The FTSE Finish Line - Monday, October 23

FTSE Attempting To Reclaim The Flatline Into The Close

Rising government bond yields and losses in commodity-linked stocks weighed on the UK's FTSE 100 on Monday. The FTSE 100, which is focused on commodities, slipped 0.15%. Gold prices fell as the U.S. dollar and Treasury yields strengthened, dragging down precious metal miners by 1.0%. Oil prices also slid more than $1 as diplomatic efforts over the weekend eased the geopolitical tensions between Israel and Hamas, causing oil and gas shares to drop 0.8%. Fresnillo, a gold and silver miner, was the worst performer in the blue-chip index, losing more than 5%, while BP, a major oil company, was down 2.2%. Investors will be watching the results of several banks this week, with Barclays, a leading lender, due to report on Tuesday. Ocado, the online grocer and warehouse technology firm, topped the FTSE 100 after Moody's Investors Service affirmed its B3 corporate family rating and its B2-PD probability of default rating. Moody's said that Ocado's rating reflected its expectation of high financial leverage and cash consumption over the next 12-18 months due to high operating leverage and investment in capacity.

On the fundamental front UK flash services PMI data is released tomorrow which is the measure of the activity level of purchasing managers in the services sector. A reading above 50 indicates expansion in the sector; a reading below 50 indicates The flash services PMI is based on approximately 85 to 90 percent of total PMI responses each month, and it is designed to provide an accurate advance indication of the final PMI data The final S&P Global/Cips UK services PMI business activity index for September was 49.3, down slightly from 49.5 in August, but well above the flash estimate of 47.2. This means that the services sector contracted for the second consecutive month, but at a slower pace than initially expected. The main factors behind the decline were supply chain disruptions, staff shortages, and rising costs. The consensus forecast for October's UK flash services PMI is 49.5, which would indicate a stable level of activity compared to September. However, there is a possibility of an upside surprise if the easing of some COVID-19 restrictions and the improvement in consumer confidence boost the demand for services. A print of 50 or above would signal growth in the sector and would support the case for another Bank of England interest rate hike, as the services sector is the dominant segment of the UK economy. On the other hand, a print below 49.5 would suggest a further contraction in the sector and would weigh on the outlook for inflation and growth.

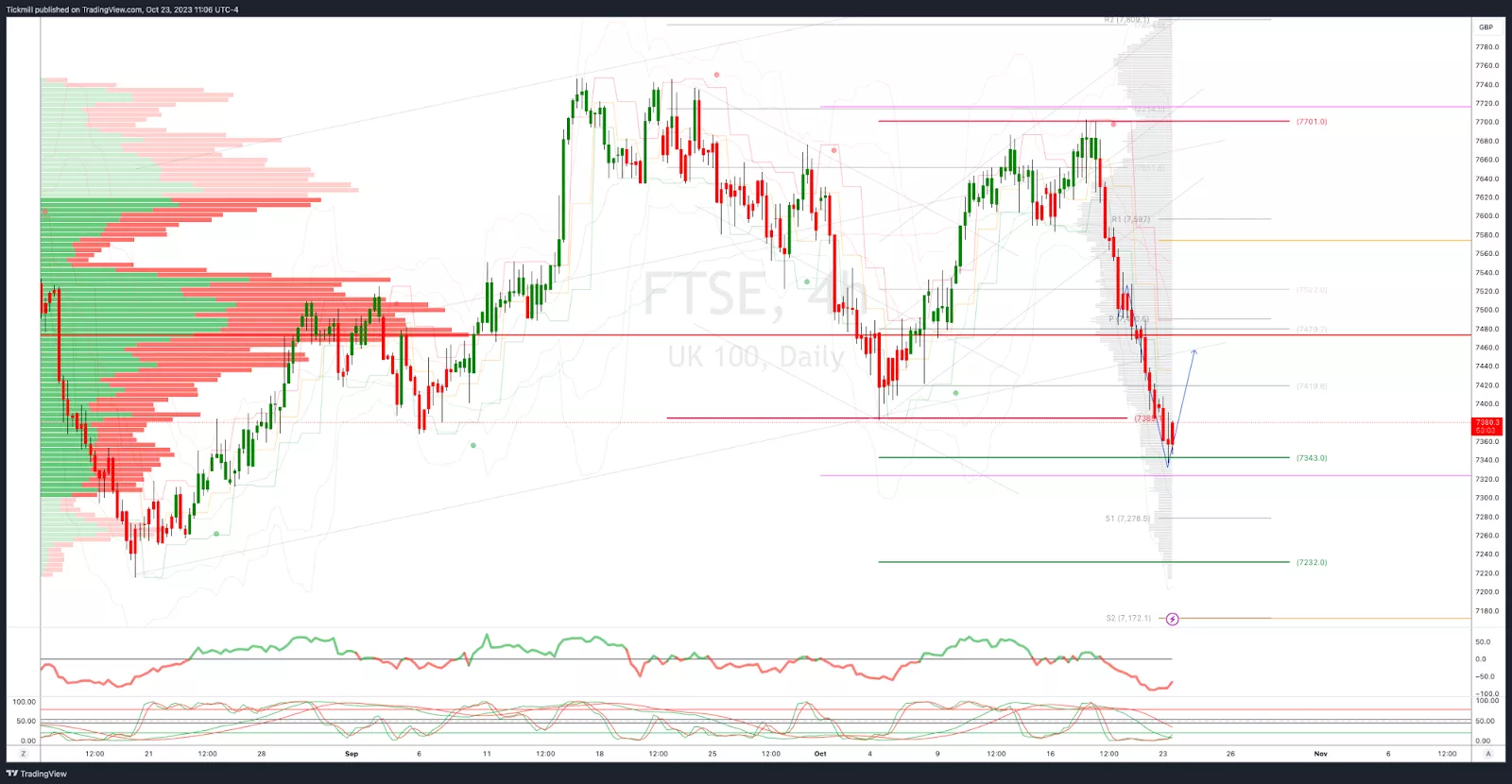

FTSE Bias: Bullish Above Bearish below 7470

-

Below 7385 opens 7340

-

Primary support is 7385

-

Primary objective 7858

-

20 Day VWAP bullish, 5 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, Oct. 23

FTSE Rentokil Continues To Rollover, Endeavour Mining Gains With Gold

Daily Market Outlook - Friday, Oct. 20