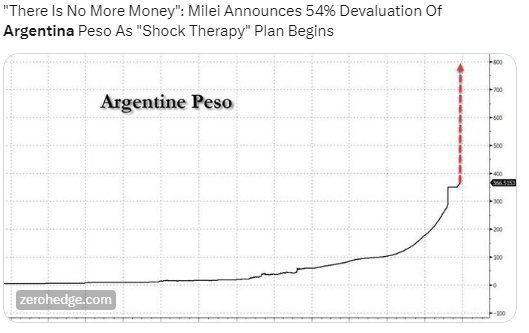

Argentina Devalues The Peso By A Whopping 54 Percent, What’s The Purchasing Power Loss?

Argentina’s President Javier Milei announced a new exchange rate of 800 Argentine Pesos per US dollar, officially devaluing the peso by 54 percent.

(Click on image to enlarge)

The New Official Exchange Rate

“There Is No More Money”

Zerohedge reports “There Is No More Money”: Milei Announces 54% Devaluation Of Argentina Peso As “Shock Therapy” Plan Begins

The government had closed Argentina’s export registry Monday, a technical step that often foreshadows a currency devaluation or major policy change. The central bank also announced Monday the official currency market would operate with limited transactions — a restriction it said it will lift on Wednesday.

To be sure, nobody was surprised by the announcement, as a devaluation was long seen as inevitable. In the run-up to Milei’s inauguration, markets were signaling a currency drop of about 27% in the first week of the new government, while investment banks like JPMorgan and local private advisory firms suggested it could weaken about 44% . Grocers had already increased prices and banks were offering sharply weaker retail exchange rates hours before the Tuesday announcement. The question now is how many more times the currency will be devalued, and if Venezuela is any indication of what to expect, the answer is “lots.”

Argentina’s previously administrations had for years slowed the peso’s decline in the official market through currency controls and import restrictions in an attempt to protect dwindling reserves. That hodgepodge of capital controls has spurred at least a dozen exchange rates, hampering business and restricting investment in South America’s second-largest economy. On the campaign trail, Milei pledged to scrap the currency altogether, replacing it with the US dollar, however it now appears that that will be one of the many campaign promises he renegs on.

On Dec. 7, the prior administration had let the peso slip by about 5%, while simultaneously limiting the amount of greenbacks banks could hold in order to prevent them from hoarding dollars. The government had been burning reserves to keep the currency largely steady at 350 per dollar since the August primary vote, when Milei’s surprise showing sent markets into a tailspin. In parallel markets, that rate is about 1,000.

Purchasing Power

So, how much did purchasing power of the peso fall?

Gold Telegraph is not in the ballpark. In fact, it is not clear at all the Peso fell.

Understanding the Contradiction

- The “official” rate is not the real rate. One could not go into a bank and exchange at that rate.

- As Zerohedge pointed out “In parallel markets, that rate is about 1,000.”

If the rate stabilizes at 800, then purchasing power would have risen by 200/1000 or 20 percent!

It’s possible 800 won’t hold. But perhaps it does. But no one would exchange pesos at the official rate of 350 per dollar other than banks cheating anyone dumb enough to deposit dollars.

When Did the Loss Occur?

The peso was not instantly devalued. Rather, the devaluation officially recognizes a loss of purchasing power that happened long ago.

We will not find out until some dust settles if 54 percent was enough or too much.

Regardless, the actions by Milei will, at a minimum, slow any further declines.

Recognition of a spending problem is a very good start.

Javier Milei Takes a Chainsaw to Argentina’s Government

Yesterday, I noted Javier Milei Takes a Chainsaw to Argentina’s Gov’t, Eliminating Half as Promised

The newly elected president of Argentina, Javier Milei, just took a chainsaw to Argentina’s government. Congratulations to Milei for keeping a promise. The US desperately needs to do the same!

Wow and Congratulations!

I would like to see the US do the same, starting with the Department of Education and Department of Labor. Get rid of them.

Some readers accurately noted that getting did of departments is a pittance. That’s true. But we will also kill all of the siffling rules and regulations at the same time.

And I would slash the military budget as well. We wasted trillions of dollars in Iraq and Afghanistan and achieved nothing. What if we spent those trillions here instead of dropping bombs there?

Why are US troops in Germany and Japan and dozens of other places? At a minimum, if Germany, Japan, Poland and other places want US troops on their soil they should pay us. If they don’t want us there we should not be there. Syria comes to mind.

Killing collective bargaining for public unions and prevailing wages would reduce the costs on stuff we do build here.

We are going to have to do something about Social Security and Medicare.

Instead, Trump stands with Biden on both tariffs and Social Security. The latter is a tax on US consumers.

