What Lurks Below The Surface Is A Reason For Concern

Image Source: Unsplash

With every pop upward in the markets, many of us are forced to ask ourselves, am I too negative and bearish? After a bit of soul-searching, logic seems to indicate we are simply being realistic.

There is a reason to be concerned. The sharp stock market rallies we have had are mostly a result of bears with tight stops creating a panic short-covering frenzy when anyone comes in buying. Still, it is an important thing to remember that many of our problems remain hidden below the surface of everyday finance.

The market action, defined by violent moves up and down, has been whipsawing investors out of their money. This market is structured in a way that destroys true price discovery. Stock buybacks and other quirks have created a disconnect between value and stock prices. This has been exacerbated by money flowing into ETFs that mainly feed into just a few stocks.

Those of us that are convinced this economy is at the end of its rope and the financial system is coming apart have been using negative words for a long time. Just a week ago, I heard the top 10 mega-cap stocks make up more than 31% of the total S&P 500 stock index. If this is true, and I suspect it is, little has changed. It could be argued that we will need a totally new view of the market's structure before things will change.

Money continually flows into the stock market because if it sits on the sidelines or in the bank. inflation nibbles away at its buying power. This has made the current market system appear more resilient than it is.

The problem is that when you eliminate true price discovery from a market, words such as bogus, manipulated, and rigged begin to appear. Still, every time it appears that the final knife is about to be thrust into the heart of this market, we see a rally occur that encourages bulls to rush in and buy the dip.

All over the world, just below the surface and out of sight, issues are surfacing that highlight how complex the economy has become. An example of this is the news that the world's largest cruise ship, an 80% finished, 9,000-passenger, 1,122-foot ship, the Global Dream II, is about to be cut apart for scrap. Yet, many people don't often hear of things like this.

Considering all that is going on across the world, it seems odd so many people are already asking whether the bottom has been put in and if markets are about to resume an upward path. We can blame this on the lies and economic wisdom that is presented by mass media. Their narrative conveniently forgets that consumers appear to be entering a time of protracted weakness.

This is becoming clear as total consumer credit continues to rise. Data shows it just rose $32.2 billion, well above last month's $26 billion. Meaning, total revolving consumer credit is making new all-time highs at just over $1.15 trillion at the same time credit card APRs move ever higher.

It is 'pie in the sky' thinking to take the position that wages will move up while prices return to normal. Unbelievable amounts of new debt and wild government spending have brought us to the place where we are now talking about trillions of dollars rather than billions.

The idea we can simply bail out every failed pension and enterprise to make everyone whole is problematic. Unfortunately, lurking just below the surface are far more of these troubling situations than most people are willing to admit.

How can we expect pension funds to remain solvent when stocks are not going wildly up and low-risk bonds pay so little? How can small community businesses compete against huge predatory companies such as Amazon? Why do people want to work when they find out the government is willing to take care of them? Why do we rush to blow up cities, countries, and pipelines rather than work to resolve disputes in more civilized ways?

Each of the questions above give me a reason to be negative. At the same time as bubble assets deflate, prices of goods and services may have started an inflationary cycle of a magnitude that the world has never experienced before. While inflation has been a problem in individual countries in the past, what we are seeing today is occurring on a global scale.

Take the time to think about what is lurking below the surface of our financial system. That truth is staring at you below.

The data we are seeing indicates retail sales are increasingly being funded by soaring credit card debt. This is a sign that consumers are struggling to maintain their standard of living. This is the reality we must face.

