Tesla Motors’ Growth Potential

Tesla Motors, Inc. (NASDAQ: TSLA) is an automobile company based in Palo Alto, CA that specializes in the design, development, production and sale of high-performance electric vehicles and electric powertrain components. The company has its own unique sales and operation channel and is the first company to build federally-compliant electric vehicles commercially. Tesla’s major vehicle products include The Tesla Roadster, Model S and Model X.

The company has substantial growth potential. With 31.32 billion market capitalization and a stock price of $261.75, Tesla Motors is the top performer in the automotive industry. Tesla’s proprietary technology in its products and services provides its customers an unbeatable user experience. Those technology innovations also create an extensive patent portfolio for this company. Tesla’s after-sale service programs have built the company a strong brand reputation and groups of loyal consumers. The exclusive manufacture of electric powertrain allows the company to gain partnerships and profits from its industry competitors and companies across industries. Located in Silicon Valley, the company is able to leverage the best engineering and technology resources in the world to keep its reputation as an industry-leading innovator and solve new challenges. The company’s CEO Elon Musk is famous for his vision in making high quality inventions and investments, which is critical to a company’s success.

The Market

The growing need for energy drives the application of alternative energy in the vehicles we drive. As a rising force in the automobile industry, Tesla is doing the right thing by putting significant effort into the safety, quality and services of its vehicles. Its strategic partnerships with Daimler AG (OTCMKTS: DDAIY) and Toyota Motor Corporation (NYSE: TM) have successfully turned those two potential competitors into friends.

Tesla’s vehicles are categorized under “luxury cars” and, for most buyers who are willing to buy luxury cars, safety is usually the top consideration for them. The Tesla Model S is the only model on the market to have received a 10.0/10.0 safety rating from U.S. News and World Report.

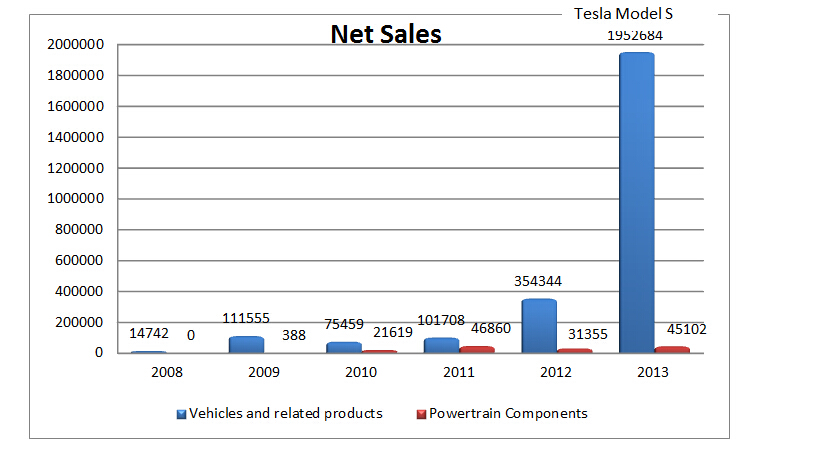

Chart 1

* in thousands

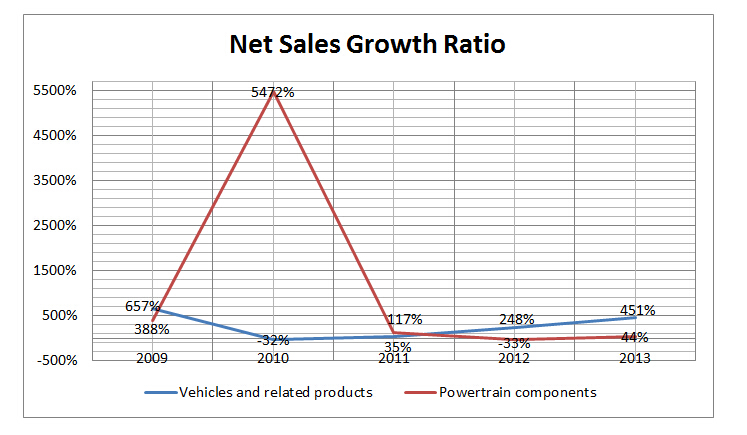

Chart 2

High performance electric vehicles are the basis of Tesla’s revenue growth. As we can see in Chart 1, the net sales of vehicles and related products were the biggest contributor to the company’s total sales in 2012, and that figure jumped 451% in 2013, thanks to The Model S, which came out in June 2012.

