The CBO’s Pessimistic But Realistic Outlook For The US Economy

“One major driver of CBO’s forecast of the economy for the next several years is the agency’s projections about how the pandemic and social distancing will unfold. CBO projects that the degree of social distancing will decline by about two-thirds from its April 2020 peak during the second half of this year, leading to an increase in social activities and commerce. That projection is in the middle of the distribution of possible outcomes, in CBO’s assessment. It allows for regional and seasonal variation, and it accounts for the possibility of multiple waves of increased transmission of the virus and retightening of social distancing measures, as well as other steps people might take to protect their health while engaging in economic activity.” (CBO, An Update to the Economic Outlook: 2020 to 2030, July 2020)

The US Congressional Budget Office (the CBO) produces 10-year economic forecasts that are intended to guide policymakers in government and in the private sector. The financial markets also pay attention to these projections, though the overly bullish equity markets seem quite oblivious to the economic outlook.

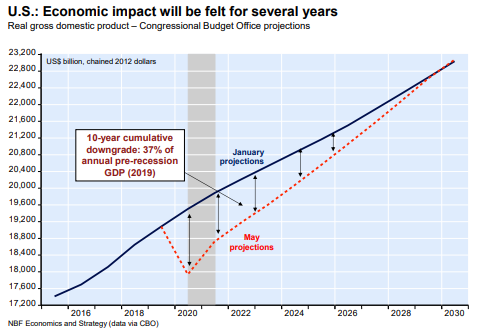

These latest CBO projections clearly illustrate that the destructive effects of the pandemic and the shutting down parts of the US economy is not limited to a single year.

There will inevitably be longer-term damage to the economy and the damage is strikingly summarized in the projections of significantly higher unemployment rates over the next several years, and as well, the massive gap which will open up in terms of the shortfall of economic growth from its true underlying potential.

The CBO’s previous economic projections were prepared in January 2020. The latest projections were updated in May, and more clearly reflect the negative side of the economic dislocation associated with the coronavirus.

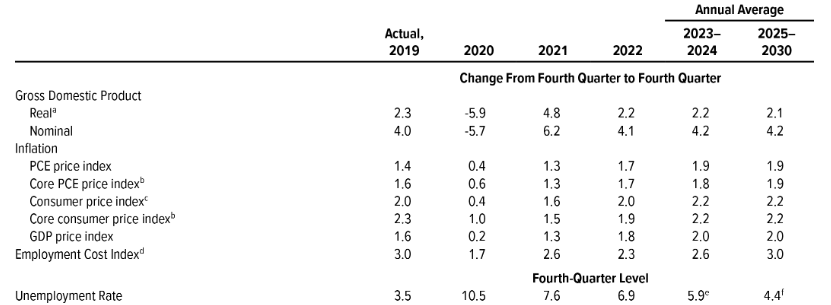

According to the latest forecast, the US economy (US real GDP) in the fourth quarter of this year is projected to be 5.9% smaller than it was in the same quarter of last year.

And as of the fourth quarter of this year, the American unemployment rate is expected to average 10.5%, a high figure that is not all that different than June’s unemployment rate of 11.1%

One year ahead, the unemployment rate is still projected to be extremely steep, at 7.6%. And as of the fourth quarter of 2022, the US unemployment rate is projected to continue to be unacceptably high at 6.9%.

Of course, the entire ten-year economic outlook is also quite grim because of the supply and demand dislocations caused by the pandemic.

Not surprisingly, as the accompanying chart illustrates, the US economy is projected to perform far better in the 2025-30 period than in the pandemic tainted previous five years.

In closing, there is no easy way to assess exactly what the economic damage from the pandemic will be on the US economy and its trading partners. Nonetheless, there is widespread agreement among economists that there will be severe negative global effects.

The CBO’s Economic Projections for Years 2020 to 2030

Percent

(Click on image to enlarge)

(Click on image to enlarge)

Certainly the damage from this plague, both direct and consequential, will not be undone quickly. The number of smaller firms that collapse will result in jobs that no longer exist. That part is obvious. The secondary damage, of the changing level of social interactions, may be more subtle and less obvious, but the damage to social interaction will also have an effect.

But the huge ogre standing in the shadows is that debt. It is the debt that will suck down a bigger portion of the GNP for many years, The big problem with debt is that it does, indeed, eventually need to be repaid. No convenient way around it.