More On The Sharp Deceleration In YoY House Price Gains, And The Fed’s Chasing The Phantom Menace

Since there is no big economic news again today, let me fill in a little more detail on house prices through January, reported yesterday, vs. CPI for shelter.

Here is the monthly % change for the past 18 months for Owners Equivalent Rent in the CPI (blue), vs. the Case Shiller national index (gold) and the FHFA purchase only index (red) (note: both house price indexes /2.5 for scale):

(Click on image to enlarge)

Month over month the Case Shiller index declined -0.2% on a seasonally adjusted basis, while as I noted yesterday the FHFA index increased 0.2%.

But the most important detail is comparing the early 2022 changes with the last 6 months. Owners Equivalent Rent has increased between 0.6% and 0.8% monthly ever since last May. By contrast, both house price indexes started declining sharply m/m beginning last June. In other words, there are still two more months (March and April) where Owners Equivalent Rent will be compared with values below 0.5% in the same months from 2022, meaning that YoY OER is likely to continue to increase at least slightly for several more months.

Meanwhile, as the YoY% graph including the Case Shiller and FHFA indexes indicate, YoY price increases have continued to decelerate sharply, down to +3.8% and +5.3% respectively as of January:

(Click on image to enlarge)

which (after /2.5 for scale) suggest that OER will be well contained by next winter.

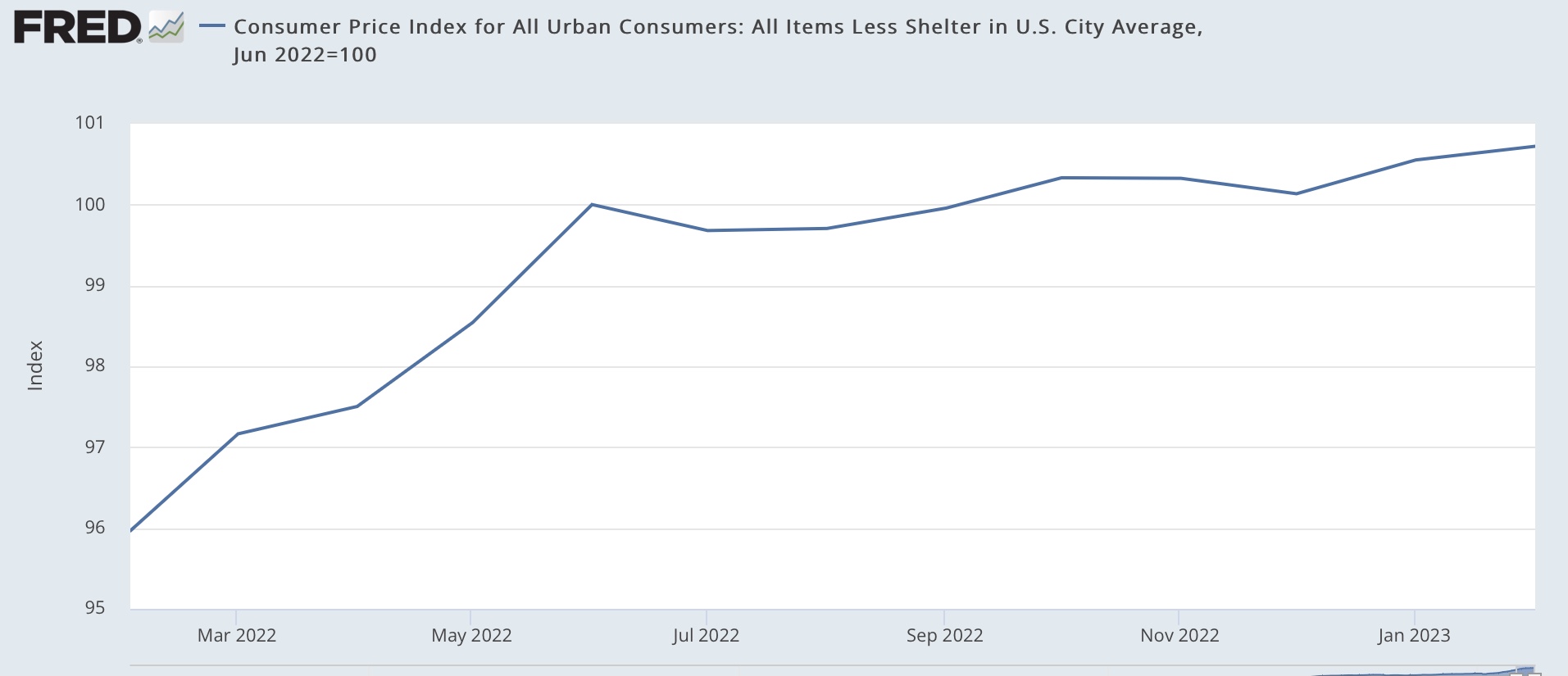

As I wrote several weeks ago, CPI less shelter is only up +0.7% in the 8 months since last June, i.e., at only a 1.0% YoY rate:

(Click on image to enlarge)

In making its case for continued rate hikes, the Fed has ignored this and been hanging its hat on services inflation in the broader measure of. personal consumption expenditures, which will be released on Friday.

More By This Author:

YoY House Price Gains Continue To Decline

3 Graphic Signs Of Financial Stress

There Is Now Only One Significant Manufacturing Datapoint That Is Not Flat Or Down - But It’s The One The NBER Relies Upon

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.