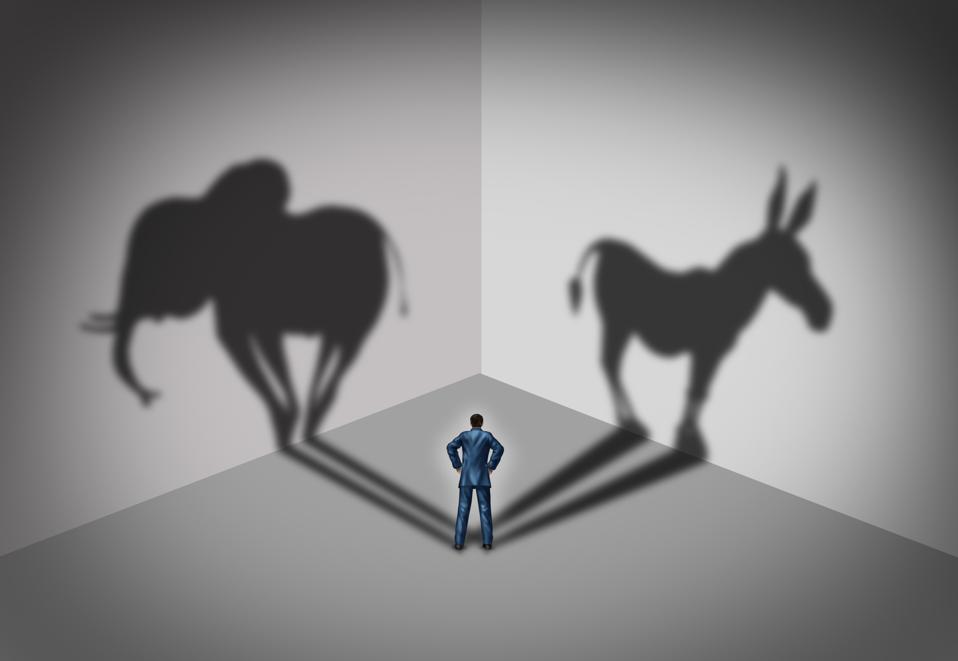

Stock Market Investors: Don’t Worry About The Election

Many investors are worried about the election’s effect on the stock market, most often through a Biden victory leading to actual—or feared—measures that would clobber corporations. One version of the theory asserts that the stock market always likes Republican victories in the presidential race and dislikes Democratic wins. Those claims cry out for both logical analysis and data.

GETTY

The logic of markets that are generally efficient is that anticipated events don’t impact prices. If everyone knows that one candidate will win, then the prices will adjust long before the actual election results. If, on the other hand, the dark horse candidate wins, then the market might change significantly because prices had embodied a different candidate winning. A good example would be President Trump’s 2016 victory, when Hilary Clinton had been widely expected to win. If you can forecast an upset, you might be able to profit by it—if there is an effect on stock prices.

The effect of the election on stock prices is easy to measure. Data on the Standard & Poor’s stock index is available as far back as the 1928 election in which Herbert Hoover beat Al Smith. For that and all subsequent elections, I calculated percentage changes in stock prices on the day after the election and for the 30 days after the election. On average, Democratic victories led to a 1.5% drop in stock prices the next day, with Republican victories leading to a 0.0% change. Over the 30 days following the election, Democrat victories led to declines of 2.7% on average, with Republican wins associated with 1.8% gains. So there is truth in the assertion that the market likes Republican victories, but the magnitude is pretty small: a 4.5% price swing over 30 days.

Caution must be taken with these numbers. All of the differences fail the standard test for statistical significance. One reason is that the sample is pretty small: 12 Democrats won in this time period, and 11 Republicans. Another reason for caution is that the range of values experienced is pretty wide. The 30-day change after Democratic victories was as low as -16.0% and as high as +4.2%. After Republican victories the range went from -6.2% to +5.8%. The data are pretty varied.

Those who have not yet decided which candidate they dislike the least may be interested in the four-year stock market performance after elections. The market gained an average of 45.9% with Democratic presidents compared to 19.1% under Republicans (measured from election day to election day, with recent closing used for the Trump term of office). That probably won’t provide much comfort to investors with conservative politics, though.

Disclosure: None.

What is worrying the market is not Republican or Democrat but not a smooth election or exchange of power. Threatening not to vote the people's choice and claiming votes by mail are illegitimate, undercutting the post office, and threatening the election to go to

the courts while you try to vote a supreme court justice in without addressing concerns is a little unsettling to the market and for good reason. We need stability one way or another, not uncertainty.

Right again, Moon!

Certainly Moon Kil Wong is totally correct.

Once again I would quote that standard caution that "past performance does not assure future results." The fact is probably that the situation affecting the stock markets also affected who won the election. Confusing cause and effect is a common error that folks fall into.