The Masses Remain Very Wrong

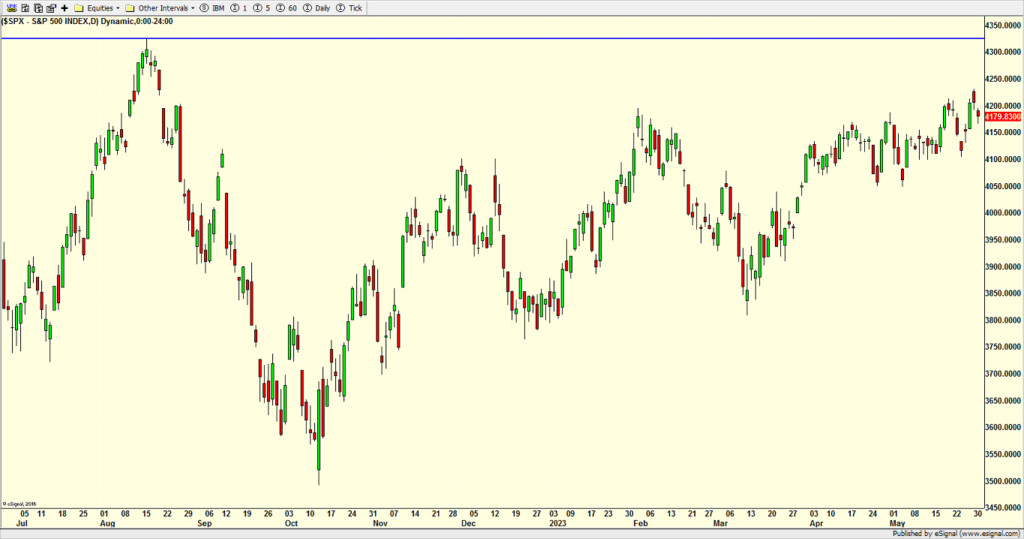

Two days ago, I argued that selling the rally post-debt ceiling agreement was the right strategy. After all, stocks had rallied sharply into the announcement and the underpinnings have not been super solid.

Rather, as the masses have reported, the rally has been well short of powerful and impressive with essentially 7 stocks accounting for almost all of the gains in the S&P 500 this year.

However, most of these pundits are the same ones who have been holed up in their bomb shelters since last year, forecasting imminent gloom, doom and Armageddon. Of course, many of them revise history and claim that they said the S&P would climb to 4200 first. That’s all nonsense and typical for the masses being wrong. Today, I heard a woman from Morgan Stanley who has been decidedly negative since last summer offer that she’s been the biggest bull on AI. I couldn’t find a single video to back up her claim. It’s just so much easier to be a strategist than to manage real money in real portfolios.

As you can see at the end of this post, many of our strategies reduced exposure and/or did some additional risk mitigation. Don’t get me wrong. I do not think the stock market is on the precipice of a big decline. Rather, risk now outweighs reward and I would rather harvest some acorns. Stocks could still spurt higher as we have the catalyst of the May employment report this Friday at 8:30am. I would be very surprised if the number came in anywhere near 0.

Back to our activity which I do not usually discuss. It was not difficult to sell some semis and tech and buy indices and sectors that have been unloved. Last week, I said that I still really liked bonds and that gold and silver stocks were getting close to a buy point. We did buy bond ETF, LQD, on Tuesday as well as adding a large gold and silver position on Thursday with a tight stop.

In a nutshell, I would like to see the S&P 500 decline to last week’s low point, 4100, to cleanse the market in the short-term. That should look like another good buying opportunity in a market where pullbacks have been very brief ad shallow since March, leaving the masses out in the cold.

On Tuesday we bought LQD, RYDHX, XLP, KIE. We sold some SOXL, some NVDA and some levered NDX. On Wednesday we bought FUTY, PCY, EMB, REGN, RYPMX, PMPIX, levered S&P 500, more levered NDX and more ENSG. We sold VYM, some KIE and some KAMAX.

More By This Author:

Behavior Befitting The Dotcom Bubble – Sell The Debt Ceiling NewsStocks Pull Back On Schedule

Will The Economy Always Be Like This?

Please see HC's full disclosure here.