Relative Complacency Rules

Image Source: Unsplash

Yesterday we noted that this week has the potential to be among the most consequential in quite some time thanks to the confluence of an FOMC meeting, the busiest week of earnings season, and the President’s meetings with key Asian leaders. Solid news about trade negotiations gave stocks an ample reason to rally to another round of new highs amidst widespread enthusiasm. Although there are few catalysts for another advance today, we continue to see relative complacency ahead of a slew of significant events that begin tomorrow.

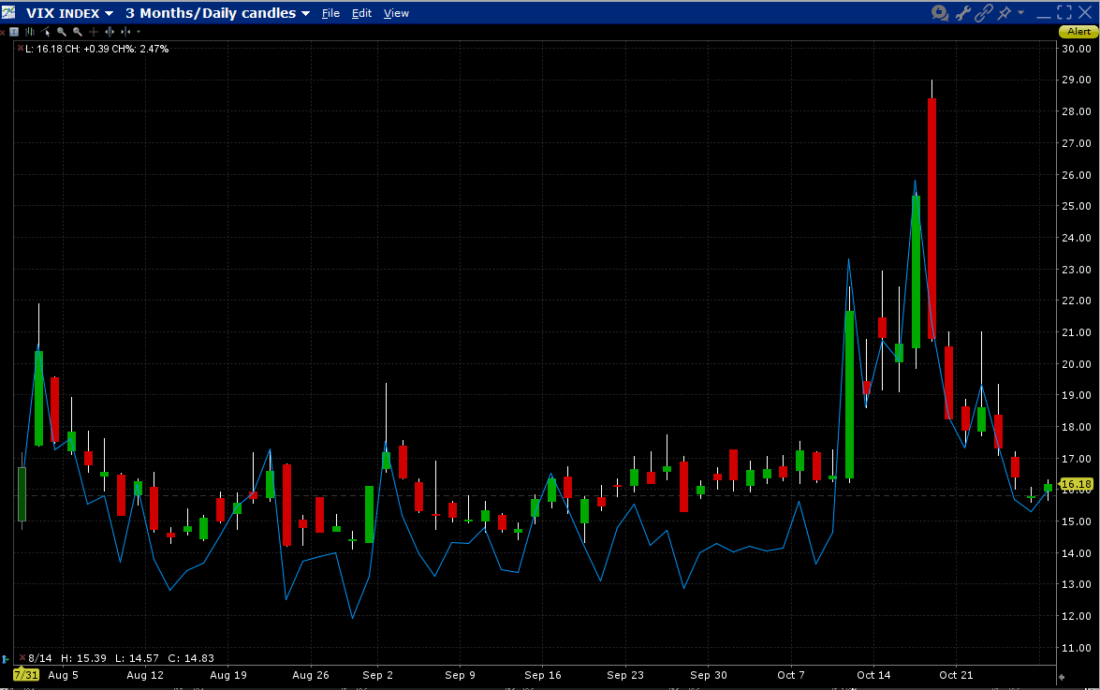

One reason for that assertion is the relatively low level of key volatility indices. After the recent bout of nervousness that prevailed earlier this month, we saw the Cboe Volatility Index (VIX) revert to the mid-teens levels that prevailed for most of the past few months.The same goes for VIX9D, VIX’s counterpart that utilizes the same calculation but with S&P 500 (SPX) index options that average 9 days, not 30 days, to expiry.Those indices understandably dipped again amidst yesterday’s rally, though perhaps they would have dipped more if there were some concern about the week ahead.

3-Months, VIX (red/green candles), VIX9D (blue)

(Click on image to enlarge)

Source: Interactive Brokers

Bearing in mind our typical refrain that VIX is not a fear gauge, but is instead better considered a measure of the demand for protective hedges by institutions, it is understandable why we see slight bumps in VIX and VIX9D even as stocks generally move sideways today.Yet they are still not at levels that would indicate a strong desire for protection.

