Nasdaq 100 Vs. S&P 500 Showdown: Where Should Your Money Be?

Watch the video extracted from the WLGC session on 17 Oct 2023 below to find out the following:

-

Which one to bet on between the Nasdaq 100 and S&P 500?

-

The immediate direction, key support and resistance of the S&P 500

-

The complete trading plan for Nasdaq 100 as it is building the right handle

-

How could a bearish scenario develop as the war is happening

-

And a lot more

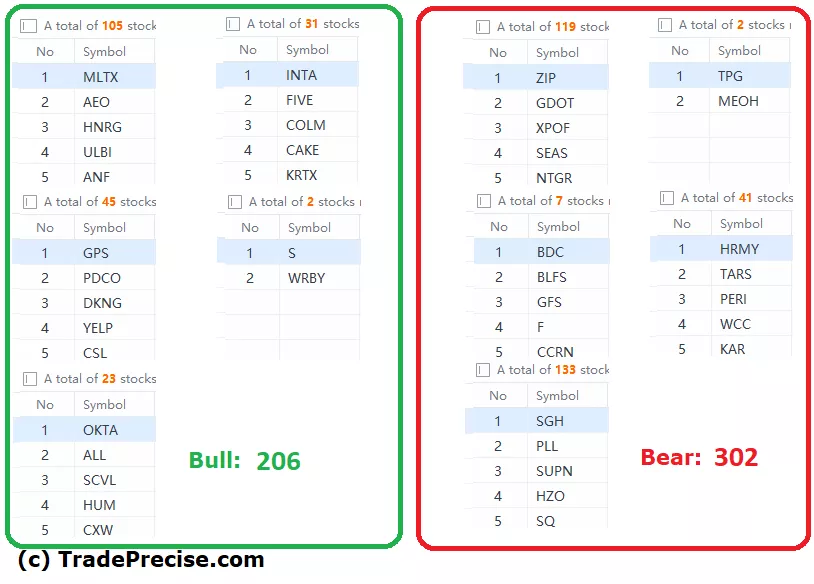

The bullish vs. bearish setup is 206 to 302 from the screenshot of my stock screener below pointing to a negative market environment.

Both the short-term and long-term market breadth are still inferior as the market is still pulling back or at best consolidating. However, Nasdaq 100 presents a swing trading opportunity (refer to the setup as discussed in the video) as it is building its right handle.

7 “low hanging fruits” (AEO, YELP, etc…) trade entries setup + 20 others (WWD, ANET, etc…) plus 38 “wait and hold” candidates have been discussed during the live session.

More By This Author:

The Change Of Character Bar's Message - Is This The Turning Point We've Been Waiting For?

October's Sneaky Dance: Unmasking The Game-Changer In Price Action And Seasonality

Is The Stock Market On The Brink Of A Meltdown? Here's What You Need To Know

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.