Stock Market Loves Powell Moving From “Keep At It” To “Stay The Course” On Fighting Inflation

When Federal Reserve Chair tersely spoke at Jackson Hole on August 26th, he sent a chill through financial markets.

Taking on the toughest inflation-fighting tone he could muster, Powell concluded by proclaiming “we will keep at it until we are confident the job is done.” The S&P 500 (SPY) promptly dropped 3.4% on the day. The message was so harsh that it almost took two months for the stock market to bottom out.

Fast-forward to Powell’s speech on November 30th titled “Inflation and the Labor Market” at the Hutchins Center on Fiscal and Monetary Policy, Brookings Institution in Washington, D.C. Powell concluded by proclaiming “we will stay the course until the job is done.” The S&P 500 promptly rallied 3.1% on the day. The move was bullish enough to close the index above its 200-day moving average (DMA) for the first time in almost 8 months. The S&P 500 also closed above the May 2021 low. Something about the difference between “keep at it” and “stay the course” significantly mattered to traders!

The S&P 500 (SPY) rallied enough to punch through two important resistance levels. The cumulative losses from Jackson Hole are now almost reversed. (Source: TradingView.com)

If not for the stock market’s reaction, I would have interpreted Powell’s speech to land somewhere between hawkish as ever and no new information. In fact, there were several key points from the speech which should have told the market the Fed is as serious as ever about sustaining an extended fight against inflation (the following are direct quotes unless otherwise indicated; particularly important quotes in bold):

- It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.

- So when will inflation come down? I could answer this question by pointing to the inflation forecasts of private-sector forecasters or of FOMC participant…But forecasts have been predicting just such…a decline for more than a year, while inflation has moved stubbornly sideways.

- It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting and Summary of Economic Projections. (a reiteration from the November monetary policy meeting)

- Restoring [supply and demand] balance is likely to require a sustained period of below-trend growth. (another reiteration)

- Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.

- It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months. (the stock market must have focused on this claim)

- As long as new lease inflation keeps falling, we would expect housing services inflation to begin falling sometime next year. Indeed, a decline in this inflation underlies most forecasts of declining inflation. (in other words, this claim is old news)

- We can see that a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon. (the stock market clearly did not hear this)

- The labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time. (in other words the job market is at risk of sustaining high rates of inflation)

- Despite some promising developments, we have a long way to go in restoring price stability.

- It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. (this is another reiteration, but the stock market seemed to treat this as welcome new news)

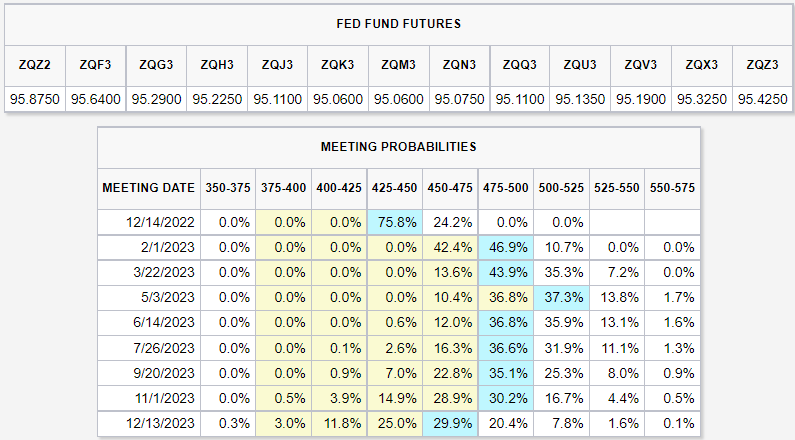

If the Fed Fund futures market reversed course and priced in lower peak rates, the stock market’s sudden burst of enthusiasm could have made more sense. However, futures speculators just shifted out the peak 5.00%-5.25% range by one meeting, from March 2023 to May 2023. The market did move up the schedule for the first rate cut and ended the year at 25 basis points lower. However, note well that during the Q&A Powell reiterated a warning about the market’s expectations for quick rate cuts: “Cutting rates is not something we want to do soon. That is why we’re slowing down.”

Fed Fund futures market peaked rates at the March, 2023 meeting ahead of Powell’s speech (source: CME FedWatch tool)

Fed Fund futures market peaked rates at the May 2023 meeting after Powell’s speech and moved the first rate cut up by 5 months (source: CME FedWatch tool)

The day’s rally in the stock market is one of those many times to ignore contrary fundamental assessments and pay attention to what the market thinks. If buyers follow through with the 200DMA breakout on the S&P 500, I will assume seasonal tailwinds are in full flight. Absent any shocks, the market could then rally all the way into the Fed’s December 14th pronouncement on monetary policy. That event will give Powell a fresh chance to redirect financial markets if financial conditions loosen up too much by then. Maybe Powell will have to reiterate how the Fed will “keep at it” instead of “staying the course.”

