The Fed Pencils In 2-3 Rate Cuts In 2024, The Market Expects 4-5

FOMC Statement

Please consider the Fed’s December FOMC Statement.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. …..

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The statement itself does nothing, says nothing, and implies nothing.

Action is in the Fed’s Summary of Economic Projections.

(Click on image to enlarge)

Compared to September, the Fed increased its GDP forecast range, expects slightly more unemployment, and lower inflation.

It’s the Fed’s lower inflation forecast that allows the Fed to reduce by a half of a point its projected Fed Funds Rate from a range of 4.4 to 6.3 percent, to a range of 3.9 to 5.4 percent.

Market’s Expectation

Pre-FOMC meeting today, the market has priced in over four rate cuts next year, Do you believe that?

(Click on image to enlarge)

🔸FED'S POWELL: WE ANTICIPATE GETTING INFLATION TO 2% WILL TAKE SOME TIME

— *Walter Bloomberg (@DeItaone) December 13, 2023

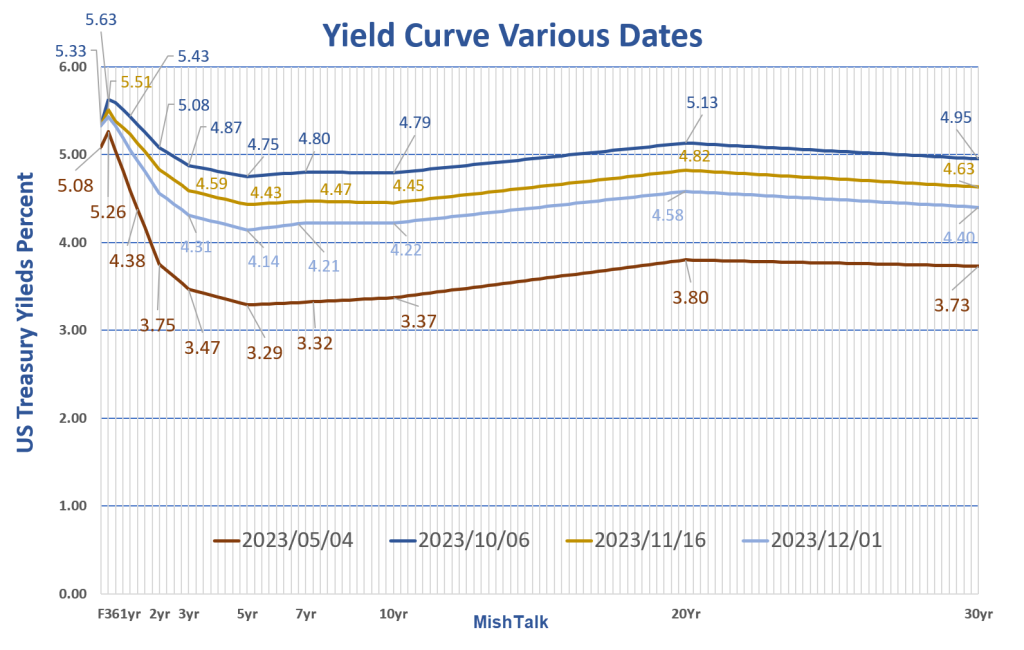

Double-Humped Inverted Yield Curve

On December 4, I commented “The yield curve went from steeply inverted to nearly flat and is now becoming more steeply inverted.”

(Click on image to enlarge)

Yield curve at various dates. Data from the New York Fed, chart by Mish.

I will do an update to my post in the next day or two, giving the market time to adjust the Fed’s comments.

As it looks now, the bond and stock markets are both cheering. The 10-year yield is down significantly over 17 basis points (0.17 percentage points) as I type.

Rate Cut Headwinds

- Global wage arbitrage and just-in-time manufacturing have reversed to inflationary onshoring and just-in-case manufacturing.

- Neither party will fix deficits and out of control spending.

- Trump’s tariffs and sanctions were hugely inflationary but Biden is much worse.

- Biden’s energy policy and regulatory madness is hugely inflationary.

- Retiring boomers need more medical care services. Their jobs are replaced by unskilled zoomers with a totally different work ethic.

- Massive wage increases in union contracts over a many year period and ongoing minimum wage hikes in many states.

Please bear in mind that for years I was one of the biggest deflationistas around.

But many factors supporting lower interest rates and lower inflation have changed 180 degrees from tailwinds to headwinds.

Musings of the Day, 12/13/23:

— Michael Kao (@UrbanKaoboy) December 13, 2023

Good chart from Bloomberg by way of @nglinsman and @Halsrethink that corroborates my Dry Tinder Mental Model for Inflation:https://t.co/CgEzuucnUz pic.twitter.com/IvsfuNLodX

LOL. Jerome Powell looks shell shocked. He just admitted that the Fed needs to stop raising and cut rates well before achieving 2% inflation so they don’t overshoot. This is after more than a year of saying they wouldn’t stop until 2% inflation is assured. This is the most dovish…

— Mike Alfred (@mikealfred) December 13, 2023

Hopium Is Alive But Questions Remain

Hopium is alive. It’s possible the Fed will cut even more than expected. But if so, will it be for strong economic reasons, a collapse in economic activity, or a surge of bank failures?

If inflation is transitory, then transitory to what?

For discussion, please see Huge Moves in the Yield Curve This Year, What’s Going On?

Regarding the huge inversion between 1 month and five years then strongly steepening: Could it be the bond market smells a short quick recession followed by a big inflation problem coming down the pike?

Due to the rate cut headwinds listed above (inflationary tail winds if you prefer), I question the widespread hopium that the Fed has inflation fixed.

More By This Author:

What Will The Fed’s Interest Rate Be A Year From Now?Argentina Devalues The Peso By A Whopping 54 Percent, What’s The Purchasing Power Loss?

Rent Jumps Another 0.5 Percent, Only A Decline In Gasoline Prevents A Hot CPI

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more