,658 to 2,904—a record year for expansion

This performance highlights operational excellence across pricing, volume, and execution.

The Dividend Triangle in Action: Growth, Profit, Payout

(Click on image to enlarge)

Casey’s General Stores (CASY) 5-Year Dividend Triangle.

The Dividend Triangle—revenue growth, earnings growth, and dividend growth—continues to shine at Casey’s:

- Revenue Growth: Boosted by rapid store expansion and strong food/beverage performance

- Earnings Growth: Stable gross margins, strong EPS growth, even amid cost pressures

- Dividend Growth: 14% raise in 2025, a strong vote of confidence from management

Casey’s checks all three boxes, proving it’s not just a growth story—it’s a compounding machine.

Final Words: Small Format, Big Power

Casey’s doesn’t chase headlines—but it does chase margins, customer loyalty, and consistent growth. In an industry with thin margins and brutal competition, it has carved out a niche where it dominates.

The playbook? Own the market, serve great food, and reward shareholders. This is one of those businesses where execution beats hype, and consistency compounds in the background. That’s a model worth owning.

More By This Author:

Dividend Growth Investing Vs. The Market – Who Wins?

Riding The Interest Rate Wave

A Safe Place To Land: How And Where To Park Cash (Especially In Retirement)