The Fed And Bond Market Similar Inflation Views

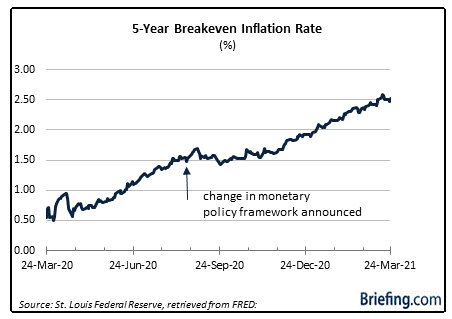

“Inflation expectations have risen sharply over the past year. What hasn't changed is the target range for the fed funds rate. It remains pinned at 0.00-0.25% and the latest projections provided by the Federal Reserve showed a median estimate for the fed funds rate to stay right where it is through 2023…..Right now, the Federal Reserve can be more tolerant of the breakeven rate sitting just north of 2.50%, because it is not materially above its inflation target AND the Federal Reserve needs the inflation rate to run above 2 percent for a time so it can hit its 2 percent average inflation target.” (Briefing.com, March 25, 2021)

The Fed’s mandate is to achieve maximum sustainable employment and price stability, currently defined as an average annual inflation rate of 2%.

Expectations of future inflation matter for many reasons, particularly since an escalating inflation pace can clearly affect US central bank policy.

Indeed, because for many years now the US economy has fallen short of the Fed’s 2% inflation objective, and given the seriousness of the pandemic recession, the Fed has indicated that it is willing to stray above the target for quite a while.

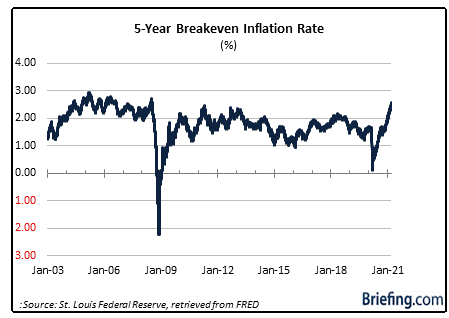

One widely accepted measure of inflation expectations is the “breakeven” inflation rate, which is a measure of expected inflation that is embedded in the bond market.

The market-based measure of expected inflation is simply calculated as the difference between the yield of a nominal bond and an inflation-linked bond of the same maturity.

In other words, the breakeven inflation rate is the inflation rate at which investments in nominal and inflation-adjusted bonds would be equally profitable for a given maturity.

The breakeven inflation rate is a particularly useful estimate of inflation expectations since it can be estimated for a range of different time horizons, though the five-year time horizon seems most appropriate.

(Some experts correctly point out that this measure of inflation expectations is not perfect, since breakeven inflation is also affected by two unobservable factors: the premium that bond investors are willing to pay for protection against the risk that inflation will overshoot its expected path, and the higher yield they require for holding relatively less liquid inflation-linked bonds.)

Nonetheless, the 5-year market-embedded inflation rate implies what the market thinks US inflation will average over the next five years. And as the following two charts illustrate, the five-year inflation rate has been rising over the past twelve months.

Indeed, as of early April, the five-year future average inflation rate was estimated to be 2.53%, the steepest inflation pace since July 2008.

In conclusion, the market's 2.5% five-year expected inflation rate is, in a strange way, comforting, since it is roughly consistent with what the Fed desires based on its 2% optimum inflation path.

Indeed, for some time now Fed officials have expressed the worry that the actual rate of inflation was too low relative to its 2% target.

In other words, there should be some comfort in the fact the Fed and the bond market are roughly consistent in terms of their expectation for future inflation.

(Click on image to enlarge)

(Click on image to enlarge)

Pushing for inflation is a lot like shooting a gun into a crowd. Some folks are going to be hurt. So why is the fed bank doing what it knows will hurt most people and will only benefit the money crowd. Something is terribly wrong with that. And yet they have been doing it, very intentionally, for many years.

Perhaps it is time to stop fueling inflation.

Arthur

Do we know what amount of inflation above 2% will the Fed tolerate and for how long? Kinda of vague on their part.