The Next Major Threat To Your Portfolio Just Arrived

The data is finally beginning to register that a recession is at hand.

I’ve been forecasting that the U.S. economy was in recession back in November. Leading indicators and the bond market made this clear.

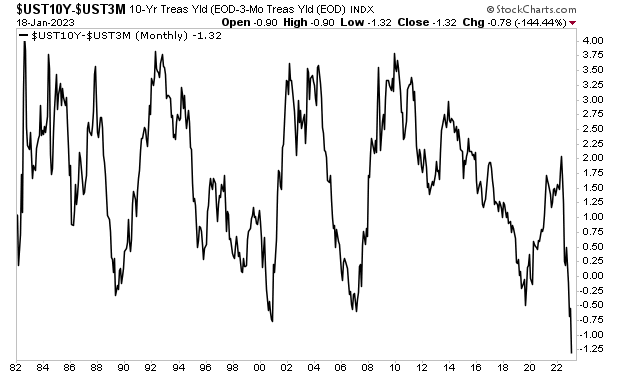

The yield curve has accurately predicted every recession since 1982. And it was SCREAMING that a recession was about to hit in the U.S. since mid-2022. As you can see in the chart below, the yield curve was more inverted than at any point in the last 40 years.

However, a big problem with economic forecasting is that most data sets are backwards looking. So often times you don’t get actual data telling you that a recession has arrived until the economy is already several months into the recession.

And the stock market pays attention to economic data, NOT leading indicators.

I mention all of this because the recession that I’ve seen unfolding since November is finally showing up in the economic data. Yesterday, the Commerce Department released a number of data series that were HIGHLY recessionary.

Retail Sales clocked in at -1.1% Month over Month. Similarly, Industrial Production came in at -0.7% Month Over Month while Manufacturing Production registered -1.3% Month Over Month.

Bear in mind, these are the data points for December. So, this is what was happening in the economy a month ago. And bear in mind, the Month Over Month numbers are a comparison between December and November. So, the downturn actually started more than seven weeks ago.

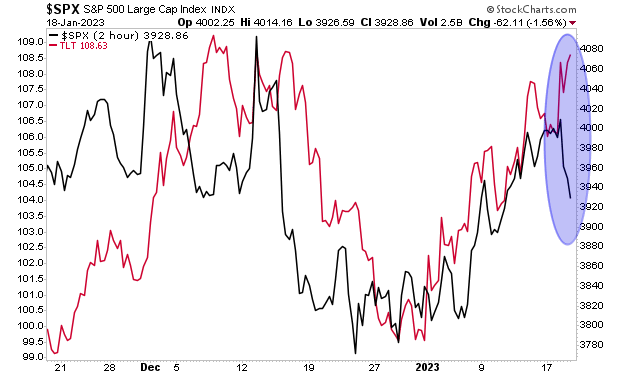

This is why stocks took it on the chin and bonds caught a bid yesterday. And judging by yesterday’s data, this process is just getting started.

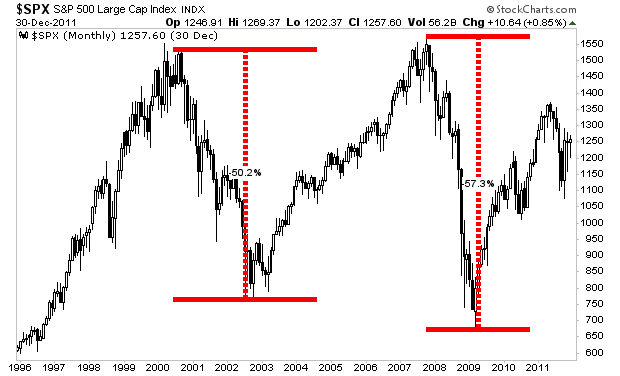

And remember what happened to stocks during the last two major recessions in 2000 and 2007.

More By This Author:

Buckle Up, The Bond Market Is About To Break A Major Central Bank

Why Japan’s Bond Market Could Make Or Break Your 2023 Returns

Is the Worst Over For This Bear Market?