Powell: Inflation: Public Enemy No. 1 To The Stock Market

The Economic Modern Family tells us the macro story and the charts are warning us. The indices and sectors closed the week lower and very stressed out.

The speech by Fed Chair Powell on Friday clarified what some did not want to believe, while others knew and were prepared for:

inflation is still very much alive and a problem in our economy.

The most interesting part of today’s conference was when Chairman Powell addressed inflation directly.

He said it's enemy number one, but also stressed they want to control inflation through raising rates as the data dictates.

The data at this point has the economy in a technical recession, while food and energy prices keep the economy in inflation.

Inflation and recession=stagflation.

Those who know are work know we have used this word for months now. Stagflation, as we can see from Powell’s data driven yet desire to control higher prices, is a quagmire for monetary policy to fix.

The Economic Modern Family saw this move on Friday coming.

The Dow sold off 1000 points on Friday. If you recall, last week we featured the Retail sector along with the small caps index.

Both have been technically perfect.

What is next from here?

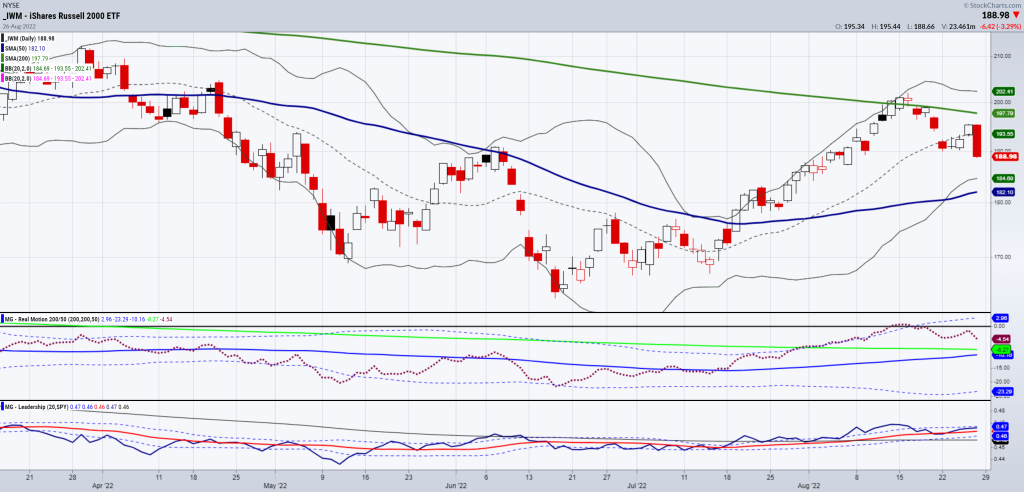

To refresh your memory, the Russell’s are our Granddad of the Economic Modern Family, and the Retail sector is our Grandma.

We also noted pivotal areas for both sectors to close above to keep the bear market rally intact. Yes, this was a bear market rally from the July lows to the mid-August highs.

Anyway, after the mid-August highs failed at the 200-DMA, the market stalled at about 50% from the lows to the highs (July-August).

That is why we wrote and stated on media that 190 was the key level in IWM and 67.00 was the key level in XRT.

Both closed lower giving up 3.5-4% on Friday.

Now, the 50-DMA becomes the next focus.

In XRT it’s at the 64.00 area (64.00-64.25).

In IWM it’s at the 182.00 area.

Based on closing levels, Granny is much closer and deserves the rightful attention. If the consumer gives up shopping because of the higher rates yet nagging and consistent inflation, that will clearly prove a quagmire for the Fed.

Another interesting development on Friday was the long bonds. Yields fell a bit as a flight to safety, so another big clue is how TLTs (20+ year long bonds) do compared to the SPY.

In other words, if the market continues the carnage, bonds could move up while SPY will move down-something we have not really seen much in 2022.

Yields move down too much, and guess what? More inflation.

Keep your eyes on Gramps too. And while you’re at it, the rest of the Family.

Transportation, Regional Banks, Semiconductors, Biotechnology, and Bitcoin are all players and have their own story to tell.

More By This Author:

Granny Retail - Can The Consumer Hang In There?

Grain Prices Suggest Inflation Far From Peaking

Is the Market Pause A Buying Opportunity In Small Caps?

Disclaimer: The information provided by us is for educational and informational purposes. This information is based on our trading experience and beliefs. The information on this website is not ...

more