Portfolio Review: Looking Back On Q1, And Forward To Q2

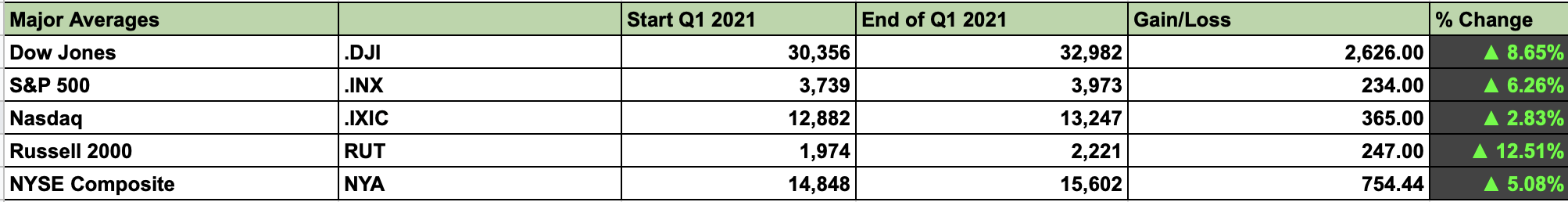

With the S&P 500/SPX (SPX) gaining approximately 6.3%, 2021 got off to a relatively strong start. However, it was a bit of a split image in the stock market, as the DJIA appreciated by approximately 8.7%, while the Nasdaq gained only around 2.8% in the first quarter. The top performing major average was the Russell 2000, with a return of about 12.5%, and the NYSE composite came up by roughly 5% in the quarter.

(Click on image to enlarge)

Source: Author's material

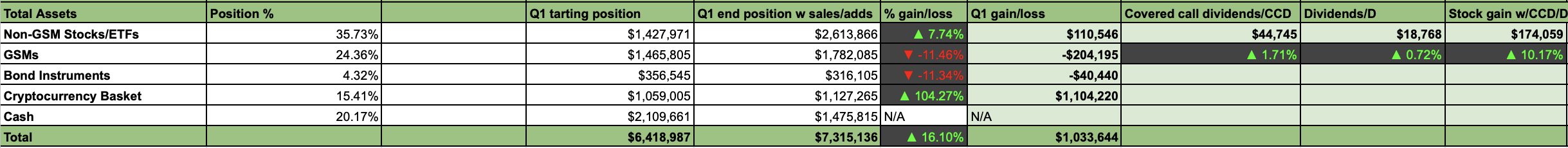

Our diversified portfolio also delivered some split results in Q1. By far our best performing asset class was the Bitcoin/digital asset segment. Most stock segments also did well, with some notable outperformance in materials, industrials, and financials. Some underperformance was noted in precious metals and bond instruments. We are anticipating growth and inflation to pick up in Q2, and have made several adjustments to our holdings to maximize gains going forward.

