Tax Cut And Budget Balance Mythologies

In the current discourse, there seems to be some amnesia with respect to when tax cuts occurred, why they occurred, and how they affected Federal budget deficits. Here is some data (read comments to this post.

(Click on image to enlarge)

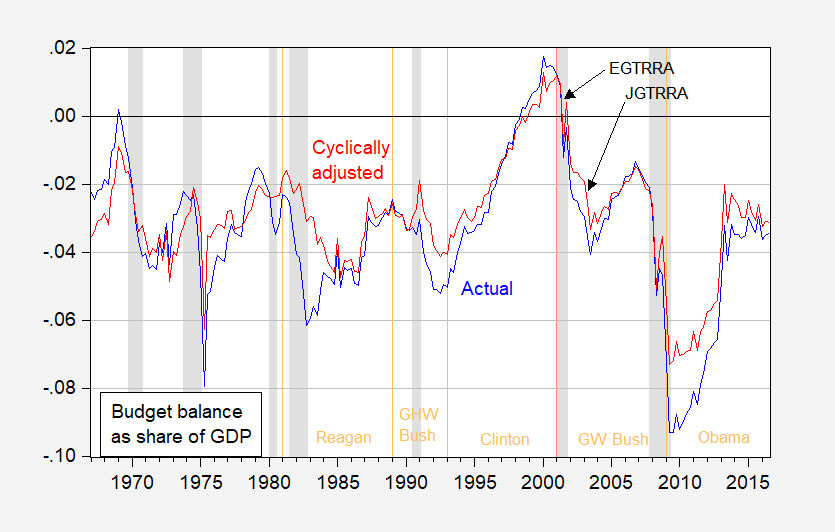

Figure 1: Federal budget balance as share of GDP (blue), cyclically adjusted budget balance as share of GDP (red), June 2017 estimates. NBER defined recession dates shaded gray. Source: BEA 2017Q4 3rd release, CBO (2017), NBER, and author’s calculations.

EGTRRA is the Economic Growth and Tax Relief Reconciliation Act, JGTRRA is the Jobs and Growth Tax Relief Reconciliation Act. Some people have argued that these tax cut acts actually improved the budget balance (or increased tax revenues). The data shown above argues against this point (as does a large empirical literature).

Disclosure: None.

You missed a bunch of huge intervening variables, namely the war on terror, the Iraq War, the dotcom bubble and its subsequent burst, and the biggest recession since the Great Depression. You would have to compare federal revenue while somehow controlling for economic fluctuations to make an apples-to-apples comparison.