Red Alert

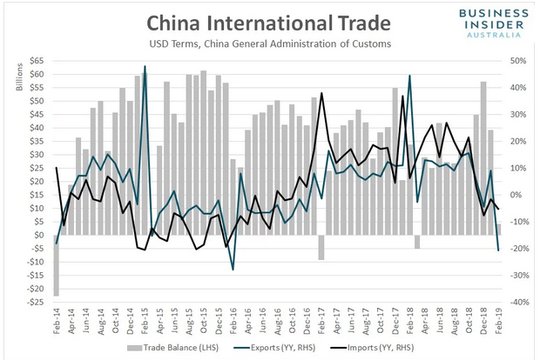

When the red light flips on the car dashboard you are supposed to pay attention and get the vehicle checked out. Similarly, when the leader of the global recovery stalls, it’s a red alert for all risk position across assets – note China equity indices fell 4% last night. The reversal of equities this week culminated today with the China trade surplus shrinking, its exports falling over 20% and imports dropping as well. Talk that the US/China trade deal will take more time added to the weight of the report driving down the China share market for the first time in 5 days and hurting markets globally. The other story was that China is back to monitoring grey-market margins and is punishing some lenders for channeling money into stocks. Things got worse with Europe as German factory orders added to the gloom that ECB Draghi already spread yesterday. The reaction of markets to the ECB TLTRO was disappointing even as the central bank is the first to act to respond to global growth weakness. The fear that monetary policy is out of bullets and that fiscal is the only gun left working remains. This brings the market back to the US and its divergent growth hopes putting the jobs release again into the spotlight. While few would argue US jobs are anything but a lagging indicator – they still reflect the underlying economy and so the risk-off mood may temper if growth holds – i.e. if jobs are above 150,000, wages are steady to higher and job participation rises. The markets are waiting to see the FOMC reaction function to the data and to the ECB and foreign growth doubts. This puts the barometer for risk shifts back to the USD, which is watching 98 for a confirmation of bigger divergence and more confusion. Safe havens like JPY and Gold are back bid and may be also going higher with the USD after 8.31 am.

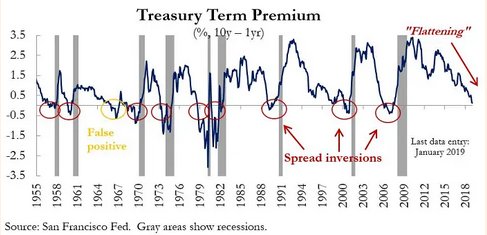

Question for the Day: Are emerging markets the next shoe to drop? As China goes, so goes EM markets. That is the usual wisdom, is this time different? The two biggest risks for 2Q maybe in China moving to QE and the US moving to intervene in the USD. The hope that the FOMC can prevent a broader global crisis in growth from spreading is not a strategy. The limits of monetary policy are showing through from the ECB yesterday. What is needed in Europe is fiscal stimulus. The measure of all growth fears remains the shape of the yield curve. For Europe with negative rates and QE, this remains positive but forced, like that of Japan. For the US it’s still not at the level where Powell will blink like Draghi.

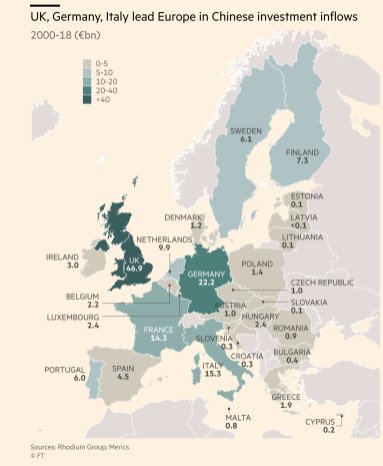

When it comes to fiscal stimulus, the US has already acted, Japan seems to be going in reverse with the VAT plans and that leaves the messy politics of Europe to consider. The role of China and the Belt-Road plan is clearly part of the story as well – if you can’t locally spend, take the money from FDI. As the WSJ quips today, “investors would be better off analyzing the output of China’s 13th National People’s Congress than that of Europe’s monetary policymakers.”

What Happened?

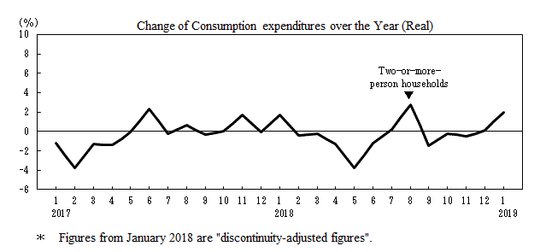

- Japan January household spending up 2% y/y after 0.1% y/y – more than 0.8% y/y expected. Housing rose 18% y/y, Education 17.7% while fuel/water -8.3% y/y, medical care -4.6% y/y, clothing/footwear -4.1% y/y. Household income was up 3.6% y/y to Y471,124

- Japan 4Q final GDP up 0.5 q/q, 1.9% y/y after revised -0.6% q/q, -2.4% y/y – better than 1.8% y/y expected. 3Q revised higher as well from -0.7% q/q, -2.6% y/y. Overall result near forecasts due to capex. The private consumption rose 0.4% after -0.2% q/q. Capital investment rose 2.7% after -2.6% q/q, external demand -0.3% q/q after -0.1% q/q. The price index was -0.3% y/y after -0.4% y/y revised.