What Worked Well In Q1

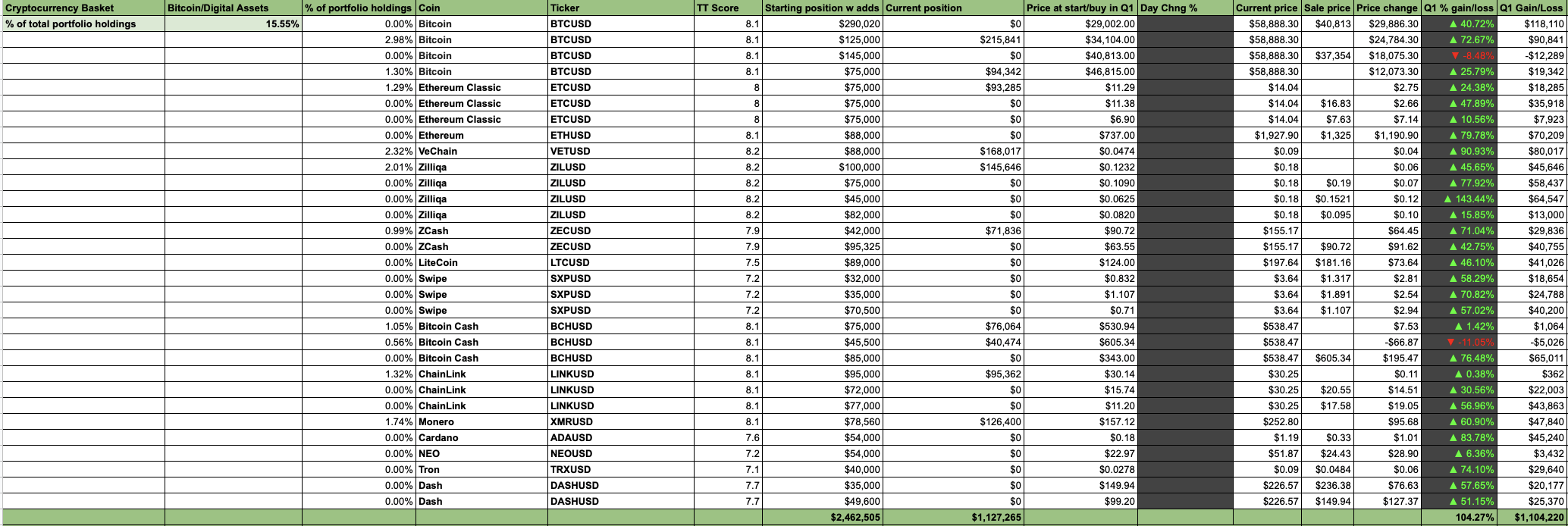

The truly stellar segment in Q1 was Bitcoin and the digital asset space, as this sector returned a remarkable 104% in the quarter.

Bitcoin/digital assets

(Click on image to enlarge)

We saw some very strong double and triple digit gains in various names like Zilliqa (ZIL-USD), VeChain (VET-USD), Dash (DASH-USD), ZCash (ZEC-USD), and others.

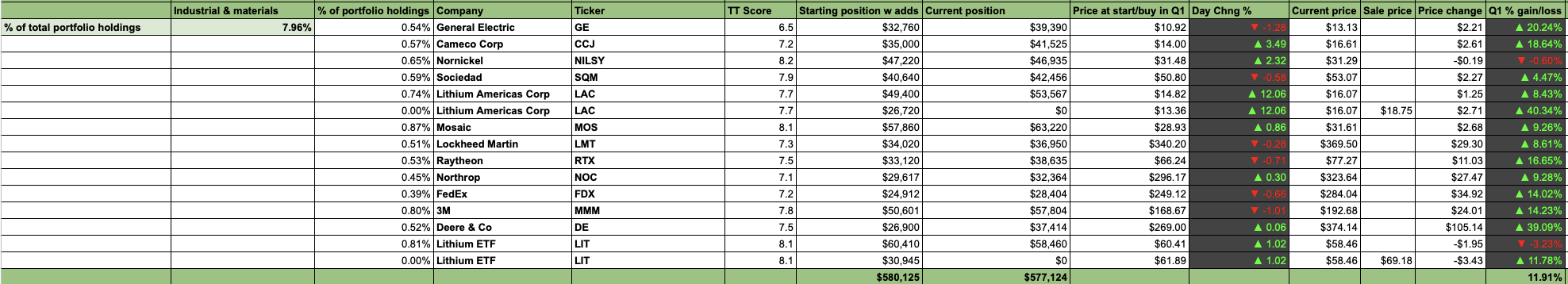

Industrials & Materials

(Click on image to enlarge)

While this segment delivered a combined returned of around 12%, we can see some strong double digit gains in several individual names. Lithium Americas Corp (LAC) delivered roughly 50%, General Electric (GE) gained 20%, and 3M (MMM) appreciated by about 40% in the quarter.

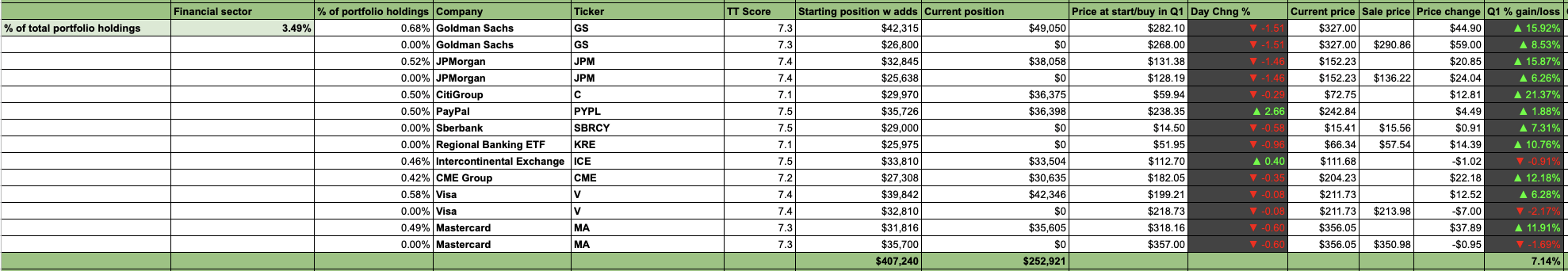

Financials

(Click on image to enlarge)

Banks also did well, as JPMorgan (JPM), Goldman Sachs (GS-PK), and Citigroup (C-PK) all provided returns of over 20% in Q1. Combined, the financial segment achieved gains of roughly 7% for the quarter.

