Precious Metals Do Not Like Higher Interest Rates

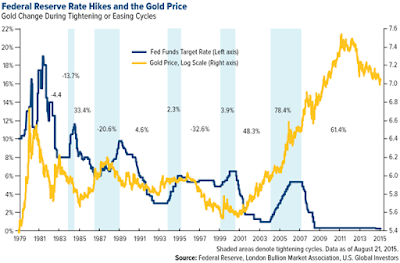

Gold and silver prices have not reacted the way some investors expected considering the rate of inflation. It seems a lesson learned back in the early 80s has been long forgotten and that is high-interest rates trump inflation.

At least they can or did in that era. I remember this well because as a young investor both believing in and seeing the effects of inflation I jumped into the markets not so much trying to catch a falling knife but believing silver would come back after its massive fall. This was after the Hunt brothers' historic attempt to corner the silver market causing silver to soar from a spot price of around $6 per ounce in early 1979, to $50.42 in January of 1980. On “Silver Thursday,” March 27, the silver futures market dropped by a third to $10.80. These same contracts had been trading at four times that amount just two months earlier.

To those unfamiliar with the story, back in 1980, Bunker, his younger brother Herbert, and other members of the Hunt clan owned roughly two-thirds of all the privately held silver on earth. When the futures contracts they bought expired, they took delivery and arranged to have the metal flown to Switzerland. This created a shortage of silver for industrial supply which drove the price higher. Their historic stockpiling of bullion wasn’t a ploy to manipulate the market, they and their sizable legal team insisted later. Instead, it was a strategy to hedge against the voracious inflation of the 1970s and a monumental bet against the U.S. dollar. Whatever the motive, it was a bet that went very, very wrong.

The debt-fueled boom and bust of the global silver market not only decimated the Hunt fortune but threatened to take down the U.S. financial system. It is important to put this all in perspective, the 1970s were not kind to the U.S. dollar. Years of wartime spending in Vietnam coupled with unresponsive monetary policy pushed inflation upward throughout the late 1960s and early 1970s. Massively adding to America's problems was that in October of 1973, war broke out in the Middle East and an oil embargo was declared against the United States. This caused inflation to jump above 10% and it remained high for years. It peaked in 1981 following the Iranian Revolution at an annual average of 13.5%.

Only by taking interest rates to nosebleed levels was then Fed Chairman Paul Volcker able to bring inflation back under control and in doing so he broke the back of those speculating that rising metal prices would continue higher. Paul Volcker, a Democrat was appointed as Federal Reserve chairman by President Carter and reappointed by President Reagan. Volcker is widely credited with ending the stagflation crisis and causing inflation to finally peak. He did this by raising the fed fund rate which averaged 11.2% in 1979 to 20% in June of 1981. This caused the prime rate to hit 21.5% and slammed the economy into a brick wall.

Volcker's action also affected and shaped the level of interest rates and the "value of money" for decades. The increased interest rates are credited by many to have caused Congress and the President to eventually balance the budget and bring back some sense of fiscal integrity and price stability to America. As the debt from the Vietnam war and soaring oil prices became institutionalized interest rates slowly dropped and the budget came under control. What has occurred over the last twenty years is a different story.

To clarify the timeline of these events, silver broke just when interest rates shot upward making the cost of speculating on prices to rise on goods you held for future sale much higher. While the panic of “Silver Thursday” took place over 35 years ago, it still raises questions about the nature of financial manipulation. In the area of public opinion, many people came to view the Hunt brothers as members of a long succession of white-collar crooks, such as Charles Ponzi and Bernie Madoff. Others see the endearingly eccentric Texans as the victims of overstepping regulators and vindictive insiders who couldn’t stand the thought of being played by a couple of southern yokels. Regardless of which opinion you embrace it did not end well for them.

This post, however, is not about the Hunt brothers but a lesson from the past that has been forgotten by many investors. Decades of interest rates drifting ever and ever lower have allowed many investors and the general public to forget the power of high-interest rates exert on defining prices. Whether it is a case of birds of a feather flocking together or strictly a coincidence the prices of different metals tend to move in the same direction more than they should. I say this because some metals are a byproduct of mining another more valued metal and supply and demand should override this link.

Another factor these metals face is that when prices rise new sellers often emerge as people rifle through their dresser drawers to find dimes and quarters with silver content to sell. Gold jewelry broken or no longer worn is gathered up, and garages are turned upside down to find metal to melt down. Also, industrial demand has a way of falling away as less expensive substitutes are used. The bottom-line here is that higher interest rates drastically increase the carrying cost for those holding not only metals but any item in inventory that sits idly with no real utility value. This means the "higher cost of money" has a negative effect on the value of precious metals.

More By This Author:

America's National Debt 31 Trillion Dollars And Climbing

What Lurks Below The Surface Is A Reason For Concern

Where Have All The Ships Gone? Signs Of A Recession

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in ...

more

Why silver has gone down 40 percent over the last year or so? Lock and load slowly increasing more as it goes lower always sell a few on a pop and reload heavier on a drop