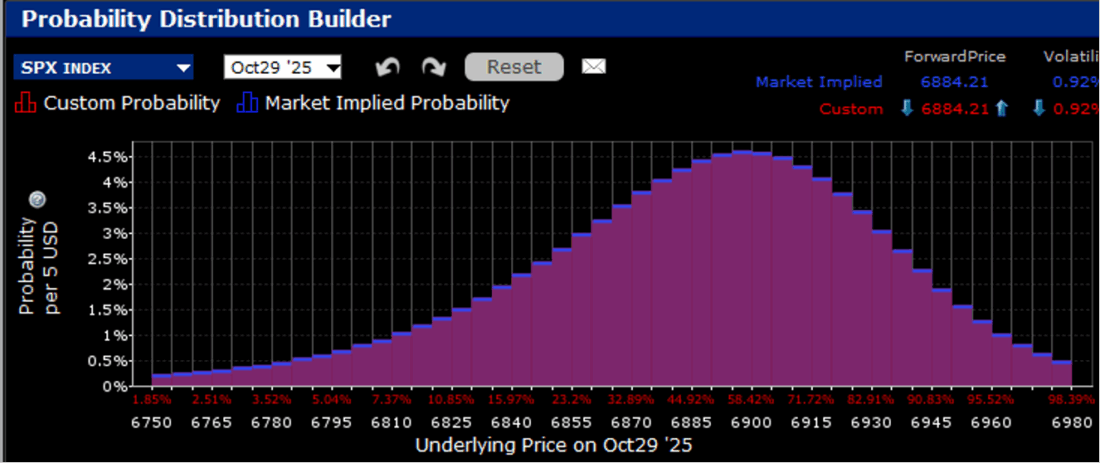

Even when we look to shorter-term options, we see little demand for hedging protection.The IBKR Probability Lab for SPX options expiring on Wednesday and Friday shows peaks above the current market price.Traders do not seem willing to buck the primary momentum trend.

IBKR Probability Lab for SPX Options Expiring October 29th, 2025

(Click on image to enlarge)

Source: Interactive Brokers

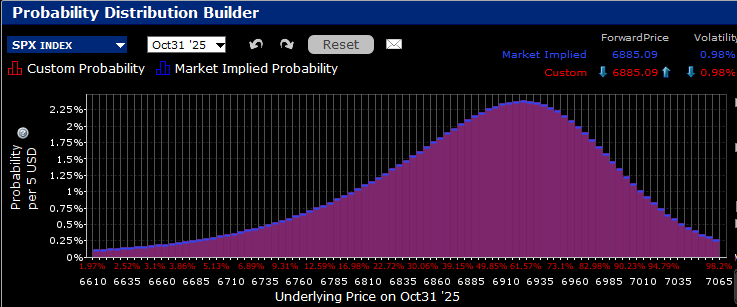

IBKR Probability Lab for SPX Options Expiring October 29th, 2025

(Click on image to enlarge)

