The Fog Of War: Silicon Valley Bank, First Republic, Fractional Reserve Banking And Bank Runs

If you’re looking for a guru to tell you how everything surrounding the failure of Silicon Valley Bank is going to play out, you’ve come to the wrong place. Because the truth is I have no idea – and neither does anybody else. But I will tell you why nobody knows what’s going to happen.

What I can tell you is that the federal government stepped in Sunday at 6:15pm EST to announce a bailout of Silicon Valley Bank (SIVB) depositors – and Signature Bank (SBNY) in New York as well (which failed on Sunday). The FDIC will backstop all depositors at both banks – though shareholders and certain unsecured bondholders will not be protected. In addition, the Federal Reserve created the Bank Term Funding Program to provide additional liquidity to depository institutions.

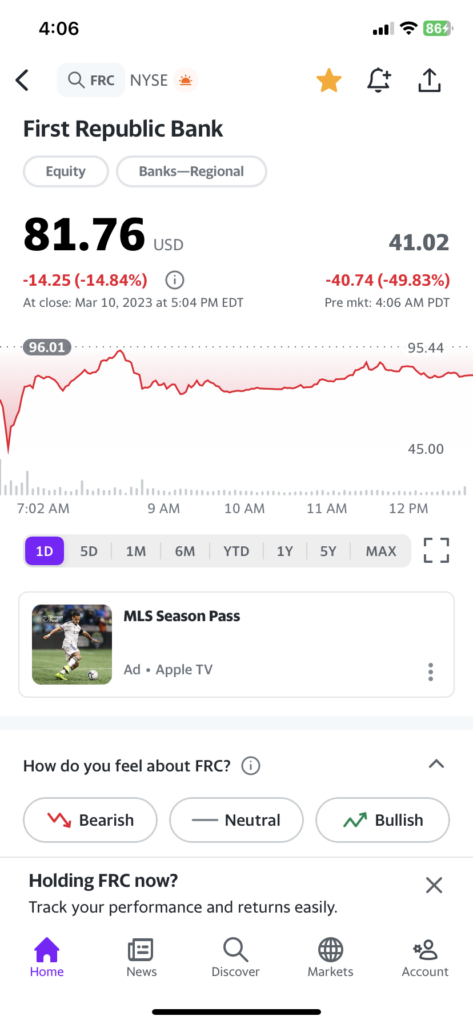

The stock Futures initially rallied on the news but are fading this morning as another Northern California Bank – First Republic (FRC) – is in the crosshairs. FRC shares are currently down about 50% in the premarket. Why?

A quick primer on fractional reserve banking. The way modern banking works is that banks take in money from a variety of sources such as deposits. Deposits are short term liabilities because depositors can ask for their money back at any time. Banks use the money they take in to make loans, among other things. The business model is profitable because the loans pay a higher interest rate than the deposits creating a net interest spread for the bank.

Loans are longer term assets. The bank can’t ask for its money back until the term of the loan ends. Therefore, there is a duration mismatch between a bank's assets and liabilities. In addition, banks keep only a fraction of the deposits they owe on their balance sheet as cash. Hence the term fractional reserve banking. In other words, a bank does not keep on hand cash sufficient to meet all its deposit liabilities.

This creates the possibility for a bank run: Should all – or a large proportion – of depositors ask for their money back at the same time, the bank would not have enough cash on hand to meet those redemptions. That’s why I can’t tell you what’s going to happen – and neither can anyone else: Nobody knows if the depositors of a given bank will get cold feet and overwhelm the bank's capacity to meet redemptions. FRC’s stock is down so much in the premarket because there are fears that that is exactly what is happening. And there are certainly depositors of other banks out there who are taking their money out or at least thinking of doing so.

The other unknown is the governmental response – though the bailout of SIVB and Signature suggest a blueprint if other banks are forced to shut down.

More By This Author:

Reminiscences Of 2007: SIVB, Bear Stearns And The Fed Decision

CPB Is In Its Sweet Spot

Will The Fed Make A Policy Mistake?