- Japan February EcoWatchers current index 47.5 from 45.6 – better than 46.3 expected– However, the outlook drops to 48.9 from 49.4 – weaker than 49.7 expected.

- China February trade surplus $4.12bn from $39.59bn revised – less than the $26.5bn expected. China exports drop 20.7% y/y after 9.3% gain – weaker than the -4.5% expected – sharpest drop in 3-years. China imports drop 5.2% y/y after -1.5% - also weaker than -1.4% expected. The trade report missed expectations in part because of the Lunar New Year holidays. However, the average Jan+Feb result shows both exports and imports lower y/y to -5% y/y from -4.4% in Dec exports, while imports -3% y/y. China exports to the US fell 14.6% in the Jan-Feb while imports fell 35%.

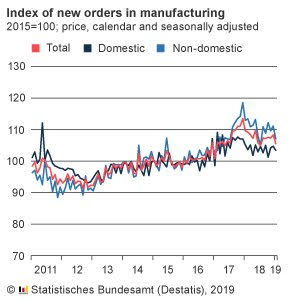

- German January factory orders drop 2.6% m/m after revised +0.9% gain (prel -1.6% m/m) – weaker than +0.4% m/m expected. New orders fell 1.2% domestically, while foreign fell 3.6% m/m, in the Eurozone they fell 2.6% m/m, outside it fell 4.2% m/m. By category, intermediate goods -1.1% m/m, capital goods -3.6% m/m while consumer goods -1.4% m/m.

- French January trade deficit widens to E4.2bn from revised E3.6bn (prel E4.7bn) – worse than E4bn expected. However, France recorded a Current Account surplus of E0.9bn in January after E0.1bn deficit. The difference was due to goods balance improvement linked to energy cost drop.

- French January industrial production jumps 1.3% m/m after revised 0% (prel +0.8% m/m) – better than 0.1% m/m expected. Manufacturing rose1% after 0.4% m/m. Energy/water rose 3.1% after -2.2%. Mining fell 3.1% after +5.8% m/m. Construction fell 5.4% after +3.7% m/m.

- Italy January industrial production up 1.7% m/m, -0.8% y/y after revised -0.7% m/m (prel -0.8%), -5.5% y/y – better than 0.2% m/m, -3% y/y expected.

- Italy January PPI 0% m/m, +3.4% y/y after -0.5% m/m, +4.1% y/y – less than 0.3% m/m, 3.6% y/y expected.

Market Recap:

Equities: The US S&P 500 futures are off 0.4% after losing 0.81%. The Stoxx Europe 600 is off 0.75% with China trade and German factory orders focus. The MSCI Asia Pacific fell 2% with Japan suffering its worst week since December.

- Japan Nikkei off 2.01% to 21,025.56

- Korea Kospi off 1.31% to 2,137.44

- Hong Kong Hang Seng off 1.91% to 28,228.42

- China Shanghai Composite off 4.4% to 2,969.86

- Australia ASX off 0.9% to 6,287.10

- India NSE50 off 0.21% to 11,035.40

- UK FTSE so far off 0.9% to 7,092

- German DAX so far off 0.6% to 11,448

- French CAC40 so far off 0.5% to 5,244

- Italian FTSE so far off 0.7% to 20,547

Fixed Income: ECB and China trade and German Factory Orders – this puts the focus on German Bunds and 0% bound again. 10-year Bund yields are flat at 0.06% off 12bps on the week. The French OATs are off 1bps to 0.41%, UK Gilts are up 2bps to 1.19%. Periphery is weaker as banks reflect the doubt that ECB action is enough – Italy up 4bps to 2.52%, Spain up 2bps to 1.07%, Greece up 4bps to 3.83%, Portugal up 2bps to 1.37%.

- US Bonds are flat waiting for jobs report, watching equities– 2Y flat at 2.47%, 5Y flat at 2.44%, 10Y up 1bps to 2.64%, 30Y flat at 3.03%.

- Japan JGBs rally, bull flatten on weaker equities, mixed data– 2Y flat at -0.14%, 5Y off 1bps to -0.15%, 10Y off 3bps to -0.03%, 30Y off 3bps to 0.59%.

- Australian bonds higher on weaker China trade– 3Y off 2bps to 1.6%, 10Y off 5bps to 2.03%.

- China bonds continue to see flattening bias– 2Y up 3bps to 2.8%, 5Y off 3bps to 3.02%, 10Y off 2bps to 3.16%. Talk of lenders being punished for stock lending and the PBOC skipping open market operations for 7thsession added to short end rates.