Tesla started building strategic partnerships with existing industry leaders in 2010, providing electric powertrain products and services to its partners’ vehicles and is still in the expansion stage of this part of its business. Tesla currently holds relationships with Daimler and Toyota, and it also has an agreement with Panasonic Corporation (OTCMKTS: PCRFY) under which Panasonic provides Tesla with battery cells. According to the company’s Q2 results this year, its powertrain components sales increased 12.96% compare to Q2 2013. As more and more automobile manufacturers jump into electric vehicles and customers’ preferences switch from traditional gasoline cars to electric cars, Tesla’s partnership program will become a winning advantage for this company in the next generation of vehicle market competition.

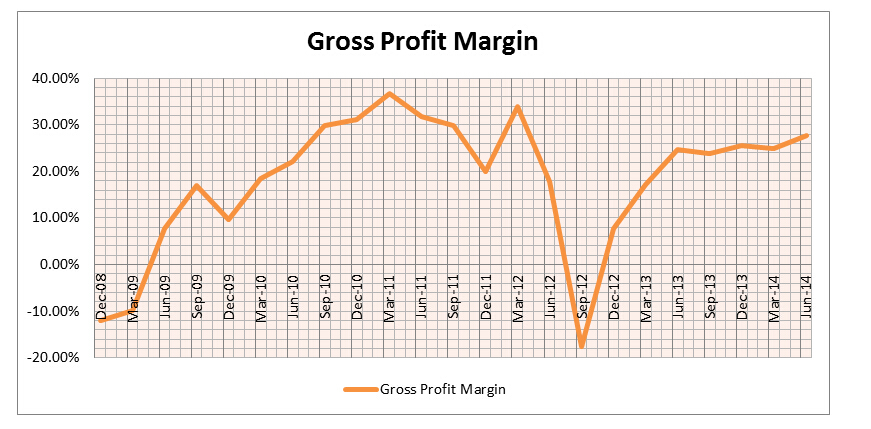

Chart 3

Until Q2 2014, Tesla’s gross profit margin was 27.69%, 16.1% higher than the industry’s average gross margin in Q2 2014, which tells us Tesla Motors is being efficient among its industry competitors.

Positives

The company has a strong management team and its CEO is well known for his business vision. Tesla’s competitive salary packages attract and will continue to attract high levels of talent to the company to contribute to the new generation of vehicles and related products and services. The Tesla series electric vehicles are convenient, comfortable and stylish. They are not only luxury but also eco and price friendly. The world-class warranty and services they offer bring the company positive feedback and loyal customers. Its Model S’s success helps boost the company’s revenues and support the prototypes for future models. Powered by electricity, the Tesla vehicles are able to be fueled with a charger anywhere with an outlet.

Negatives

The current administrative and operations costs are high. Tesla’s powertrain components partnership program needs to reach a new level, and the fact that the current battery can only last up to 265 miles per charge means there is still room for improvement.

Tesla Motors, Inc. is still in its development stage. Investing heavily in R&D at this point is inevitable and necessary for the company’s future growth, hence it is normal for the company to have negative earnings during this period. Yes, the charging process currently takes a long time, but that does not mean this process cannot be reduced in the future. Just like the evolution of smartphone, the charging process will become shorter and the battery will last longer; technology makes this happen. The exceptional location advantage of the company gives Tesla Motors the necessary technology resources it will need to succeed.

With a current stock price of $261.75, the company still has substantial growth potential and I like its potential as an investment.

Disclosure: None.