The Santa Rally Could Fizzle This Year

AI-Generated Image

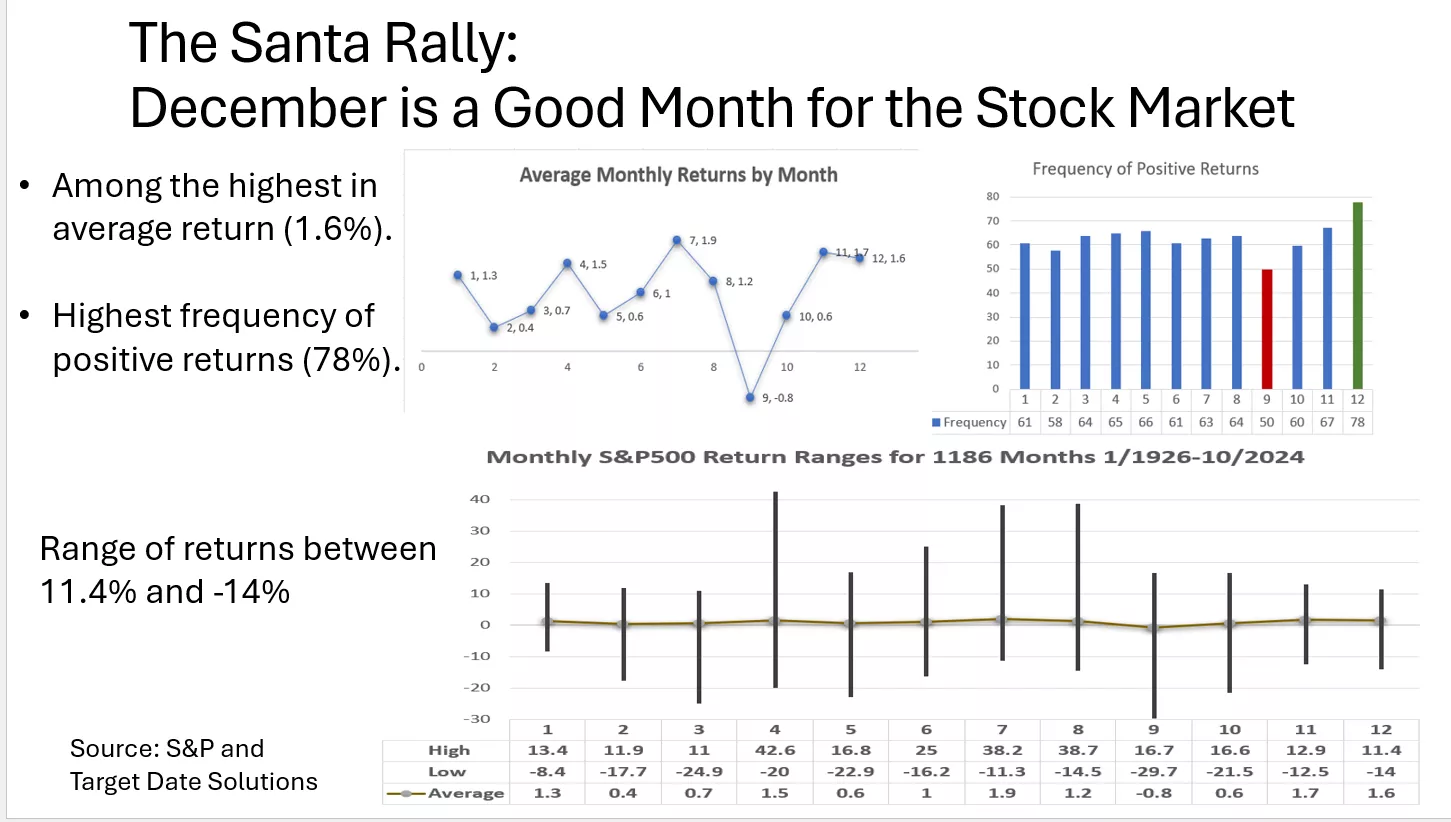

- The Santa Claus rally, a historical December market trend, typically brings positive returns, with December outperforming most other months.

- The S&P 500 has delivered a 12% return so far this year, aligning with the most frequent returns (mode), barring a repeat of rare major December losses.