The Q&A of the Brookings Institution session mainly reiterated points from the speech. There were two points that stirred my interest for future reference.

First of all, Powell actually admitted that the housing market was in a bubble. The conditions he described were easily observable at the time: “coming out of the pandemic, rates were very low, people wanted to buy houses, get out of the cities and move to the suburbs. You had a housing bubble. Had prices going up that were very unsustainable levels, and overheating…” However, of course, the Fed did not dare say the “B” word in the middle of the mania. Powell did not offer any thought on whether the bubble could have been moderated by hiking rates sooner…or at least jawbone about the bubble.

Secondly, Powell mentioned one regret from the 2020 policy framework reset that he mentioned almost as a footnote. Powell indicated that he would not repeat the mistake of relying on a long history of low inflation as a basis for making policy. At the reset, Powell communicated that the Fed would not “lift off” (start hiking rates) until it “saw both maximum employment and price stability.” The stock market soared on this news as it correctly interpreted the change as a Fed more tolerant of a higher range in inflation. Powell admitted that commitment “made us under-estimate tail risk.”

I soundly criticized this pronouncement at 2020’s Jackson Hole. While Powell insisted this mistake has nothing to do with today’s inflation, I continue to insist that this commitment made the Fed slow to respond to rising and then realized inflation risks. Members of the Fed have also dismissed the notion that starting rate hikes a little earlier would have made a material difference in the inflation landscape. We will never know the counterfactual of course. Still, I feel somewhat vindicated that the Fed has taken note of its policy mistake (and prior deflationary bias) and learned some lessons.

Be careful out there!

Appendix: Notes from the Q&A session

Wage increases are going to be a core part of the inflation story going forward.

The labor market has a real supply imbalance

For most workers, wage increases are being eaten up by inflation. Need price stability to get real wage increases.

We assumed that the natural rate of unemployment had gone higher during the pandemic. It’s very hard to pin down where it is when there is a massive disruption.

Used to be able to look through supply shocks. But if we have repeated shocks, it changes things. What are the implications if true? Very hard to know the answers. We tend to think things will return to where they were naturally, but that’s not happening.

Need to be humble and skeptical about inflation forecasts for some time, calls for a risk management framework. If you are waiting for actual evidence for inflation coming down, it is possible to over-tighten. Slowing down is a good way of balancing the risks.

Very few professional forecasters have gotten inflation right.

There isn’t any one summary statistic to determine when policy is sufficiently restrictive. We monitor the tightening of financial conditions (which happens based on expectations). We also look at the effect of these conditions on the economy. Look at the entire rate curve. For significantly positive real rates along the entire curve. Forward inflation expectations reflect confidence in the Fed getting inflation down to 2%. Look at exchange rates, asset prices. Put some weight on these things.

How do you know when you can stop shrinking the balance sheet? This has already been described in a document. We’re in an ample reserves regime. General changes will not impact the funds rate. Will allow reserves to decline until somewhat above where we think is scarcity. Hold the balance sheet constant….. The demand for reserves is not stable. It’s a public benefit to have plenty of liquidity.

Question: August 2020 announced new flexible inflation targeting framework. Anything in that we should be rethinking. Answer: We will do another review in 2026 or 2026. We implemented through guidance of various kinds. Put in strong guidance because there were a lot doubters that we could ever achieve 2%. Neither did we know. One piece of guidance we wouldn’t do again (it doesn’t have anything to do with the inflation we are currently seeing): we wouldn’t lift off until see saw both maximum employment and price stability. It made us under-estimate tail risk. Remember 25 years of low inflation, inflation just didn’t seem likely.

Cutting rates is not something we want to do soon. That is why we’re slowing down.

It’s not reasonable to expect we get back to the labor force participation in 2020 before the pandemic. But I wouldn’t rule it out. It’s been disappointing and surprising how little we’ve gained back.

We have to assume that for now most of the labor force balancing has to come on the demand side. By slowing job growth, not putting people out of work.

At what point do people ask for more wages because they aren’t keeping up with inflation. Don’t know when that happens, but if it does, you’re in trouble. Labor shortage is not going away anytime soon.

Coming out of the pandemic, rates were very low, people wanted to buy houses, get out of the cities and move to the suburbs, You had a housing bubble. Had prices going up that were very unsustainable levels, and overheating, now the housing market is coming out the other side of that. We have a built-up country, we have zoning, it’s hard to get homes built to meet demand

More By This Author:

The Swiss National Bank Knows More About Inflation Than You Do

Inflation Expectations And Inflationary Psychology

Why The Fed Won’t Read Cathie Wood’s Open Letter

Excellent, thank you.

Thank you for reading!

Great summary of the current situation.

Thanks for reading!