What Could Have Done Better

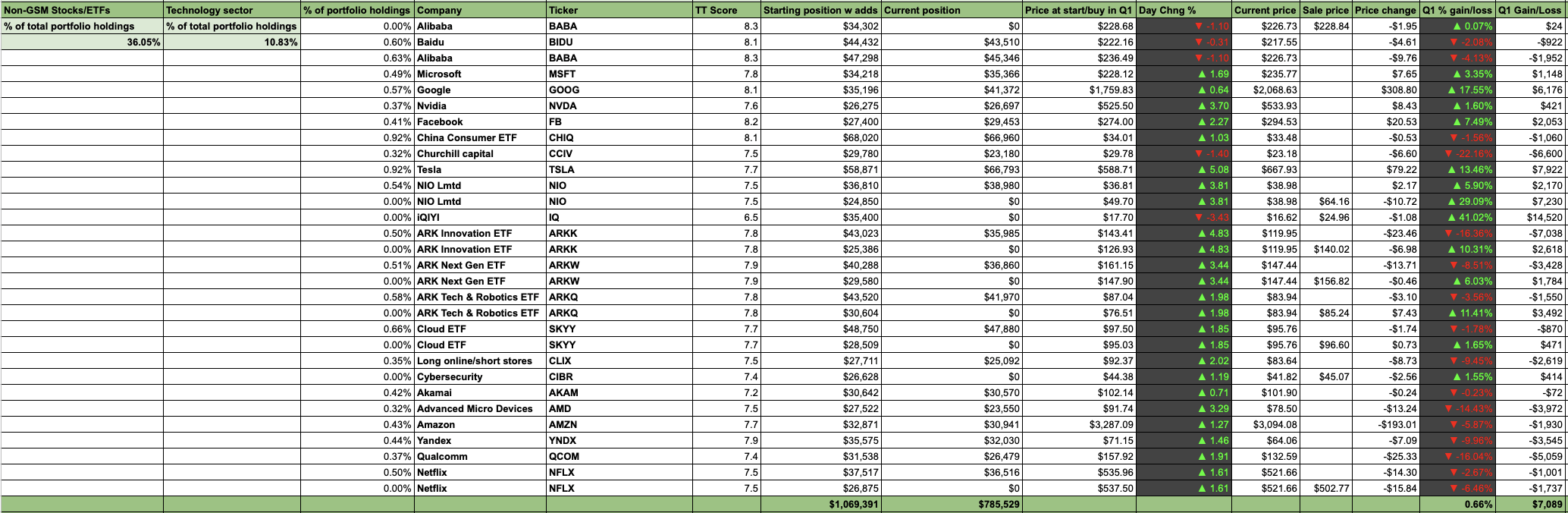

Technology

(Click on image to enlarge)

Due to timely exits in names like NIO (NIO) and iQIYI (IQ), we locked in some strong gains in several "tech" stocks. However, unfortunately, many technology companies gave up much of their gains in a late quarter correction. Therefore, the technology segment returned an unimpressive 0.66% in Q1.

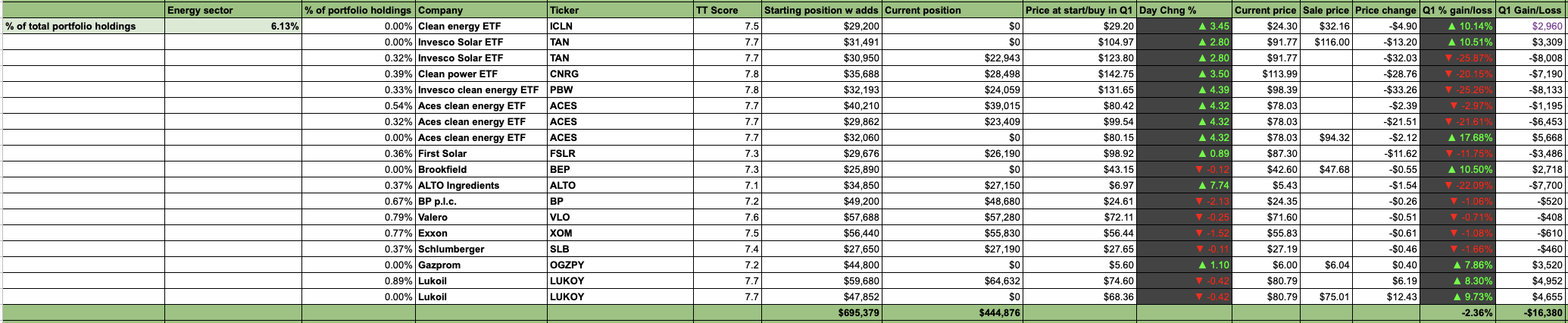

Energy

(Click on image to enlarge)

