After Stock Changes, US Corn And Bean Yields Are Next Market Factors

Image Source: Unsplash

Market Analysis

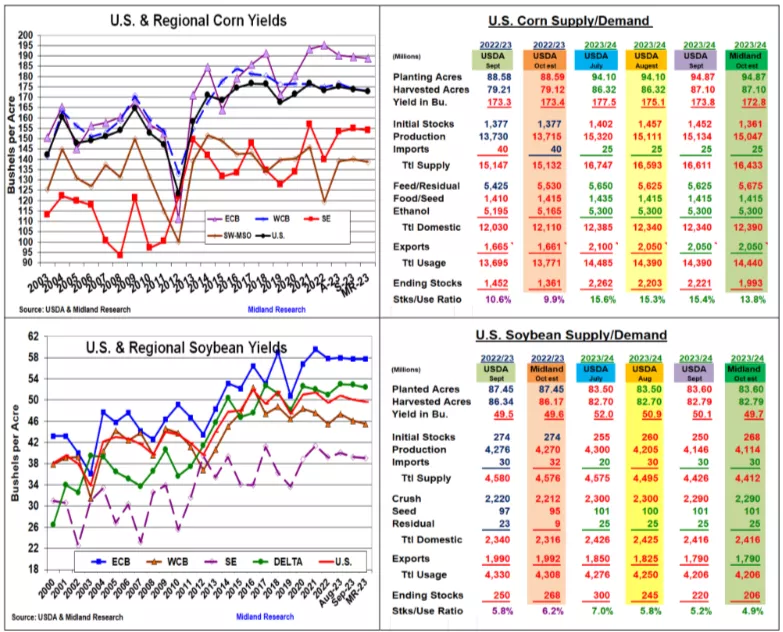

The USDA’s final 2022/23 corn & soybean ending stocks and wheat’s unchanged quarterly stocks despite a larger 2023 US output had the trade rethinking the initial negative Sept 29 reaction, after the US Congress passed a stop-gap budget on the weekend. Corm’s 91 million lower stocks & 15 million smaller 2022 crop suggested a strong summertime feeding level for this to occur. Soybean’s 18 million larger 2023 ending stocks was unexpected, but a late season slowdown in the US crush for maintenance of 8 million bu was a big part of this higher carryover. These US corn & bean carryovers will be a portion of both crops 2023/24’s bushels, but October’s crop report is the next market factor.

Lower ethanol (-30 mil) & export (4 mil) August corn demands surfaced this week. However, this summer’s sizable US livestock and poultry numbers apparently utilized this supply with a 105 million rise in feed to 5.53 billion bu so 2022/23’s stocks could decline. 2023’s big swings in Midwest rainfall from below normal late May & June to alternating dry spells from north to south and back north during July & August & the Central US overall dry Sept isn’t a strong yielding pattern. This suggests 1 bu decline to 172.8 US bu average in Sept. with the WCB & SW/Delta off 1.1 & 1.3 bu each while the ECB & SE may also dip by 0.7 & 0.9 bu. With 75% of US crop in the field, plenty of crop unknowns remain. This year’s smaller carryover & crop size along with a 50 million increase in corn’s feeding could drop 2024’s corn stocks to 1.993 billion bu.

Along with a smaller US crush, beans’ seed & residual level was sliced from 120 to 104 million bu in its 22/23 S&D. Similar to corn, 2023’s weather pattern could dip the US yield by 0.4 bu to 49.7 bu, This drop is led by lower WCB (-0.6), Delta (-0.5) & SE (-0.2) yields while the ECB yield remains unchanged. With no US new-crop demand changes, 23/24’s bean stocks could drop to 206 million bu.

Wheat’s 78 million larger US crop & static Sept 1 stocks suggests a higher summer feeding, but wheat’s 23/24 ending stocks could rise to 650 million bu this month.

(Click on image to enlarge)

What’s Ahead

Despite the potential for tighter US 2023/24 corn & soybean ending stocks, the trade’s focus will be on the size of the US crops, the size and the location of China’s trading activity and the ongoing Black Sea strife impacting Ukraine’s exports as major US ag market factors. Argentine & Brazilian spring weather also remain important. Continue to hold 20243 sales at 50% for beans, 35% for corn & 45% for wheat.

More By This Author:

Larger US Wheat Output & Soybean Stocks Pressured CBOT Prices

USDA's Quarterly Stocks and Small Grains Report

On Alert For Stronger Corn Feeding & A Smaller US Bean Crop

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more