Larger US Wheat Output & Soybean Stocks Pressured CBOT Prices

Market Analysis

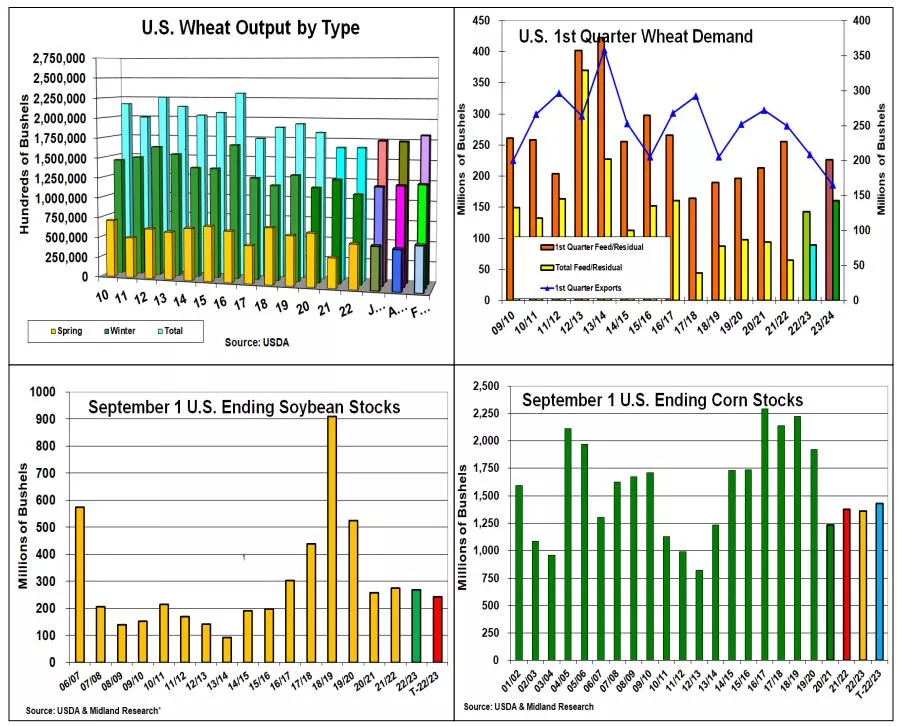

This year’s larger US soybean stocks & a hefty jump in US spring wheat output pressured prices on Friday. Corn’s final stocks were lower than expected while wheat’s Sept 1 stocks were similar to 2022’s Sept 1 levels despite 2023’s higher overall wheat crop. Last year’s US soybean & corn crops were also shaved slightly from their previous levels.

This month’s dramatic jump in US wheat crop output was led by a 45 million spring wheat jump to 505 million bu. After August’s 3.4 bu yield drop, the USDA rebounded this variety‘s yield back to 46 bu, similar to 2022’s yield. NASS also increased its H red & S red crop sizes by 16 and 9 million bu each. This increased the US overall crop by 78 million to 1.812 billion bu. In a twist, the USDA’s Sept quarterly wheat stocks were just 2 million higher than last year at 1.78 billion bu. level. This stock level projects a hefty jump in last summer’s US wheat feed usage to 226 million, an 83 million increase over 2022. Given the tight supplies and high price of corn in US Plains, cattle feed yards could have turned to this alternate feed.

Soybean’s final 22/23 stocks were higher than last month & 26 million larger than the trade’s expectations. However, even with a 6 million smaller 2022 US crop and some small changes in old-crop demand, the USDA will likely tighten its 22/23’s residual to just 12 million bu, the lowest level since 2012/13 crop year. Interestingly, 2023’s stock level is 6 million lower than last year’s carryover.

Corn’s final 22/23 stocks level was 91 million bu lower than the USDA’s Sept forecast at 1.362 billion bu. Despite this lower carryover, corn was pressured from lower CBOT prices and larger 2023 harvest ahead. The USDA did lower 2022’s US corn size by 15 million bu, but they seemed comfortable about raising 2022/23’s corn feeding to a likely 5.5 billion vs lowering last year’s crop further to match this smaller US ending stocks.

The outlook for an open harvest ahead & no positives signs of a stop-gap or general US budget bill being passed by Oct 1 added pressure going into the weekend.

What’s Ahead:

The limited impact of 2023’s larger US wheat crop & quarterly bean stocks on Sept 1 stocks and the US Congress passing a last ditch stop-gap 2024 budget could lift some of late last week’s price pressure. With country yield reports continuing to be variable, producers will likely hold their sales until more knowledge about 2023’s farm yields are known.

Keep bean sales at 50%, corn at 35% & wheat at 45%.

More By This Author:

USDA's Quarterly Stocks and Small Grains Report

On Alert For Stronger Corn Feeding & A Smaller US Bean Crop

Higher U.S. Plantings Countered Lower Yields Limiting Stock Changes

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more