Our energy segment also came under notable pressure during the correction. Renewable energy names, in particular, got hit hard, which resulted in a combined loss of slightly over 2% for the quarter.

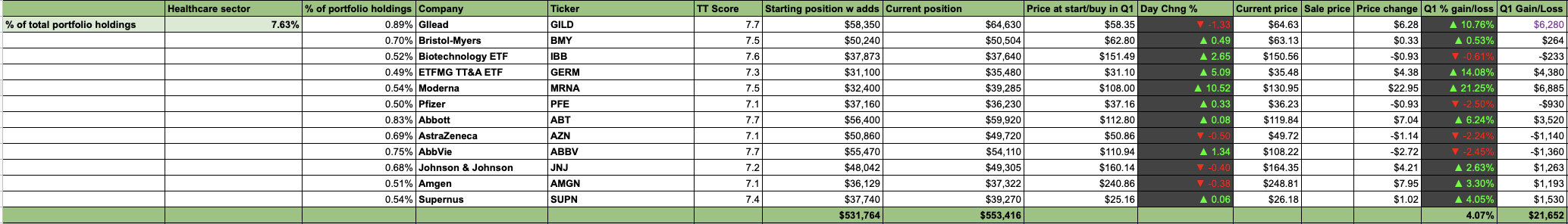

Healthcare

(Click on image to enlarge)

The healthcare segment was led by vaccine maker Moderna (MRNA), as the company's stock appreciated by over 20% in Q1. Yet, the rest of the segment provided relatively modest gains, which resulted in a combined return of roughly 4% for the quarter.

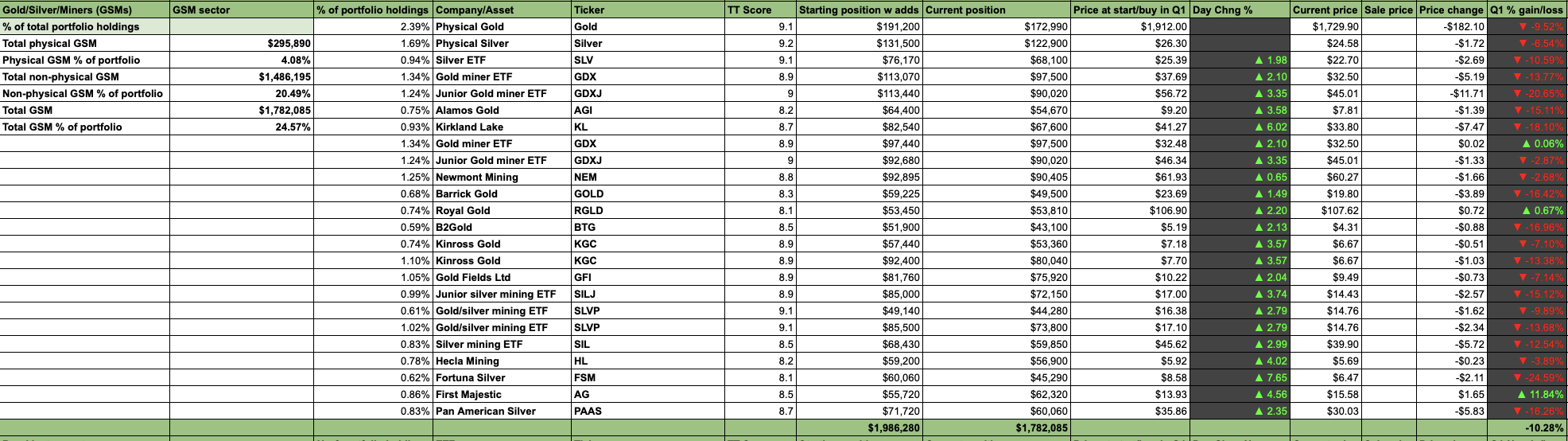

What Did Not Work

(Click on image to enlarge)

The first quarter proved difficult for precious metals and miners, as the segment lost around 10% in Q1. Gold and silver lost around 9.5%, and 6.5% respectively in the quarter, which caused many gold and silver miners to sustain double digit losses for this time frame. A notable rise in interest rates also had a negative impact on our bond instruments (TLT), and (IEF), which gave up a combined 11.3% in Q1.