Foreign Exchange: The US dollar index fell 0.25% to 97.44. In emerging markets, USD mixed - EMEA:RUB off 0.3% to 66.454, ZAR up 0.1% to 14.49, TRY up 0.2% to 5.459; ASIA: INR off 0.1% to 70.14, KRW off 0.2% to 1136.1

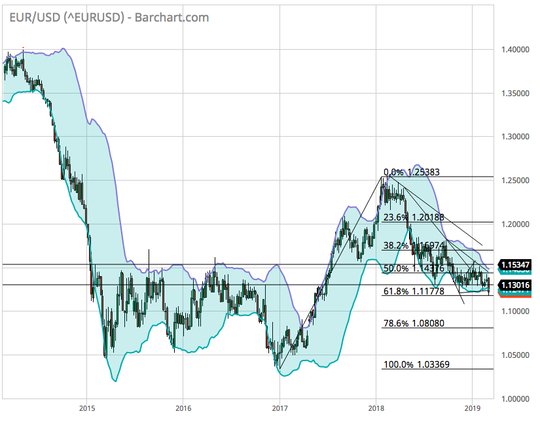

- EUR: 1.1215 up 0.2%.Range 1.1185-1.1221 with 1.1180-1.1250 consolidation and US jobs key – ECB vs. FOMC key. EUR back to June 2017 lows.

- JPY: 111.20 of 0.4%.Range 110.95-111.65 with EUR/JPY 124.70 off 0.15%. The equity reversal key with 110-112 intact – watching 125 break for 122.50 in EUR/JPY

- GBP: 1.3075 flat. Range 1.3067-1.3108 with EUR/GBP .8580 up 0.3% - focus is on Brexit still more than economic data with 1.3050 pivotal and 1.2980 risk.

- AUD: .7025 up 0.15%.Range .7003-.7030 with NZD .6790 up 0.5%. China trade matters but USD and rates more with .6980-.7050 key.

- CAD: 1.3460 flat. Range 1.3444-1.3466 with focus on US rates/jobs report against commodities, China and politics with 1.3420-1.3550 risks.

- CHF: 1.0100 off 0.1%. Range 1.0092-1.0118 with EUR/CHF 1.1330 up 0.15%. The focus is on 1.0080-1.02 for $ with risk off and China growth leaving 1.00 pivot play.

- CNY: 6.7210 up 0.1%. Range 6.7130-6.7260. PBOC fixed 6.7235 from 6.7110 reflecting EUR weakness – with 6.68-6.77 keys – focus is on US/China talks

Commodities: Oil lower, Gold higher, Copper off 1.95% to $2.9125.

- Oil: $55.71 off 1.7%. Range $55.61-$56.51 with focus on China trade, German factory orders with US jobs next key. Brent $65.10 off 1.8%. WTI still watching $55 support with risk for $52.50.

- Gold: $1293.80 up 0.6%.Range $1285.60-$1296.20 with EUR not USD the driver and equity pain also helping - $1282-$1305 hot points. Silver $15.14 up 0.6%. Platinum $1819.80 up 0.3%. Palladium $1481.70 off 0.05%.

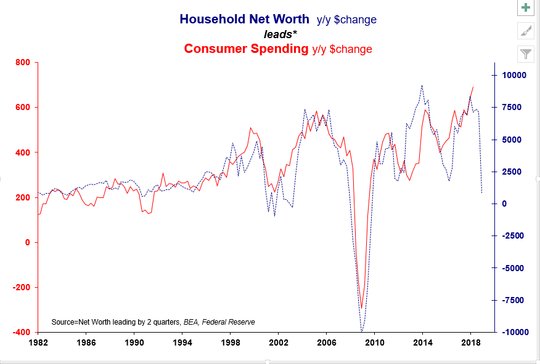

Conclusions: Do stocks matter? Yes to the tune of $4trn. Used to be that when you have a collapse in stocks, central bankers paid attention as the real economic impact of wealth destruction bleeds into the spending plans of consumers. The US net worth hit in 4Q was notable and the relationship of US consumer spending to household net worth is worth considering – especially today as we have unwound the bullish froth from February.

Economic Calendar:

- 0830 am US Feb non-farm payrolls 304k p 180k e / unemployment rate 4%p 3.9%e / wages 0.1%p 0.3%e

- 0830 am Canada Feb jobs change 66.8k p -5k e / unemployment 5.8%p 5.7%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

China is not the only one hurting. These trade war tariff games have gone on too long and is setting in to where their effects are spreading to all economies. This needs to be settled one way or the other soon or else the markets will come unsettled. That said, I am not convinced a market downturn will be as bad for oil as some are thinking it will be. Global instability tends to make oil hoarding by nations more common. That said most global instability in the past has been Middle East related.

The simple fact is the US is shooting itself in the foot in the oil market and the inventory buildup has been mainly centered in the US where its oil is not being consumed as the small oil plays keep dumping at a loss to keep from defaulting. This is not a global issue more than a domestic issue. Most global refineries are not geared for the oil being pulled up from fracking.