The Emerging Markets Are About To Feel The Pain Of A Soaring Dollar

Since 2008 US dollar credit has grown more rapidly outside than inside the U.S. One of the unintended consequences of U.S. monetary expansion has been the virtual explosion in USD debt held in the emerging markets.

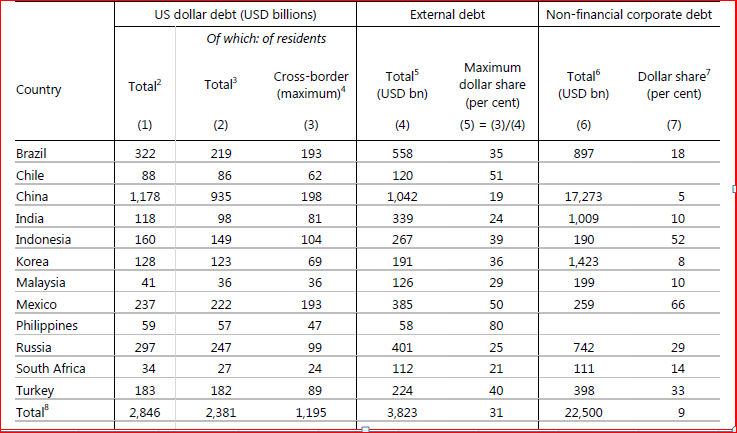

According to the Bank of International Settlements (Table 1), emerging markets have accumulated a staggering USD debt of $22 trillion spread throughout the developing world. Considering external debt, Brazil, Chile, Mexico and the Philippines have the greatest exposure. As for non-financial corporate debt, Indonesia, Mexico, and Turkey have the most to lose from a soaring USD.

Table 1 Emerging Market US Dollar Debt)

(as of 2015 Q2)

This enormous credit expansion was driven, in large measure, by the rapid growth in many emerging markets, especially in Asia. Adding more fuel to the fire was the use of the USD as a substitute for local currency credit because of favourable interest rates. Those countries that were major commodity exporters, literally, banked on the surge in commodities prices in 2011-14 to support of their dollar loans. Once commodity prices started to slump in 2014, USD loans became a greater burden. Now, that burden has increased even further in the wake of the U.S. election results.

The emerging economies used USD credit to issue:

- Sovereign bonds

- Bank loans at home

- Bank loans booked by offshore affiliates of U.S. multinationals

- Private loans to local investors

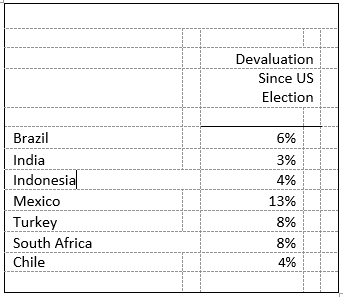

Prior to the U.S. presidential election, these major USD borrowers experienced a steady depreciation as worldwide trade softened. Since the election, however, the USD has been on a tear and these countries are undergoing further currency declines (Table 2).

Table 2 Countries Most Vulnerable to Rise in US Dollar

The rise in the USD has set in motion dynamics that affect currency and monetary policy in the emerging markets. They include the following:

- The re-pricing of USD dominated debt as measured in domestic currency; this increases the cost of servicing the debt and introduces greater prospects for default;

- Depreciating currencies are making it very difficult for regional central banks to ease domestic monetary conditions; more regional central banks will remain on hold until the dust settles;

- Depreciating currencies add to inflationary pressures and to an acceleration of capital flows ;

- There will be greater emphasis on export growth in order to generate hard currency to support FX reserves and to manage currency devaluation;

- Domestic bond yields will command a higher risk premium vis a vis US Treasuries to reflect the more risky nature of the domestic USD debt; and,

- There will be continued pressure to sell risk assets as money flows into safer assets at home and abroad.

A similar situation occurred in 1997-98 in Asia when reserves were not adequate to stabilize Asian currencies. Ultimately, the Federal Reserve shored up the global system by making U.S. dollar swaps available to regional central banks. However, twenty later, the huge size of USD debt raises considerable doubt that Federal Reserve can come to the rescue. The imbalances today are much greater and the international economy is more at risk .

When the Fed meets next month it will be forced to consider the impact of its rate decisions beyond the U.S. borders.

If these nations default, as in if #Trump cuts their #imports to the US forcing the defaults, our #banks could be in real trouble. I can't imagine how another credit crisis would help the United States prosper.

I agree that there are lots of scary outcomes. Past crisis, like in 97-98 were easy to handle because the USD #debt load was manageable. Now, the #USD overhang is around $25 T( in 2016)--- about 6 times the size of the #Fed's balance sheet--- and the Fed cannot help should things really come apart. A strong #dollar policy is not in anyone's interest.