Source: Interactive Brokers

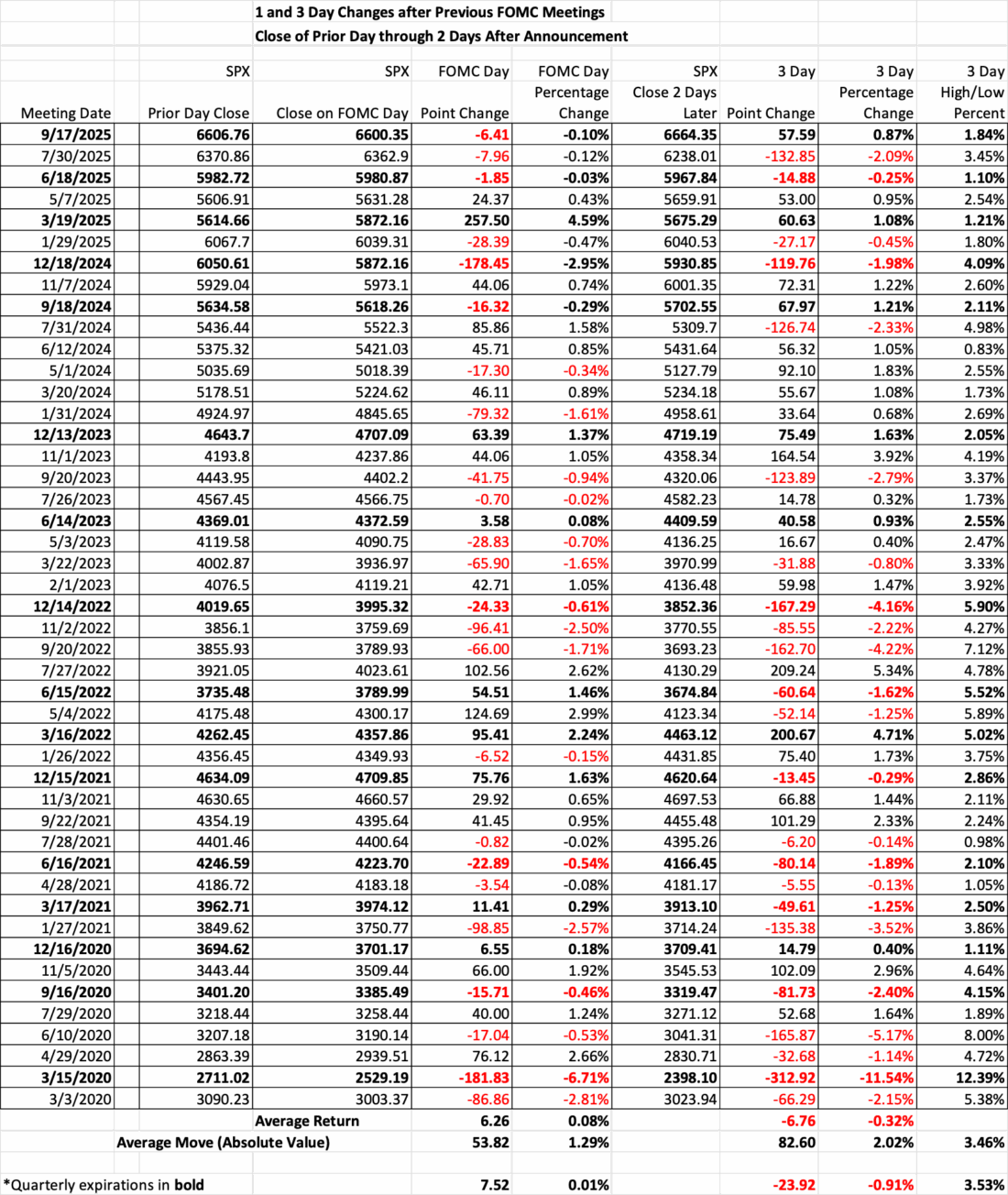

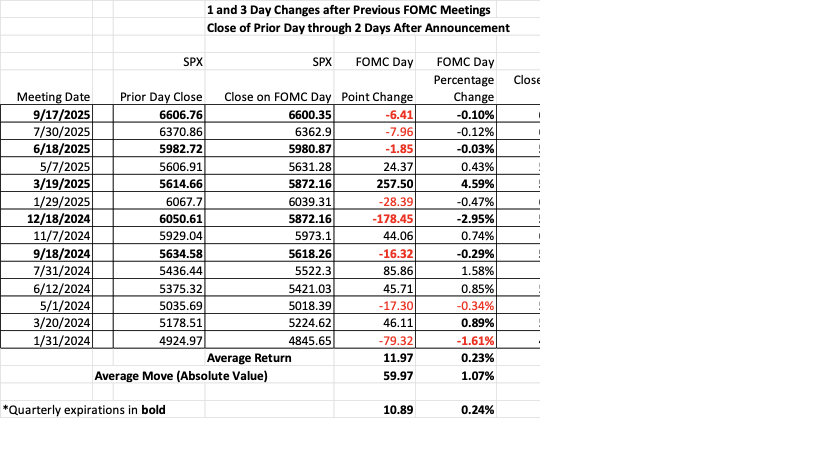

We can see from the values in the top right corners of the charts that the implied daily volatilities for both SPX expiries remain just below 1%.Looking at the history of SPX moves after FOMC meetings, we see that those assumptions could be considered quite high by recent standards, but relatively low when we look at longer post-FOMC histories.The tables below show the 1- and 3-day moves in SPX after FOMC meetings in point and percentage terms – including absolute values.The larger table is the total history since Covid; the smaller one is the history since the Fed ended its post-Covid hiking cycle. The past four one-day moves have been quite modest, implying that the ~1% volatility expectations are more than generous; yet if we look at longer-term averages, they seem rather low. Considering the other exogenous factors, I’d take the over.

(Click on image to enlarge)

Source: Interactive Brokers

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Big Week (And Full Steam) Ahead

All Clear From CPI

Numbers Due Tomorrow. Do They Matter?

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing ...

more