Dividend Growth Investing Vs. The Market – Who Wins?

Image Source: Pixabay

Setting the Ground Rules

When comparing any strategy to a benchmark, it’s critical to match apples with apples. I focused on long-standing ETFs with broad exposure, so the results would be relevant across entire market cycles—not just the last few years.

Here’s what I used for the comparison:

U.S. Market Benchmark:

- SPDR S&P 500 ETF Trust (SPY)

Canadian Market Benchmark:

- iShares S&P/TSX 60 ETF (XIU.TO)

U.S. Dividend Growth ETF:

- Vanguard Dividend Growth Fund (VDIGX)

Canadian Dividend Growth ETF:

- iShares Canadian Dividend Aristocrats ETF (CDZ.TO)

I selected these ETFs due to their long histories, widespread recognition, and diversified holdings. Many of the companies they hold—like Microsoft, McDonald’s, or Canadian banks—are typical of what you’d find in a dividend growth portfolio.

What I Expected Going In

Let’s be honest: we all have biases. So before showing you the results, here’s what I expected:

- I didn’t expect dividend growth to outperform the S&P 500. The U.S. index is loaded with tech giants that have driven massive returns over the past 10–15 years.

- I thought Canadian dividend growers would fare better than the overall TSX. Canadian dividend payers tend to be banks, pipelines, telecoms—sectors that are more stable than resource-heavy indexes.

- I expected dividend growth to hold up better during down markets. Companies that consistently raise dividends tend to be more resilient.

- I wasn’t chasing who “won”—I was interested in how each strategy behaves through ups and downs.

With that in mind, let’s look at what the charts actually showed.

Since Inception: Long-Term Growth

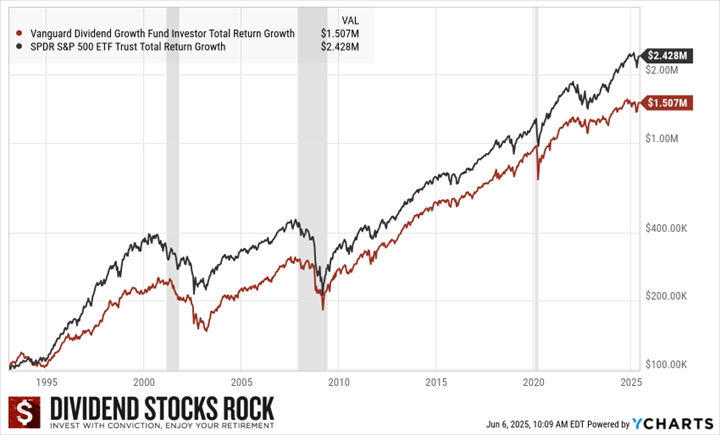

On the U.S. side, we can go all the way back to 1993. If you had invested $100,000 in each strategy at that time:

$100K returns if invested in SPY and VDIGX in 1993.

- S&P 500 (SPY): Grows to $2.4 million

- Dividend Growth (VDIGX): Grows to $1.5 million

There’s no denying the S&P 500 crushed it. That growth was supercharged by tech giants like Apple, Microsoft, and Nvidia. Since 2009, the S&P has run away with it. However, note the trade-off: significantly higher volatility along the way.

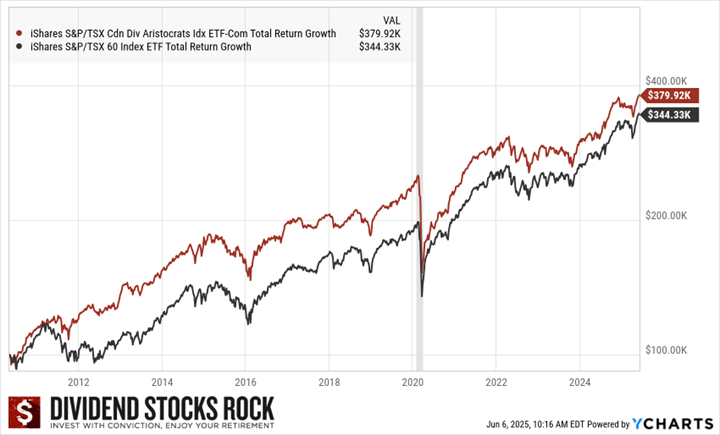

Now to the Canadian side: data for CDZ only goes back to 2010, after the 2008 financial crisis.

$100K invested in XIU.TO and CDZ.TO returns since 2008.

- TSX (XIU.TO): $100K grows to $380K

- Dividend Growth (CDZ.TO): $100K grows to $344K

This one’s closer. Dividend growers didn’t win, but they kept pace—and did so with less drama.

In both markets, this proves something important: dividend growth works. You won’t always beat the index, but you won’t get left behind either—and you might sleep better along the way.

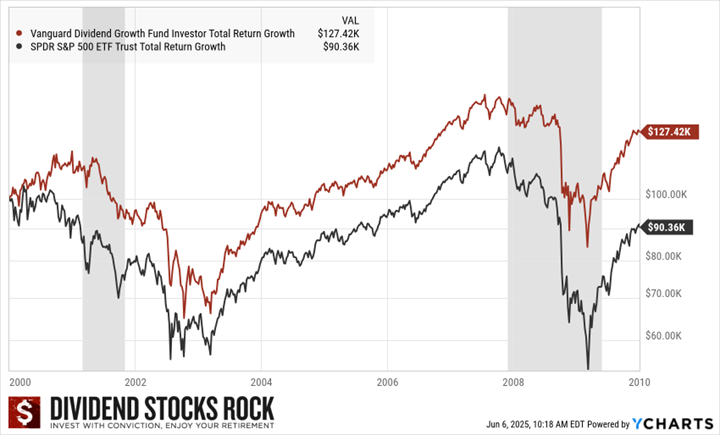

The Lost Decade (2000-2010)

The 2000s were rough. First came the dot-com crash, then the 9/11 attacks, and finally the 2008 financial crisis.

SPY vs VDIGX returns during the lost decade.

- S&P 500: $100K shrinks to $90K

- VDIGX: $100K grows to $127K

That’s not just a win for dividend growth—it’s a knockout.

More than that, the DGI strategy experienced shallower drawdowns:

- S&P 500’s low points: $56K in 2002, $54K in 2009

- VDIGX’s low points: $65K in 2002, $84K in 2009

This is what many dividend investors value: downside protection. While markets were swinging like a yo-yo, dividend payers cushioned the blow. Investors who reinvested dividends during that period would have benefited from buying low while collecting consistent income.

This trend—outperformance in downturns—will continue to show up as we look at more data in Part 2.

Strategy vs Psychology

Here’s something I’ve learned after two decades of investing: the best-performing strategy is useless if you can’t stick with it.

Many investors chase what performed best over the past five years. But every strategy has a rough patch. What matters more is whether it fits your temperament and goals.

Dividend growth investing isn’t about chasing hot returns. It’s about:

- Knowing what you own and why

- Earning rising income along the way

- Benefiting from long-term compounding

I once heard a great quote from a fellow investor:

“It’s hard to be friends with ETFs—you don’t know what’s inside.”

–Jane Langmaid, DSR member.

Dividend stocks are different. When you own them individually, you know the businesses. That connection builds confidence during uncertainty.

More By This Author:

Riding The Interest Rate Wave

A Safe Place To Land: How And Where To Park Cash (Especially In Retirement)

Apple Inc.: Is The Shine Still There?