Non-Confirmation Between Small Cap And Large Cap Stock Indices

Image Source: Unsplash

The S&P 1500 is a composite index of three sub-indices: S&P 500 (large caps), S&P 400 (mid caps) and S&P 600 (small caps). It covers approximately 90% of all the market capitalization of U.S. listed stocks.

The S&P 100 Index includes the 101 largest company stocks by market capitalization in the S&P 500. The stocks of the S&P 100 Index represent about two-thirds of the market capitalization of the S&P 500 Index and more than half of the total market capitalization of the U.S. equity markets.

The Russell 3000 Index is composed of the 3,000 largest exchange-listed stocks in the U.S., representing more than 95% of the U.S. total market capitalization. It consists of two sub-indexes: the Russell 1000 Index, which includes the 1,000 largest company stocks of the Russell 3000 Index, and the Russell 2000 Index, which includes the 2,000 smallest company stocks of the Russell 3000 Index.

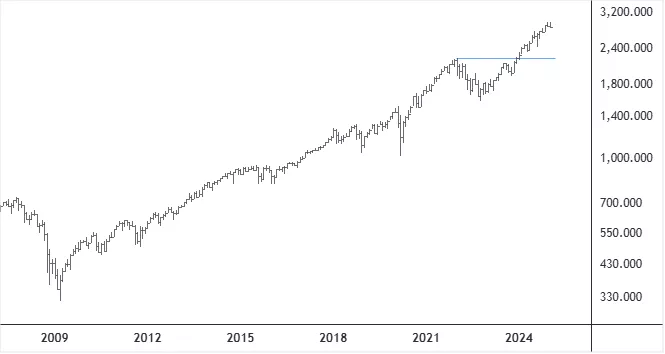

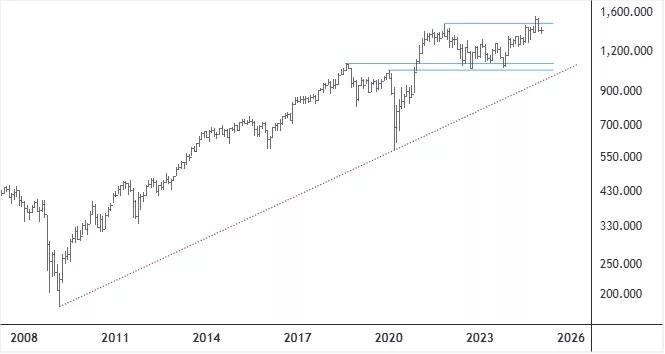

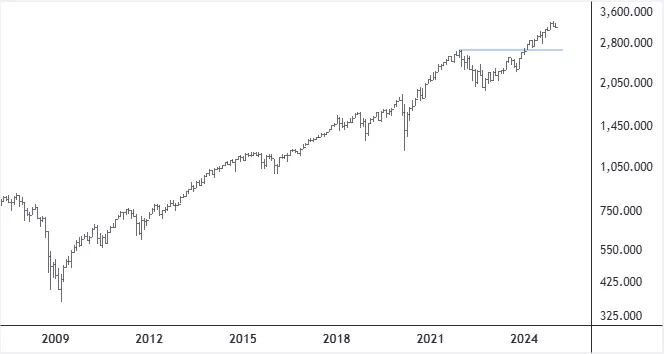

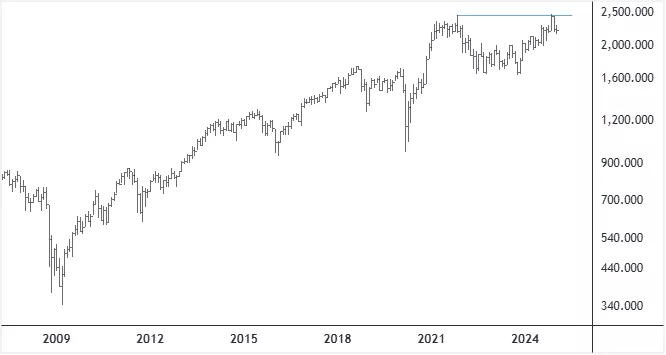

The four charts below show a severe underperformance of the S&P 600 Index vs. the S&P 100 Index and the Russell 2000 Index vs. the Russell 1000 Index. In other words, the small caps have lagged considerably the large caps in performance, as can be seen for instance with the small caps - unlike the large caps - not taking out their November 2021 highs. Such a non-confirmation (bearish divergence) between the small cap and large cap stock indices often resolves itself in some kind of decline.

Monthly Chart - S&P 100 Index

Monthly Chart - S&P 600 Index

Monthly Chart - Russell 1000 Index

Monthly Chart - Russell 2000 Index

More By This Author:

Nasdaq 100 Tech Sector Index At Key Inflection Point

Nasdaq 100 Indices Vs. Gold Price At Critical Point

Iceland´s Equity Indexes At And Above Their 52-Week Highs

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more