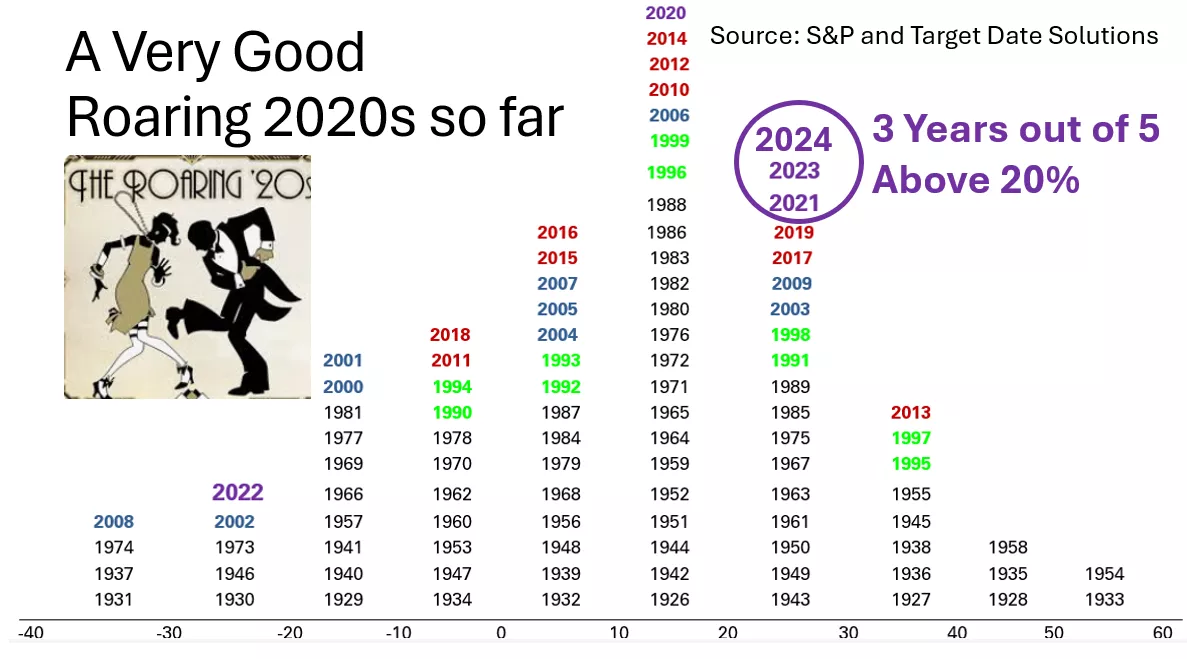

- If this December avoids significant declines, 2025 will post an above-average return, continuing a strong long-term trend where 3 of last 5 years have returned more than 20%.

- Despite historical optimism, long-term sustainability is questioned due to global systemic risks and uncertainty about AI's ability to sustain this17-year rally. If something cannot go on forever, it will end.

According to Investopedia:

The Santa Claus rally is the sustained increase in the stock market that occurs around the Christmas holiday on Dec. 25. Most estimate these rallies happen in the week leading up to the Christmas holiday, while others see trends that begin Christmas Day through January.

Theories that explain the Santa Claus rally include end-of-year tax considerations, a general feeling of optimism and seasonal happiness on Wall Street and investing holiday bonuses. Some institutional investors settle their books and vacation during this time of year, leaving the market to retail investors, who tend to be more bullish toward the market.

Good odds

The odds are good that Santa won’t disappoint in 2025. Here’s the history of the past 99 Decembers, compared to the other months. December is most frequently positive and has delivered one of the best average returns.

Happy Ending, Unless…

The S&P500 has returned 12% so far this year, placing it in the mode of historic annual returns. It will stay in that group as long as the stock market doesn’t continue recent losses that have cost 2.4% over the past month. If it repeats the biggest December loss of 14%, experienced in 1931, the annual return in 2025 will decline to a 3.7% loss, the likes of which were last seen 6 years ago in 2018.

2025 will probably go into the record books as a pretty good year, earning above the 10.4% average return over the past 99 years from 1926-2024.

Conclusion

Four years ago, in April 2021, the Council on Economic Policies wrote:

“If something cannot go on forever, it will stop.” This famous observation was made by Herb Stein, Senior Fellow at the American Enterprise Institute. It became famous largely because it was just that, obvious. Yet, what is no less obvious is that public policy is commonly based on a wholly contrary assumption, that the future will be like the past, more or less. This is deeply unfortunate since many of the most important systems on which the future of mankind depends are evolving in an unsustainable way. They threaten to stop. Global economic, political, environmental and health systems are all showing clear signs of stress and prospective breakdown. The Four Horsemen of the Apocalypse can be clearly seen riding, purposefully, in our direction.”

The past 17 years has been the longest bull stock market ever. Will it go on forever? Can artificial intelligence sustain the rally?

More By This Author:

Tipping Point: Baby Boomers Beware

Will Baby Boomers Survive A Stock Market Crash?

Real Versus Pretend Management Of Retirement Plan Investments