Higher U.S. Plantings Countered Lower Yields Limiting Stock Changes

Market Analysis

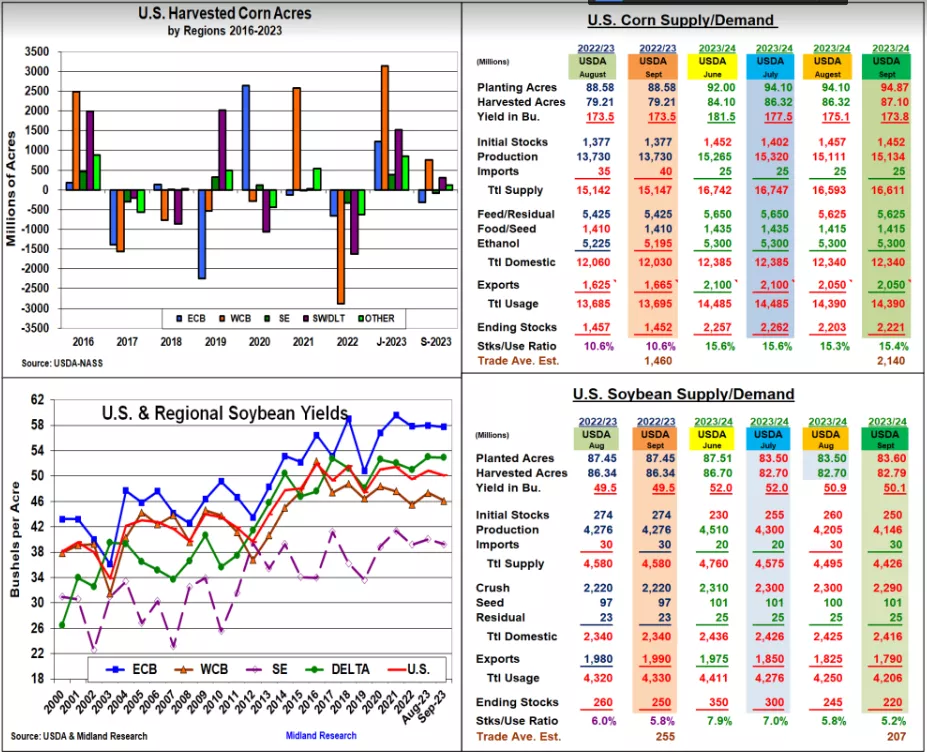

September’s US crop updates revealed lower US corn & soybean yields, but this month’s higher planted crop areas countered these yields & limited this month’s ending stocks changes. The USDA’s resurvey revealed a 774,000 increase in US corn harvested acres. This occurred in WCB and C Plains while the ECB was down 270,000. Interestingly, IA and IL, the two highest US yielding states, had their harvested areas decreased by 300,000 acres each. Much of 2023’s higher 6.29 million acres were planted west of Miss River where heat & drought has occurred. US soybean areas also rose in the Midwest, but declined in the Mid-south. Overall, beans’ US harvested acres rose 95,000 this month.

The USDA dipped the US corn yield by 1.3 bu to 173.8 bu which was near expectations. However, this month’s higher area boosted the US output to 15.134 billion. This was 126 million higher than expected, but only 23 million larger than last month. The ECB output was down while the WCB and the Delta/SW were up on larger harvested areas. The USDA increased old-crop exports (+40) & imports (+5) but dropped ethanol (-30 million). They didn’t change corn’s 2023/24 demand so ending stocks rose only 19 million to 2.22 billion bu.

This month’s US soybean yield was also shaved by 0.8 bu to 50.1 bu with all US regions average yields down. Similar to corn, the W Midwest had the largest decline of 1.2 bu. Interestingly, KS (-6), WI (-4) and NE (-3 bu) were hard hit by drought while excessive rain hurt LA bean yield by 6 bu. Overall, Sept’s US output dropped by 59 million to 4.146 billion which was 11 million below the trade estimate. The USDA did up old-crop exports by 10 million bu, but they also dropped new-crop bean processing by 10 million & overseas sales by 35 million, despite no change in their S Am crops. 2023/24’s US stocks were dropped to 220 million, but they were still above the trade’s 207 million level.

No change in US wheat data with Sept 30 Small Grains ahead. However, the USDA sliced 6 mmt from Argentina, Australia and Canada’s crop with El Nino intensifying, This dropped world stocks to 258 mmt. the lowest since 2014/15.

(Click on image to enlarge)

What’s Ahead

This month’s lower US soybean & corn yields were positives, but the larger acreages that the USDA found muffled their prices. S America’s planting progress, Ukraine’s ability to forge new export paths with their Black Sea ports under siege and US country yield reports as the 2023 harvest picks up steam will be market factors. Hold new-crop bean sales at 50%, corn at 35% and wheat at 45%..

More By This Author:

USDA September Crop Supply/Demand And Production Report Summary

2023 Midwest Crop Tour - Heat/Dryness Overpowered The ECB Crop Count

Weather & The Black Sea Remain Important Market Factors

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more