“The Inflation Surge Is Over. Now We’ll See If Interest Rate Increases Cause Recession.”

From the Milwaukee Journal Sentinel today (title not mine):

As much as some may try, we can’t blame any single institution or political party – there are just too many factors contributing to inflation. The $4 trillion federal government spending during the Trump administration propped up prices by allowing individuals and businesses to keep buying goods and services. Meanwhile, the Federal Reserve’s commitment to low interest rates and emergency lending kept the economy afloat at a time when steep price declines could have been disastrous.

The $1.9 trillion American Rescue Plan passed during the Biden administration added to upward pressure on prices. The fiscal policies contributed to much of the acceleration in inflation in 2020 through mid-2021. However, starting in mid-2021, supply chain disruptions and labor market tightness, more related to the pandemic, took on more importance. The oil price increase in the wake of the Russian invasion of Ukraine was particularly important in mid-2022.

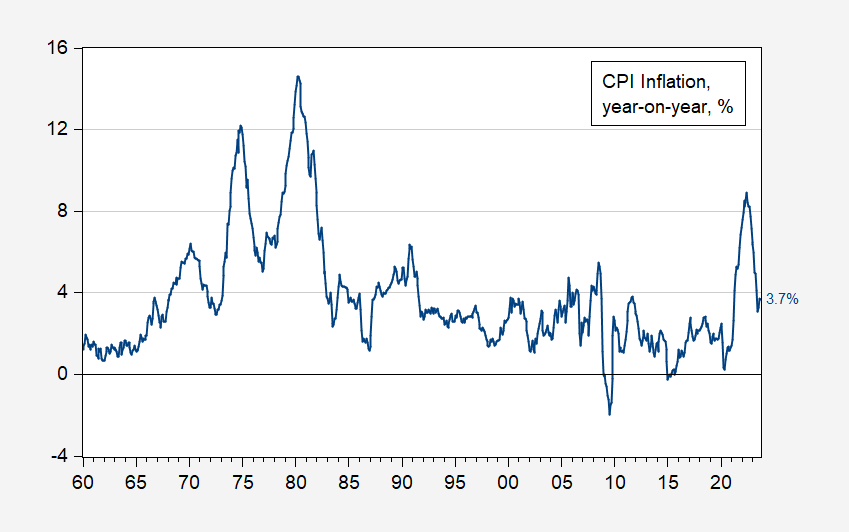

Here’s a picture from the article.

Figure 1: Year-on-Year CPI inflation, % (blue). Source: BLS, author’s calculations.

Looking at the inflation series over a long span highlights the fact that in the end, inflation was transitory. However, it was less transitory and high than many expected.

I argue, in line with most recent analyses (e.g. here), that a combination of supply, cost-push, and demand (fiscal) shocks pushed inflation in recent years. Here’s a detail.

Figure 2: Year-on-Year CPI inflation (blue), instantaneous per Eeckhout (T=12, a=4) CPI inflation at annual rate (tan), and Core CPI (red), %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Note that inflation did rise post-ARP. But it also rose in European countries. And certainly European inflation rose in the wake of the expanded Russian invasion of Ukraine. Needless to say, that occurred with a much less expansive fiscal policy in that region.

Looking forward, it looks like inflation is down, but not out, as shown by the persistence in core inflation (keeping in mind that housing costs will exert a negative impact over the next year).

More By This Author:

Inversions, Bear Steepening Dis-Inversions, And Recessions

CPI Inflation In September: Instantaneous Headline, Core & Headline Median And Trimmed Mean

IMF October WEO