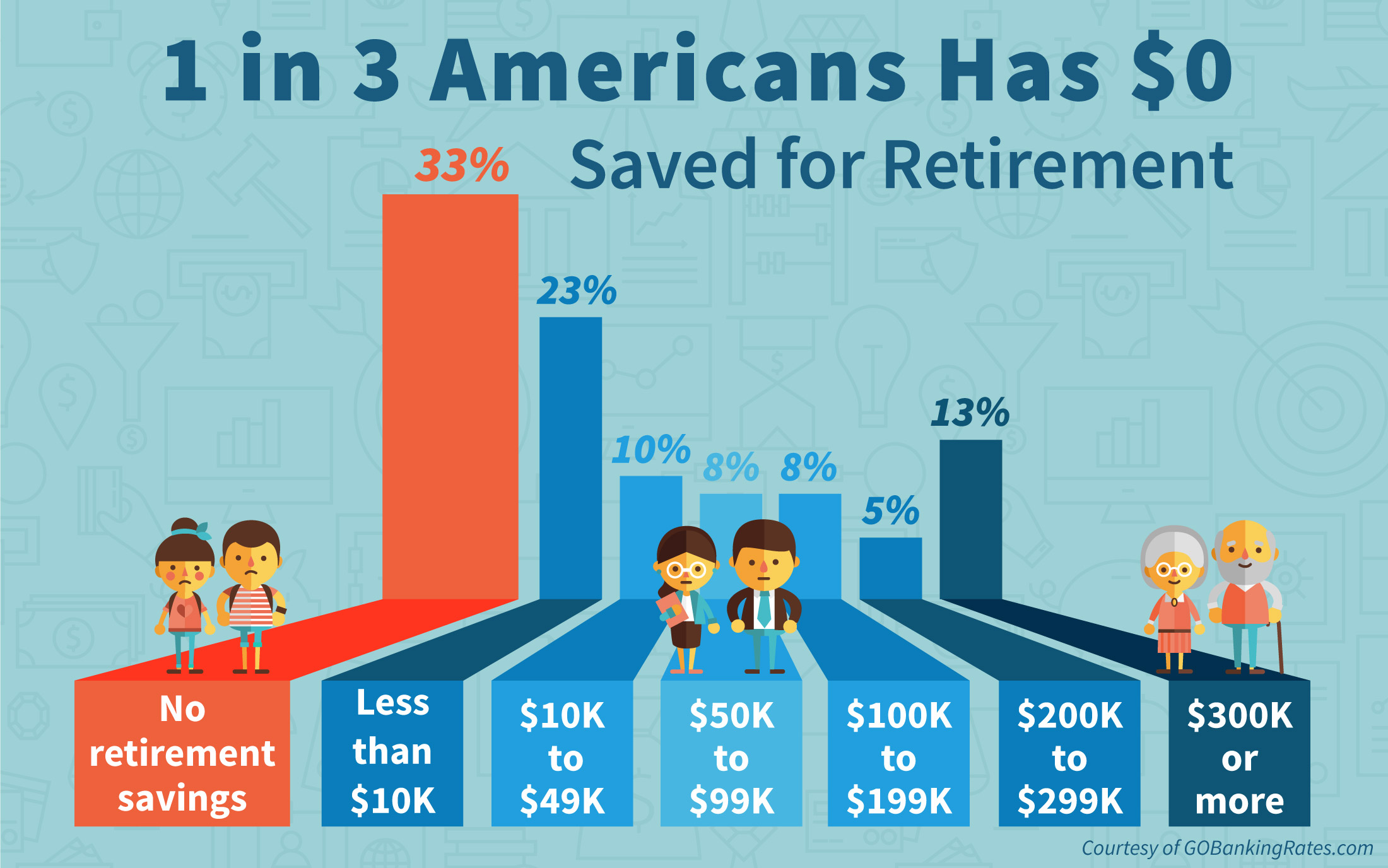

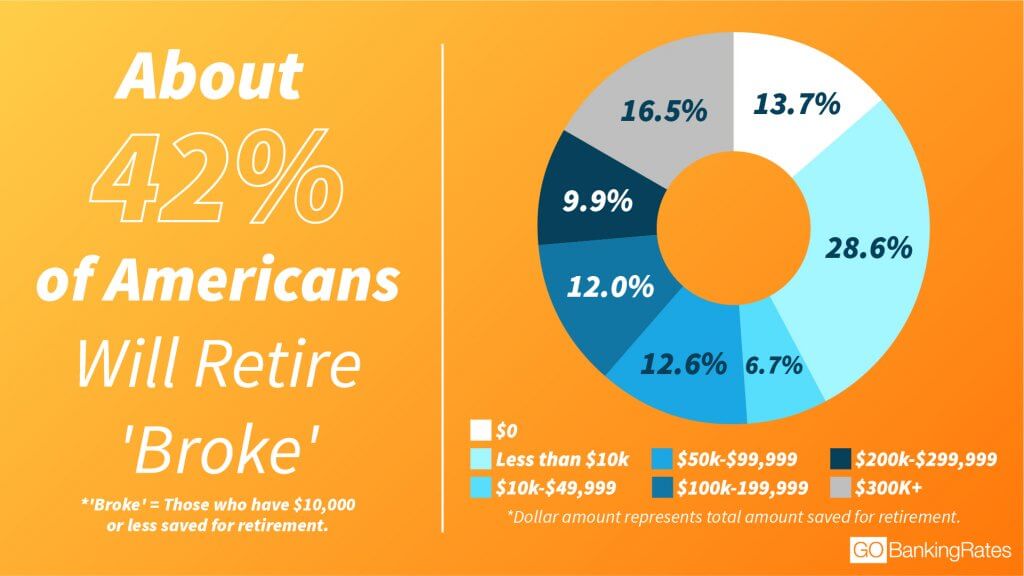

When people retire poor society becomes their backstop, and they will find that it has to carry them on its back. The national debt of the United States just passed 31 trillion dollars. The growing burden of providing for those in poverty bodes poorly for the national deficit going forward.

There are so many holes in our financial system that it is only being held up by air. Don't expect things to suddenly improve. What lurks below the surface of our financial system is a reason for concern and indicates our troubles have just begun. We ain't seen nothing yet.

More By This Author:

Where Have All The Ships Gone? Signs Of A RecessionThe Narrative Of Housing Shortage Beginning To Crumble

Is The Yen About To Resume Its Path Lower?

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in ...

more