Will Baby Boomers Survive A Stock Market Crash?

- Baby boomers are at high risk of devastating investment losses during the critical Retirement Risk Zone this decade.

- Historical market crashes show that a severe downturn could permanently harm retirees' lifestyles, especially if recovery is not 'average.'

- Target date funds (TDFs), widely used by retirees, do not offer sufficient protection in the Risk Zone despite perceptions of safety.

- Moving to safer assets like Treasury bills and TIPS is recommended to preserve retirement dignity and avoid the risk of outliving savings.

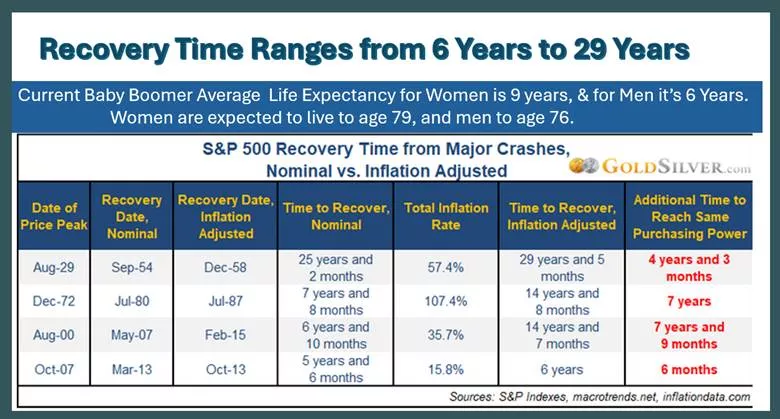

Our 75 million baby boomers are currently spending this decade in the Retirement Risk Zone during which investment losses can ruin the rest of life. But the threat of suffering diminished lifestyles, and possibly outliving savings, is being shrugged off because according to Investopedia the average full recovery time (from the peak back to the prior high, including the decline and subsequent rebound) is roughly 2 years, so no problem. The average crash is easily survived.

Since 1928, the S&P 500 has experienced around 26 bear markets. The average bear market duration (from peak to trough) is approximately 11 months, with an average decline of about 35%, but the average recovery is quick

But what if the next crash is not “average”? After all, we’re currently enjoying the longest bull market ever, leading some to call this decade the “new Roaring 20s.” As shown in the following, the average baby boomer will not recover from a “big crash” defined as a repeat of one of the 4 longest crashes in history.

Who cares

Baby boomers care. Who wants to end life as a poor person? Baby boomer heirs care for obvious reasons. Baby boomer friends care because they like their friends. The list goes on. We all get just one trip through the Risk Zone.

Protecting

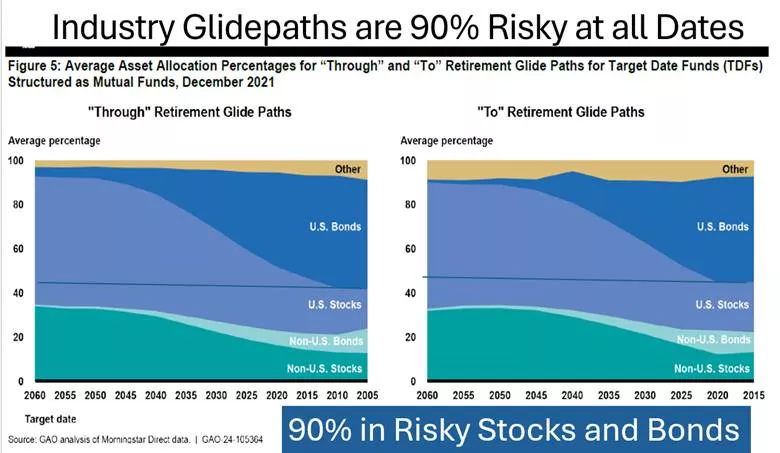

The whole idea of the Retirement Risk Zone is that investors should protect themselves while they’re in it. But most don’t, including the millions who invest their 401(k)s in target date funds (TDFs), the most popular qualified default investment alternative (QDIA). Most people in TDFs think they are protected in the Risk Zone, but they are not. Just look at the 2008 30%-plus losses in 2010 TDFs.

Also, be aware that the academic theory that TDFs say they use is actually very safe in the Risk Zone, although TDFs are not – they’re not following the theory.

As shown in the following, both vintages of TDFs – To and Through -- are 90% risky throughout their glidepaths when you consider equities and long-term bonds to be risky.

(Click on image to enlarge)

Baby boomers need to move to safety – now. Those who have defaulted into TDFs need to un-default and take back risk control over their lifetime savings. Safe assets include Treasury bills and short-to-intermediate TIPS even though their returns are low; the price of safety is low reliable return.

Conclusion

There is historical precedent for stock market crashes that could devastate today’s baby boomers. They could end life suffering the pains of being poor. That’s an ugly risk that is just not worth taking – especially not now.

More By This Author:

Real Versus Pretend Management Of Retirement Plan Investments

YTD Asset Class And Portfolio Performance

Compete Against The Target Date Fund Oligopoly By Innovating