The Takeaway

(Click on image to enlarge)

After a robust 2020 (87% return), we came into the year with some caution. However, throughout the quarter we increased holdings, particularly in our non gold and silver mining ("GSM") related equities segment. Excluding GSMs, the equities portion of our portfolio returned roughly 8%, and about 10% once covered call premiums and dividends were factored in. Looking back, with a 104% return, our best performing sector was digital assets. While GSMs and bond instruments delivered strong returns in prior quarters, Q1 2021 proved difficult. Certain stock segments gave up some of their gains late in the quarter due to the correction in tech and other growth names. Nevertheless, our diversified portfolio achieved a combined gain of 16.1%, beating all major stock indexes, including the SPX, and the Russell 2000, which returned roughly 6.3% and 12.5% over the same time frame, respectively.

Going Forward

Technology

Just several days into the new quarter, and our increased position in technology is already starting to pay off. Many quality technology/growth names were hit hard late in Q1, and we were able to pick up many quality names at discounted prices. We are bullish on tech and growth going forward and expect tech leadership to remain amongst the top performing sectors in the stock market.

Healthcare

Like in tech, most names were rolled over in our healthcare segment as well. However, we dismissed a couple of holdings, sticking mainly to companies with COVID-19 exposure, and several undervalued names in the healthcare space. Multiples are quite compressed in this segment, and it seems likely that some names in this field could go through multiple expansions going forward.

Energy

The energy segment has been modified to contain several diversified solar/clean energy ETFs, as well as a few oil majors/oil services plays. With higher inflation and increased growth on the horizon, oil is likely to appreciate going forward, which should bode well for energy and oil services names.

Industrials and Materials

The industrials and materials segment has some very strong performing names. Due to various factors like rising inflation, higher demand for lithium, relatively low valuations, growing profitability and other elements, this is likely going to be one of our best performing segments going forward.

Financials

Due to relatively low valuation and access to essentially unlimited capital, major U.S. financials should probably continue to do well going forward. Other names in our financial segment are more geared towards delivering growth and expanding profits in future years.

GSMs

Despite a weak quarter in Q1, we remain bullish on the gold, silver, and mining space. Higher inflation and the ever expanding monetary base provide a favorable backdrop for gold, other precious metals, and the companies that derive them. Therefore, we are keeping a relatively large position in this area. On the other hand, bond instruments were let go for now, as it is possible to see some further transitory increases in key rates in the near-term.

Bitcoin/digital assets

While Bitcoin consolidates, alternative digital assets are appreciating notably. Many of our positions are up by 25-40% in the first several days of the quarter. This is the typical "catch-up" pattern we've been following in the digital asset market for some time now. We remain bullish on this space, as the Bitcoin bull market remains alive and well in my view.

The Bottom Line

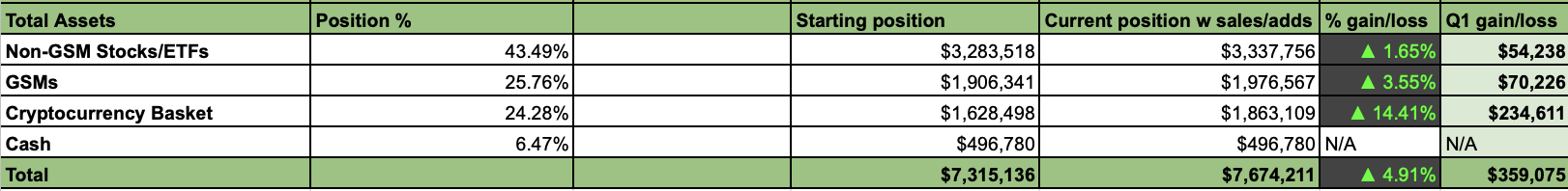

(Click on image to enlarge)

With about a 5% gain, this quarter is getting off to a bullish start. While we kept our GSM segment about the same size as last quarter, we increased positions in our non-GSM, and digital asset segments. In turn, we reduced our cash holdings, and cut out our bond instrument segment entirely. With increased growth and higher inflation on the horizon, risk assets like stocks and digital assets should continue to attract easy capital going forward.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss ...

more