Looking Ahead: Jobs Report, CPI, And The Fed

Image Source: Pixabay

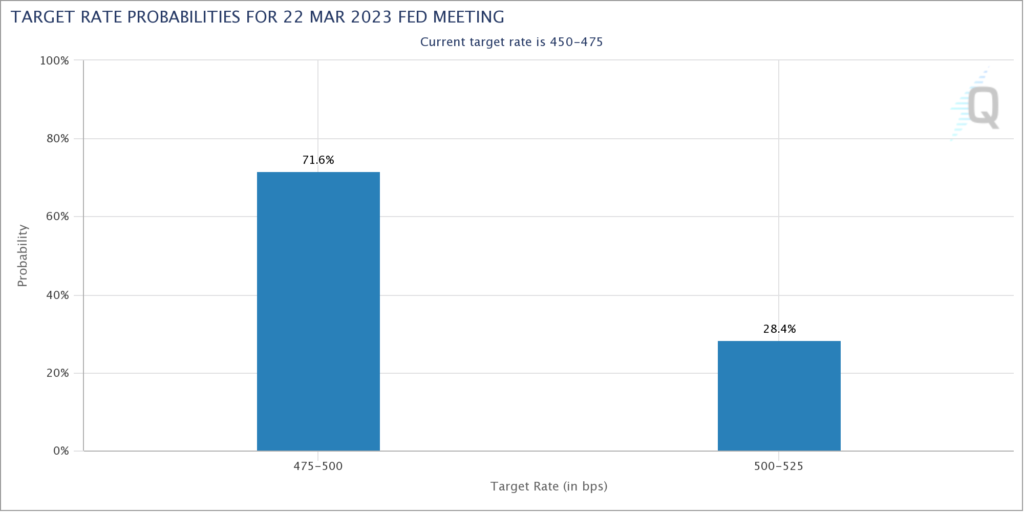

I have been writing a lot about individual stocks in recent weeks, but for the next few weeks, macro will take center stage leading up to the Fed Decision on Wednesday, March 22. As you can see in the chart above, Fed Futures markets are assigning a 72% probability of a 25 basis point hike and a 28% probability of a 50 basis point hike.

In other words, there is a good deal of uncertainty heading into the next Fed Decision, and which decision they make may be decisive for short-term market direction.

There are two key reports in the next two weeks that will likely determine what the Fed does. First, on Friday, March 10, the February jobs report is released. Then on Tuesday, March 14, the February CPI report is released. While I have no clue what those reports will say, stocks would obviously prefer dovish data and a 25 basis point hike.

#ES and #NQ

— Yuriy Matso (@yuriymatso) March 3, 2023

Both indices bounced exactly at their respective 200d moving averages pic.twitter.com/7kSCQDEjUV

Meanwhile, price action continues to lean bullish as the major indexes bounced off their respective 200-DMAs on Thursday and Friday.

The most important level, in my opinion, is 4% on the 10-year Treasury. If yields start to breakaway to the upside, that will tighten financial conditions and put a lid on stocks. If, however, they can stay below 4%, I think stocks could be alright in the short-term. Which way they go will depend on the Jobs report, the CPI report, and the Fed.

More By This Author:

Speculating On A COST Membership Fee IncreaseRIVN May Be A $0

TGT: Righting The Ship