Tesla Motors - Did It Go Too Far?

Quite often financial crises start from a set of events. I have no idea what event is going to ignite another crisis (if there is any crisis) but Tesla Motors fits a crisis scenario very well. Look at these two charts:

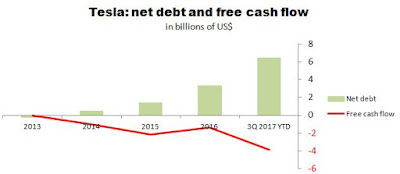

The first chart shows Tesla's net debt (defined as debt less cash) and free cash flow (defined as cash flow from operations less investment spending):

(Click on image to enlarge)

source: Simple Digressions

Note: free cash flow reported during 3Q 2017 YTD is the sum of free cash flows reported in 1Q, 2Q and 3Q 2017

As the chart shows, the higher net debt the higher negative free cash flow, which is a nice recipe for severe financial problems.

The second chart shows cash flow from operations before working capital adjustments. In other words, it shows cash flow delivered by Tesla's core business:

(Click on image to enlarge)

source: Simple Digressions

Note that this year up to date the company has generated lower cash flow than in 2016. Of course, the fourth quarter may be totally different but during first three quarters of 2016 Tesla delivered cash flow of $471.6M, which was a slightly higher figure than that reported this year ($420M). So there is some regress anyway.

To be honest, I like Elon Musk. He is a visionary but as far as financial issues are concerned such a company as Tesla has to be led by a hardball financial officer. A quick look at Tesla's balance sheet makes me wondering whether there is any financial officer at all.

Summarizing - it looks like the whole world (banks, investors, Tesla's customers etc.) is financing the visions created by Elon Musk. However, the main questions is:Did Tesla go too far?

Last but not least - I am not going to start commenting on other issues than the precious metals market. Not at all. However, any financial crisis should have a positive impact on gold and silver. Simply put - during financial meltdowns the precious metals are safe harbors so Tesla's problems could have an indirect positive impact on gold and silver prices at some time in the future....

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more

The problems #Tesla is experiencing now have been long coming. As soon as the company committed itself to manufacturing a mass market car it was obvious cash flow problems were going to occur. Think this stock is heading down fast! $TSLA