Processing Paychecks, Powering Dividends

Image Source: Pixabay

Few companies can claim to be as entrenched in everyday business operations as this one. Payroll never stops—whether during a booming economy or a slowdown, employees still expect to get paid accurately and on time. This company has built a business around this certainty, expanding beyond payroll into the broader human capital management (HCM) space. With a vast client base and a recurring revenue model, it has become a cornerstone of dividend growth investing.

Global Payroll Powerhouse

Automatic Data Processing (ADP) provides cloud-based payroll and HCM solutions that unify HR, benefits administration, time tracking, and compliance services. The company operates in over 140 countries, serving 1.1 million clients, and processes pay for 1 in 6 U.S. employees.

Its business is split into two main segments:

- Employer Services: The larger segment, offering payroll, tax, HR outsourcing, workforce analytics, benefits administration, and compliance. This generates steady, subscription-based revenue tied to employee counts and service breadth.

- Professional Employer Organization (PEO): Operates under the ADP TotalSource brand, providing outsourced HR solutions through a co-employment model. This segment is more cyclical but delivers strong growth and cross-selling opportunities.

The combination of scale, reputation, and global compliance expertise allows ADP to maintain a leadership position in an industry where trust and accuracy are paramount.

Business Highlights from Q4 2025 Infographic.

Bull Case: Wide Moat in Payroll and HR

ADP’s bull case is rooted in its scale, reputation, and recurring revenue model. Once embedded, ADP becomes a critical partner for businesses, creating sticky, high-retention client relationships.

Playbook

The company benefits from a subscription model linked to the number of employees processed, meaning growth in employment directly benefits ADP. Built-in service upgrades, add-ons, and inflation-adjusted price escalators provide additional tailwinds. With client retention above 92%, ADP’s revenue base is highly predictable.

Growth Vectors

- Cross-Selling Services: Retirement planning, benefits administration, workforce analytics, and digital hiring tools deepen client relationships.

- Technology Investments: The rollout of ADP Lyric, its new AI-powered platform, modernizes the company’s HR suite, positioning it against newer SaaS rivals.

- Strategic Acquisitions: The recent purchase of WorkForce Software strengthens time tracking and scheduling solutions, an increasingly important segment for employers.

- Labor Market Tailwinds: With tight employment markets, payroll volume remains strong. ADP also earns interest income from client funds held before payroll distribution—an attractive feature in higher rate environments.

Economic Moat

ADP’s moat comes from high switching costs and regulatory expertise. Payroll mistakes are costly, both financially and legally, and few companies want the risk of transitioning away from a proven provider. ADP’s deep compliance infrastructure across multiple jurisdictions further entrenches its advantage.

Bear Case: Cyclical Risks and Rising Competition

Despite its durability, ADP is not immune to risks. Its performance is tied to employment cycles and competition is intensifying.

Business Vulnerabilities

In recessions, payroll volumes shrink, particularly in small- and mid-sized businesses. The PEO segment is especially exposed to downturns, as small businesses may cut staff or close entirely. Payroll itself has also become more commoditized, pressuring ADP to bundle services in order to justify premium pricing.

Industry & Market Threats

- Macroeconomic Slowdowns: Layoffs and slower hiring directly reduce payroll volume.

- Pricing Pressure: Cloud-native SaaS competitors offer cheaper and more agile products for mid-market clients.

- Execution Risks: Integrating acquisitions and rolling out new platforms like Lyric bring operational challenges.

Competitive Landscape

ADP competes with Paychex, Paylocity, Workday, and SAP, among others. While ADP maintains unmatched global breadth, competitors often dominate niches such as SMB payroll (Paychex) or enterprise HCM (Workday). ADP’s challenge will be to remain technologically competitive while leveraging its scale and reputation.

What’s New: A Strong 2025

On August 8, 2025, ADP reported another solid quarter:

- Revenue up 7.5%, EPS up 8%, beating analyst expectations.

- Employer Services revenue up 8%, with 6% organic growth.

- PEO Services revenue up 7%, with worksite employees rising 3% to 761,000.

- Client retention at 92.1%, underscoring the stickiness of the model.

- Interest income up 11% to $308M, reflecting higher rates.

- Full-year revenue reached $20.56B (+7%, +7% organic).

Looking ahead, ADP guides for 5–6% revenue growth in FY26, 50–70 bps margin expansion, and 8–10% EPS growth.

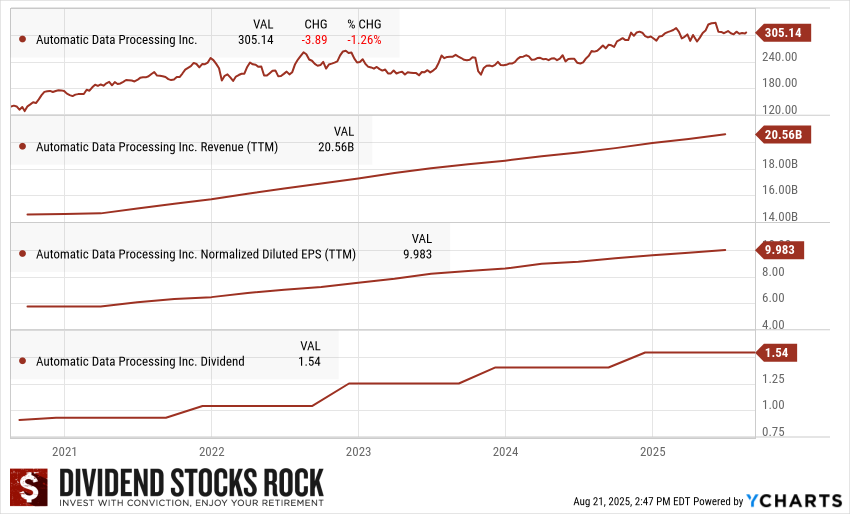

The Dividend Triangle in Action: Consistent Climb

Automatic Data Processing (ADP) 5-year Dividend Triangle Chart.

ADP’s Dividend Triangle highlights its long-term strength:

- Revenue has grown steadily, reaching $20.6B.

- EPS sits just under $10, compounding at a healthy pace.

- Dividend continues its reliable climb, now at $1.54 per share. ADP is also part of the Dividend Kings list with 50 consecutive years of dividend increases.

While ADP’s yield isn’t high, its consistent double-digit dividend growth has compounded returns for decades. It is a classic example of quality over yield—one of the most dependable income growers in the market.

Final Thoughts: The Payroll Giant that Never Sleeps

ADP combines a wide moat, resilient recurring revenue, and strong free cash flow generation. Its entrenched position in payroll and HR, combined with technology upgrades and cross-selling potential, supports continued earnings and dividend growth. While cyclical risks and rising competition are worth monitoring, ADP remains a best-in-class dividend growth stock for investors seeking steady compounding over the long run.

More By This Author:

Canadian Perspective – July Dividend Income ReportEquinix: Powering The Digital World’s Connections

MA: Turning Every Transaction Into Growth