Inversions, Bear Steepening Dis-Inversions, And Recessions

Does it matter if spreads are dis-inverting because short yields are falling, or long yields are rising? MacKenzie and McCormick (Bloomberg) say yes. With long yields rising…

If it looked at first glance as though the shift in the yield curve was a solidly positive sign — one indicating that the economy is now at less risk of a recession than it was — that’s probably not the case. True, it shows traders aren’t expecting the Fed to shift into firefighting mode soon. Even so, it’s almost certain to further dampen the economy as it ripples through to mortgages, credit cards and business loans. That will tighten financial conditions further, which may be a welcome development to the Fed. The risk, though, is that it hits the brakes so hard that the economy stalls completely.

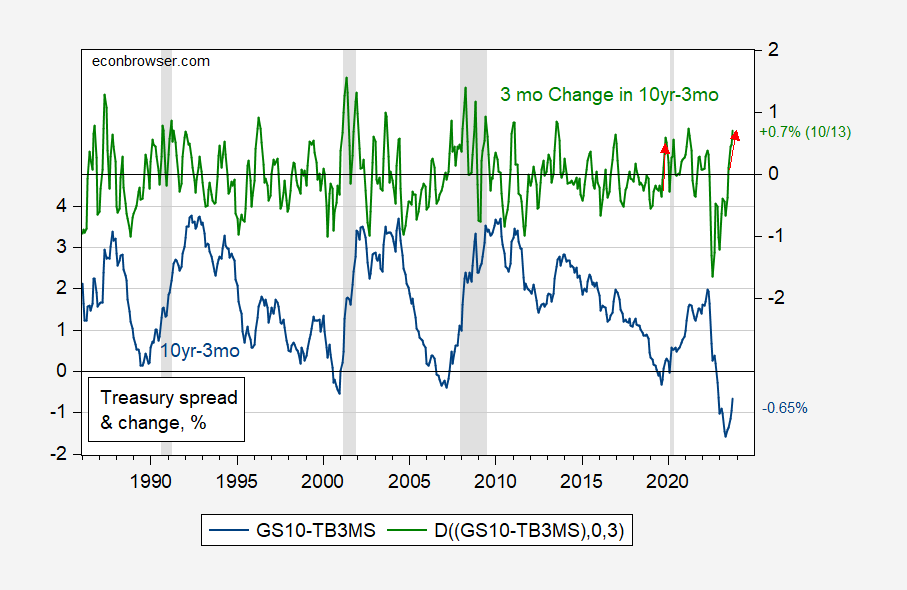

Does having a bull steepening prevent a recession? Figure 1, covering the Great Moderation, is somewhat conducive to that hypothesis, at least eye-balling it.

Figure 1: 10 year-3 month Treasury spread, % (blue, left scale), and 3 month change in 10yr-3mo spread, ppts (green, right scale). October observation for data through 10/13. NBER defined peak-to-trough recession dates shaded gray. Red arrows when 3 month change is positive during period when dis-inversion is occurring. Source: Treasury via FRED, NBER, and author’s calculations.

The evidence in favor of the bear steepening hypothesis is stronger when evaluating the proposition formally. I estimate probit models for (i) spread only, (ii) spread and short rate, and (iii) spread, short rate and 3 month change in spread. The 3 month change in spread is statistically significant and adds to the pseudo-R2.

(ii) Pr(recession=1)t+12 = 0.813 – 76.11spreadt + 9.80itshort

Pseudo-R2 = 0.28, Nobs = 241, bold denotes significant at 5% msl.

(iii) Pr(recession=1)t+12 = 0.736 – 98.37spreadt + 11.99itshort + 98.28Δ3spreadt

Pseudo-R2 = 0.34, Nobs = 241, bold denotes significant at 5% msl.

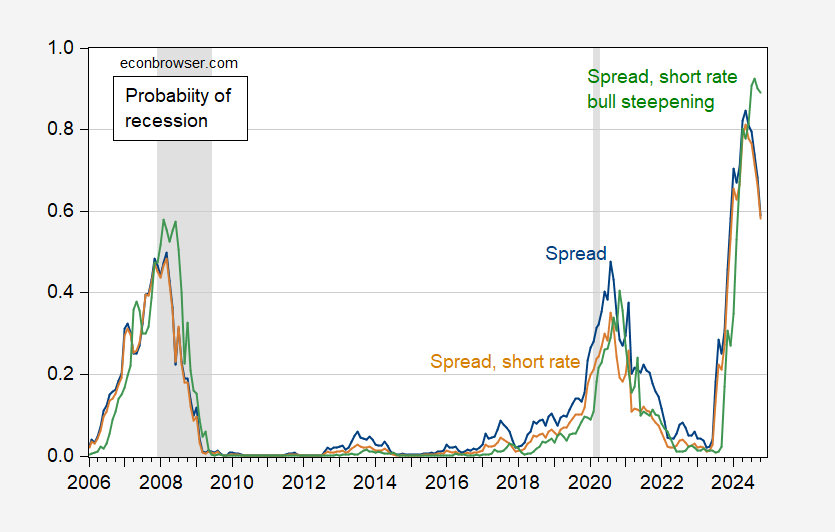

The recession probabilities are shown below.

Figure 2: Recession probability 12 month ahead estimated over the 1986-2023M10 period for spread (blue), for spread and short rate (tan), and spread, short rate, and 3 month change in spread (green). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

The bear-steepening specification implies 90% probability of recession in 2024M09, while it’s only 66.4% using the spread + short rate (peak probability for this specification is May 2024). Does this make me more pessimistic about avoiding a recession? Not really; the Ahmed-Chinn specification with the foreign term spread (but no steepening measure) was about 90.8% probability for September 2024.

More By This Author:

CPI Inflation In September: Instantaneous Headline, Core & Headline Median And Trimmed Mean

IMF October WEO

Manufacturing On The Rise?