Will The Fed Make A Policy Mistake?

(Click on image to enlarge)

Powell: New data suggests “the ultimate level of rates is likely to be higher than previously anticipated"

— Nick Timiraos (@NickTimiraos) March 7, 2023

⁰“If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes”https://t.co/uGVS4otLYd

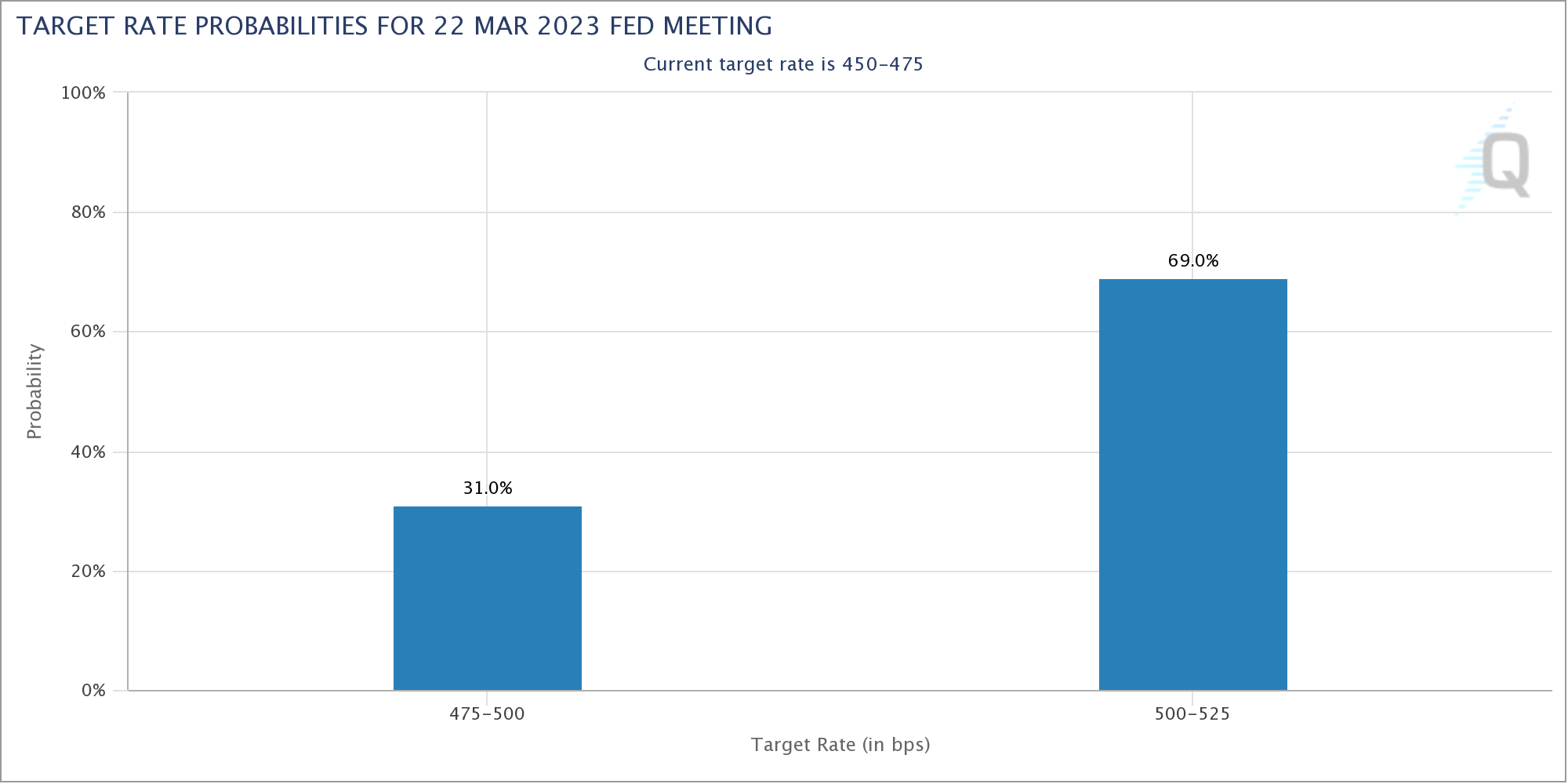

Fed Chair Powell gave testimony before Congress this morning that was decidedly hawkish. As a result, the probability of a 50 vs 25-point rate hike in two weeks flipped from 30/70 before his testimony to 70/30 after, as you can see in the chart above. That’s why the stock market is getting hit today.

As I discussed in detail in my blog from this weekend “Looking Ahead”, what the Fed does will depend on the Jobs Report this Friday and the CPI Report next Tuesday. But Powell’s testimony made clear that a 50 point hike is definitely on the table.

I believe a 50-point hike would be a policy mistake. That’s because inflation in the real world is rolling over (see my YouTube below) and the economy can’t handle that much tightening. The Fed was slow in reacting to inflation – and now it’s in danger of overreacting. The former led to a stock market bubble and soaring inflation in the wake of COVID. The latter will lead to a stock market crash and deflation. There’s got to be a better way to do monetary policy.

More By This Author:

Looking Ahead: Jobs Report, CPI, And The FedSpeculating On A COST Membership Fee Increase

RIVN May Be A $0