Tipping Point: Baby Boomers Beware

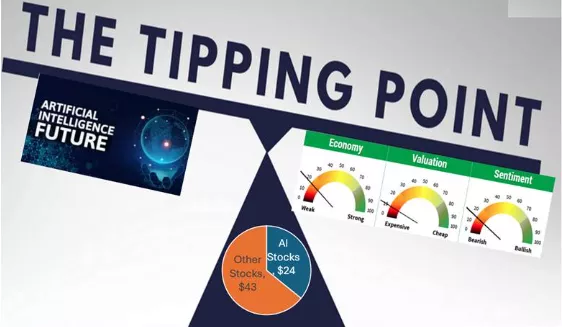

- US stock market valuations are historically high, fueled by AI-driven gains, raising concerns of a potential bubble and eventual correction.

- AI-related stocks now comprise 36% of the US market, with rapid appreciation suggesting overvaluation reminiscent of past bubbles.

- Economic indicators signal warning signs: weak economic activity, expensive valuations, and bearish sentiment, increasing crash risk.

- Baby boomers, heavily exposed to equities, should shift to safer assets like Treasury Bills and TIPS to avoid devastating losses in a potential downturn.

We are currently enjoying the longest bull market ever, leading some to call this decade the “new Roaring 20s” that could see a repeat of the Crash of 1929. There’s no denying that the US stock market has become very expensive, and that paying a high price for a stock diminishes the future return on that stock. But artificial intelligence is forestalling a correction, perhaps for a long time. Nevertheless, we will eventually reach a tipping point because Stein’s Law will hold: if something cannot go on forever, it will end.

How Long Can Artificial Intelligence (AI) Forestall a Crash

AI-related stocks currently make up 36% of the total US stock market. Total AI stock capitalization is estimated at $24 trillion, while the total stock market is estimated to be $67 trillion.

AI stocks are a substantial segment of the stock market, so their valuations weigh heavily. And AI stocks have led the growth in the stock market. This rapid appreciation suggests that AI stocks may have been bid up beyond their fair value, and that this bubble will end. Remember the dotcom and housing bubbles. Like those crashes of the past, we are currently seeing strong warning signs of trouble ahead.

Economic Indicators are Flashing Warnings

Capital Market Consultants (CMC) regularly publishes their Capital Market Indicators that provide insights into what lies ahead. The November 13 version warns on all three metrics as follows:

Here are CMC’s explanations:

U.S. Economy—The Atlanta Fed’s GDPNow measure ticks up to 4.0%. Growth continues to grind higher.

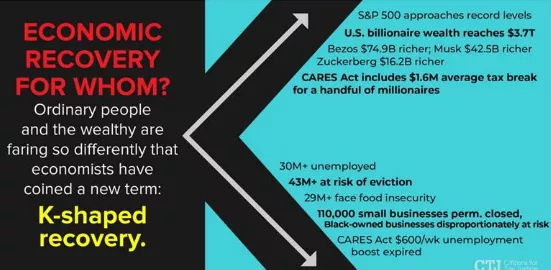

- Greater spending by wealthy households has been key to consumer spending that has been keeping the economy rolling. Asset appreciation from housing and equities (now near all-time highs in household portfolios) has been a key factor in the spending. See discussion below on the K-shaped economy

- Based on the Federal Reserve Bank of Philadelphia’s U.S. Coincident Index, our gauge of U.S. economic activity (above left) registers an August 2025 reading in the 18th percentile (Weak).

Capital Markets—The S&P 500 was up 17.7% YTD as of 11/11/25 while the MSCI All Country World ex-U.S. was up 28.6%.

- Valuation:

- Based on the S&P 500 trailing 12-month price-to-earnings ratio, our gauge of U.S. equity valuation (above center) registers an October 2025 reading in the 10th percentile (Expensive).

- Sentiment:

- Based on the National Association of Active Investment Manager’s Exposure Index, a contrarian indicator, our gauge of U.S. stock market sentiment registers an 11/5/2025 reading in the 16th percentile (Bearish).

- Recent developments: Consumer sentiment reached its lowest level on record with consumers expressing worries about potential negative consequences for the economy from the government’s shutdown. The decline cuts across age, income, and political affiliation.

Economic Control

The wealth divide is widening which means that the stock market will crash if the wealthy decide to sell. It is a K-shaped economy.

Baby boomers in particular are exposed because they are currently in the Retirement Risk Zone when investment losses will ruin the rest of life. They should sell and move to the safety in Treasury Bills and short-to-intermediate TIPS. Baby boomers hold around $23 trillion in stocks, which is a third of the stock market. Their move to protect would lead to a crash, but they will not move en masse.

Conclusion

Fear of missing out (FOMO) continues to drive the US stock market higher, driven in large part by the big advances in artificial intelligence. But this will end. Baby boomers need to be among the first to get out, not the last, because they might not recover from the next crash. That’s my warning.

More By This Author:

Will Baby Boomers Survive A Stock Market Crash?

Real Versus Pretend Management Of Retirement Plan Investments

YTD Asset Class And Portfolio Performance

More By This Author:

Will Baby Boomers Survive A Stock Market Crash?

Real Versus Pretend Management Of Retirement Plan Investments

YTD Asset Class And Portfolio Performance