Oil And Gasoline Inventories Continue To Climb, Could Be Pointing To Economic Weakness

Over the past several months, I have been publishing a series of weekly reports on this site discussing the weekly trends in domestic oil inventories. Regrettably, other matters prevented me from publishing my weekly report for last week so this week's report will discuss the prevailing trends in both this week's and last week's petroleum status report published by the Energy Information Administration.

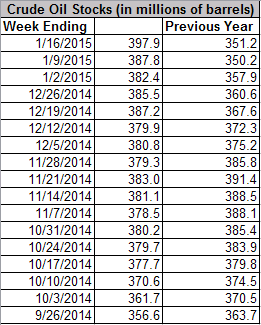

Oil inventories continued to increase during the week ended January 9, 2015, as the amount of crude oil contained in the nation's commercial inventories of crude oil increased to 387.8 million barrels from 382.4 million barrels at the end of the previous week. These inventories grew yet again and much more substantially during the week ended January 16, 2015. At the end of that week, the nation's inventories of crude oil contained a total of 397.9 million barrels of crude. This is substantially greater than the 351.2 million barrels of oil that these inventories contained at the end of the corresponding week last year. This clearly supports the claim that the mainstream media has been making that the United States is oversupplied with oil. It appears to be the case that this oversupply is caused by falling demand for oil due to a weakening economy rather than by an excess of production.

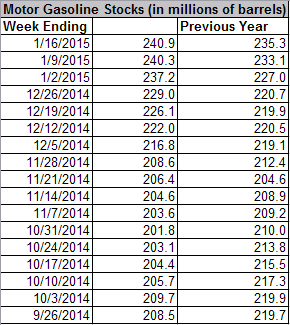

It is worth noting that the nation's inventories of motor gasoline have also been growing in size but at a slower rate than crude oil inventories. During the week ended January 9, 2015, the nation's commercial inventories of motor gasoline grew from 237.2 to 240.3 million barrels of gasoline. These inventories grew again during the week of January 16, 2015 to 240.9 million barrels of motor gasoline. As is the case with crude oil inventories, the nation's commercial inventories of motor gasoline currently contain more gasoline than these inventories contained at the same time last year.

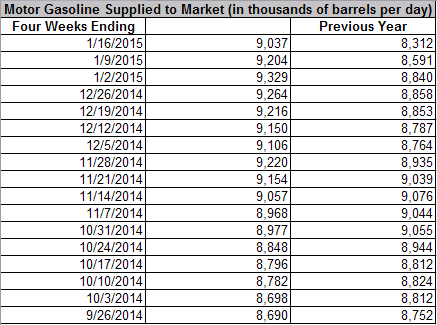

Interestingly, this increase in motor gasoline inventories comes despite the fact that the production of gasoline at the nation's oil refineries declined somewhat over the most recent weeks. During the four week period ended January 9, 2015, the nation's refineries produced an average of 9.204 million barrels of gasoline per day, a decline from the average daily production of 9.329 million barrels of gasoline produced during the four week period ended January 2, 2015. Motor gasoline production declined again during the four week period ended January 16, 2015 to an average of 9.037 million barrels per day. The fact that gasoline production has been declining but inventories have been growing could also be a sign that demand is beginning to fall which is a sign of economic weakness.

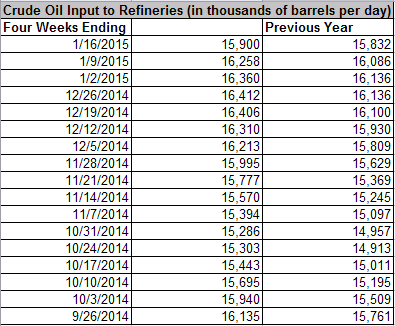

One of the reasons for these declines in gasoline production is that the amount of oil being sent and processed by the nation's oil refineries has also been declining. During the four week period ended January 9, 2015, the nation's refineries received and processed an average of 16.258 million barrels of crude oil per day, a notable decline from the daily average of 16.360 million barrels processed during the four week period ended January 2, 2015. This figure fell again during the most recent four week period, with the nation's refineries processing an average of 15.900 million barrels of crude oil per day. It is worth noting though that despite the declines in refinery utilization, the nation's refineries have still been processing more oil than during the corresponding period last year.

There are certainly signs that the United States has begun to become oversupplied with oil and gasoline. Furthermore, it does appear that this oversupply is increasingly being caused by economic weakness and not so much by an excess of production.

Disclosure: I am long several oil stocks and MLPs as are several clients. I have no positions in oil futures.

You write that the surplus in oil inventories is due to a weakening economy and lower gas prices. But the logic of this escapes me. From what I've been reading, the low price of oil has been a boon to the average American - equivalent to a $750 tax cut. That excess money is being spent elsewhere which will be a boost to the economy. And more Americans are taking advantage of the low prices to travel/commute more. Most business have lower costs to produce/deliver their goods and to match the increased demand are hiring more. How would all this cause a economic weakness and a decrease in demand for oil?

It is basic economics that when the price of a commodity decreases, demand for that product increases. Why would that not be the case here? What am I missing?

In many cases it would be true that the falling price of crude oil and by extension gasoline is a boon to the economy. However, this is not true in this case. The shale oil boom has either directly or indirectly been responsible for a very high percentage of the middle-class jobs that have been created since the end of the last recession. In fact, those states that do not have shale oil or gas fields still have, in aggregate, less jobs than they had back in 2007. The opposite is true in those states that do have shale oil or gas fields. Outside of the energy industry, the majority of the jobs created have been part-time or temporary positions.

Now with the declining price of oil, many of these jobs are in jeopardy. This is because the majority of North America's shale plays cannot be operated at today's oil prices. We have already been seeing layoffs in the oil patch as well as in supporting industries such as steel companies. As the majority of the non-shale related jobs that were created were low-wage or temporary positions, it is unlikely that these displaced workers will be able to find jobs that allow them to maintain their incomes. This is likely to cause a decrease in spending power and start to slow down the economy.

I've discussed this a few times in the past. Read these reports for a much more indepth analysis.

seekingalpha.com/.../2826556-are-commodity-trends-pointing-to-a-global-economic-slowdown

seekingalpha.com/.../2800715-why-declining-oil-prices-are-not-unequivocally-good-for-the-u-s-economy

seekingalpha.com/.../2812965-further-evidence-that-low-oil-prices-are-not-unequivocally-good-for-the-u-s-economy

I see your point - from my understanding, Shale oil needs to be sold at a minimum of $70 a barrel to be profitable. We're far below that which means shale oil will either lose money, or simply not be produced, putting many people out of work.

But I see Craig's point as well - Shale related jobs make up a tiny percentage of the total jobs. Yet virtually EVERY worker (and the unemployed) are benefiting from lower oil prices. When looking at the American work force (and overall economy) as a whole, wouldn't these benefits outweigh the damage? Or in even more basic terms, isn't it better that one industry suffers for so many other industries to prosper?

Thanks for the links, I'll read more on this to gain a better understanding.

Interesting insight. We will see if your argument holds up in the next few months. Generally, I would tend to say yes in that there is increasing signaling that the economic cycle is turning despite Europe's mass QE printing shock which, like the US is suppose to make the stock market world giddy on even more newly printed money based on no real production or demand. Although one may not call it money printing, you can say the liquidity it creates is pretty much liar money caused by the reallocation or theft of value from those who had money in the first place. You could also call it a massive hidden tax.