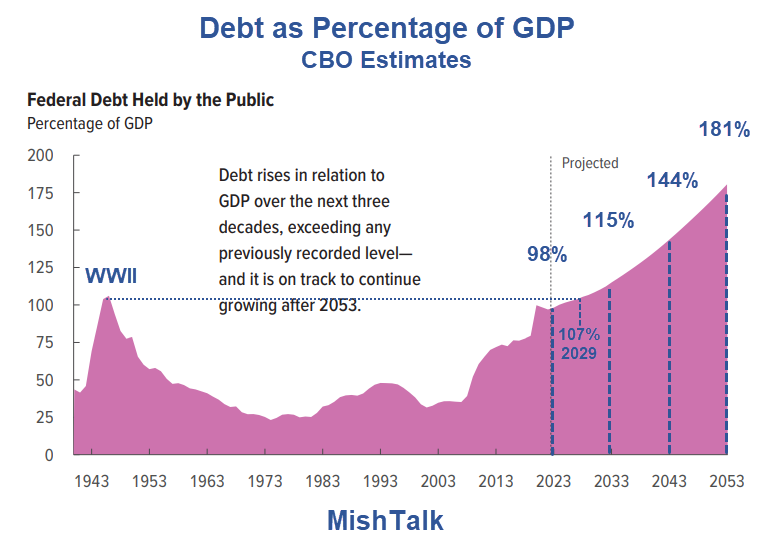

Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

(Click on image to enlarge)

On September 7, 2023, I commented Debt to GDP Alarm Bells Ring, Neither Party Will Solve This

Within a few years the debt-to-GDP ratio of the US will topple highs set in WWII. This time, there will not be a huge baby boomer led recovery.

No One Will Fix This

Compromise is always more spending for this in return for more spending on that.

Bnd both parties want to spend more on the military.

“Neither party will fix the deficits. Neither party will do anything about mounting debt. No one will do anything about anything because the political system is totally broken.” Mish

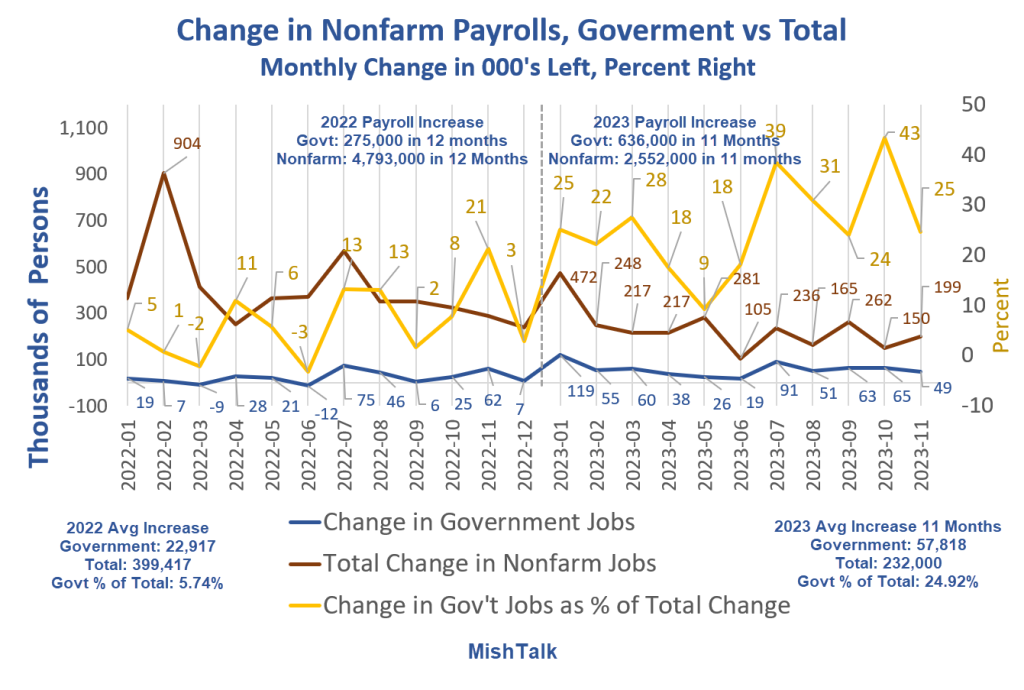

Government Accounts for Nearly 25 Percent of All Job Gains in 2023

(Click on image to enlarge)

Data from the BLS, chart by Mish

On December 10, I noted Government Accounts for Nearly 25 Percent of All Job Gains in 2023

Government jobs have been on fire the entire year.

The total job gains so far in 2023 is 2.552 million. Government jobs account for 636,000 of them!

US Chainsaw Needed

Can we please take a chainsaw to the US and State Governments?

But it cannot stop there. Collective bargaining, inane regulations, and even reduced military spending all need to be on the table.

Javier Milei gives us hope that it’s possible.

But it sure won’t happen with this crop of Republicans and Democrat losers.

Trump is no hero. The best we can say is he is better than Biden economically speaking.

Since that is saying next to nothing, it’s not a good start. We have not yet hit the recognition phase, or if we have, not enough for anyone to take any actions.

Rising debt under Trump is proof enough.

More By This Author:

Rent Jumps Another 0.5 Percent, Only A Decline In Gasoline Prevents A Hot CPIThe Price of Rent Surged 27 Straight Months. Is Relief Finally Coming?

California Has A $68 Billion Budget Deficit With Only $30 Billion In Reserves

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more