Weather & The Black Sea Remain Important Market Factors

Image Source: Pixabay

Market Analysis

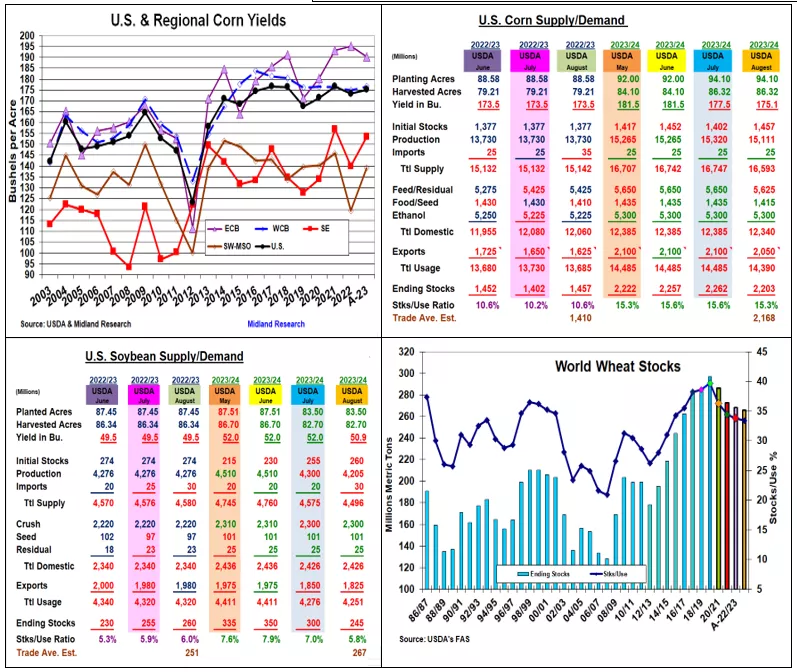

Given this year’s lower US crop ratings than last month & last year, the market was expecting smaller August US corn, soybean & spring wheat outputs in the USDA update. The USDA did reduce their yield levels & crop sizes, but the World Board also decreased their 2023/24 demand outlooks reducing this month’s smaller new-crop impacts. Higher imports & sluggish old-crop exports were behind their lower new-crop corn & soybean exports. However, their reduced US wheat sales given the recent Black Sea grain accord demise with both Russian & Ukrainian ports under attack isn’t very easy to understand.

The USDA’s August US corn yield was sliced by 2.4 bu to 175.1 resulting in a 15.111 billion bu US crop, down 209 mil bu from July. A 5 bu decline in the ECB’s average regional yield to 190.5 bu because of sizable yearly declines in IL (-13 bu) & WI (-14 bu) yields was the major reason for corn’s smaller August crop. Higher yearly yields in SE (+13.5), SW (+19.5), and WCB (+1.8 bu), but there were no new record state yields this month. For the 3rd year, this month’s corn crop was below the trade vs the USDA’s update being above their average estimate for 6 years going back to 2015. The USDA sliced 25 million from corn’s old crop & 50 million from 2023/24 export outlook while slicing 25 million from feed’s new-crop demand. Overall, corn’s 2023/24 stocks decreased only 61 million to 2.203 billion.

Soybeans’ August US yield was also lower than the trade at 50.9 bu, down 1.1 bu from July, This cut the USDA’s latest crop estimate by 95 million to 4.205 billion bu. Regionally, yields are slightly up from last year, but harvested acres are down 4 million acres. Like corn, the World Board also slipped its 2023/24 export outlook by 25 million bu resulting in a 55 lower US ending stocks outlook of 245 million.

USDA rearranged wheat’s US output this month. They upped winter wheat’s size by 20.8 million led by a larger SRW crop.

But, they also slashed spring wheat & durum’s production by 25.6 million bu dipping 2023’s overall crop by 5 million bu. The World Board’s lower US export of 25 million despite their smaller, Canadian, EU & Chinese crops dipped August’s world stocks to 265.6 mmt & the Black Sea trade under major threat.

What’s Ahead:

Given wheat and soybeans' modest US 2022/23 carryovers, the balance of the 2023 US growing season remains important, particularly in the Western Midwest. Various field reports and Pro Farmer’s Midwest crop tour in 8 days doing field samples from corn and soybean fields from Ohio to S. Dakota will be watched closely. Hold 2023/24 soybean sales at 50%, corn at 35% and wheat at 45%.

More By This Author:

USDA May Nip Corn & Soy Yields, But US Weather & Black Sea Are Factors

US 2023/24 Stocks Change Modestly, But Weather Stays Important

Despite Lower US Soybean Acreage, Trade Watching Nearby Weather

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more