Slightly Larger US Soybean And Corn Crops Prompts Small Stocks Changes

Market Analysis

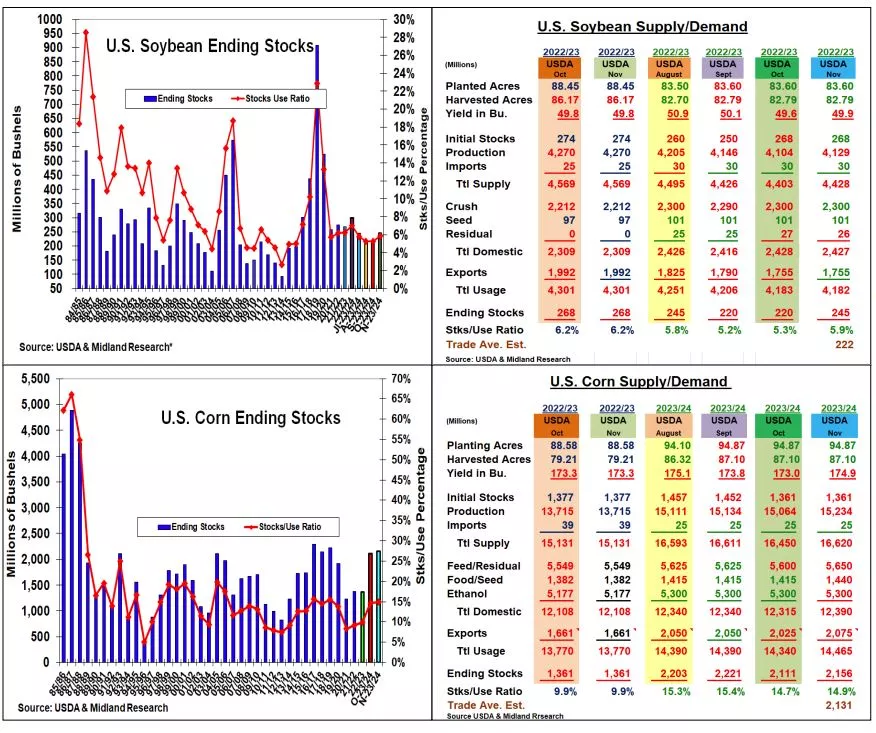

The USDA’s latest crop update follows its recent trend with both corn and soybeans US yields increasing during this month’s crop update after lower Sept & Oct updates. These higher yields upped November’s US corn & soybean output by 170 & 25 million bu. However, this month’s corn & beans ending stocks had only modest increases this month. Wheat’s US stocks also rose 14 million bu because the USDA’s increased its latest US import forecast & slipped food demand.

Instead of the trade’s unchanged yield, NASS’s US soybean average rose by 0.3 bu to 49.9 bu. This upped the US crop to 4.129 billion, a 25 million increase. Many of the major state yields were unchanged (IL, IA, IN, MN) while WI (+5) and TN (+4) had some big jumps. However, the USDA didn’t change their crush & export outlooks, so November larger crop upped stocks by 25 million to 245 million. With no change in S Am’s bean crops & a 1 mmt USDA decline in its world stocks, the market will continue to monitor’ S AM’s crops. Brazil’s southern regions have been too wet while Mato Grasso’s dryness has delayed their planting. Last week’s 3 mmt of Chinese & unknown purchases shows buyer output concerns are rising.

The USDA’s 1.9 bu higher corn yield to 174.9 bu was unexpected vs the trade’s 173.3 bu average. This upped corn’s US output by 170 million bu to 15.235 billion. Larger Midwest (IL, IN, IA, WI, MN, ND, SD) yields were behind the USDA’s higher US yield & output. However, the USDA upped its 2023/24 demand outlooks because of the current US cash price. They raised both their feed & export forecasts by 50 million bu and their ethanol usage by 25 million. This lowered Nov’s stocks rise to just 45 million & a 2.156 billion level. The USDA did raise its World corn stocks by 3 mmt when they upped both Russia & Ukraine’s crop 1.5 mmt each. However, S Am’s crop were left unchanged despite current erratic weather likely delaying their safrina crop seedings & cutting output prospects.

The US wheat stocks rose by 14 million to 684 million. The USDA also increased Russia’s crop by 5 mmt, but they decreased Argentina by 1.5 mmt & India by 3 mmt. This left their world stocks at their lowest level since 2015/16 again in Nov.

What’s Ahead:

Despite higher yields & outputs, this month’s US & world stocks increases were modest. Given the US seasonal need to secure supplies ahead of winter & the Dec 1 closing of the upper Miss River exporting facilities, seasonal price strength normally remains.

Looking to up Jan bean sales to 65% at $13.90-$14, Dec corn to 50% at $4.80-95 range & Dec KC wheat to 65% in the $6.65-85 range.

More By This Author:

Slightly Smaller US Corn & Soybean Crops Dip Ending Stocks This MonthLower Soybean & Corn Yields Reduce US Ending Stocks

After Stock Changes, US Corn And Bean Yields Are Next Market Factors

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more