All Clear From CPI

We finally got some government data for the first time in weeks, and like thirsty travelers, traders lapped it up.Fortunately for exuberant stock investors, the liquid refreshment was very much to their liking.All the various month-over-month readings on headline and Core CPI came in 0.1% below expectations.Huzzah!

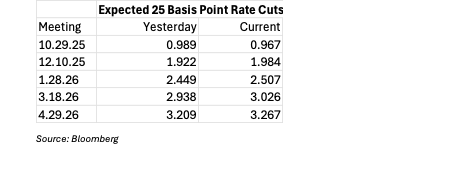

We asserted yesterday that the number really didn’t matter, at least for those expecting rate cuts.We stand by that assertion.Expectations for cuts were quite high yesterday and remain so today.It’s not clear that even a truly negative shock would have deterred the FOMC from cutting rates next week, yet the better-than-expected report did little to influence rate cut expectations in future months.

Today’s reaction is more about stock traders using today’s good news on inflation as an excuse to continue the rally that was already in place than about the ratification of future rate cuts.They were just as priced in before the report as they were afterwards. Good news is of course good news, but if traders were truly concerned about today’s report derailing the rally that was already in place, then we wouldn’t have seen the S&P 500 (SPX) rally by more than ½% yesterday and by another 1/3% in the pre-market prior to the report. Nor would we have seen VIX fall from 18.6 to 17.3 yesterday.If there was some nervousness about CPI, the markets certainly had a funny way of showing it.

Who remembers two Fridays ago? I do, and I think most of you do as well.We described the event as some steam being released from an overheated market, and noted that most traders would perceive the dip as yet another buying opportunity. That’s proven to be the case.

With that mentality in place, the headlines can simply become noise.That mini-correction was triggered by an unexpected round of tariff threats from the President, and those were quickly put behind us.(The flash crash in a wide range of cryptocurrencies that ensued was not as easily brushed off).The positive spin on almost all news persisted this morning.I awoke to headlines that said futures were higher because of optimism on trade – there are well-founded hopes that a positive tone, if not actual progress, could emerge from expected talks between Trump and Xi – but right below it were headlines that said that trade talks with Canada were being suspended because of dissatisfaction with an advertisement.

Is there progress on the trade front?Clearly yes and no. Does the market care about the no?Apparently not.It’s the power of positive thinking, and that’s why there is real positivity about CPI, even if the indisputably good result didn’t really change the likelihood of the rate cuts that good inflation news should spur.

More By This Author:

Numbers Due Tomorrow. Do They Matter?

Pavlov’s Market

Stocks Rebound Sharply As Regional Bank Earnings And Conciliatory Trump Stabilize Markets

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more