3 Graphic Signs Of Financial Stress

The theme of my weekly “high frequency” economic indicators update over the weekend was the sudden deterioration in some measurements of financial stress.

Tomorrow we’ll find out that house prices as measured by both the FHFA and Case Shiller have declined further, and that increases are substantially lower than as measured by the CPI, and on Friday we’ll find out what two of the NBER’s important measurements: real personal income and spending, as well as real manufacturing and trade sales, are, but since today there’s no big news, let’s take a look at those financial stress indicators I mentioned above.

First, the Leverage subindex of the Chicago Fed’s Financial Conditions Index got big revised last week (from gold to red in the graph below), to show that leverage is now more restrictive than at any time not shortly before or during recessions (compared with the YoY change in the Fed funds rate, blue, for comparison):

(Click on image to enlarge)

This tells us that credit has actually been pretty tight for the last year, especially the past few months.

Second, the St. Louis Fed’s Financial Stress index, which had been below zero, i.e., un-stressful as late as one week prior, suddenly shot up to levels not seen outside the last several recessions (see sliver at far right), except for the Long Term Capital Management crisis of 1998:

(Click on image to enlarge)

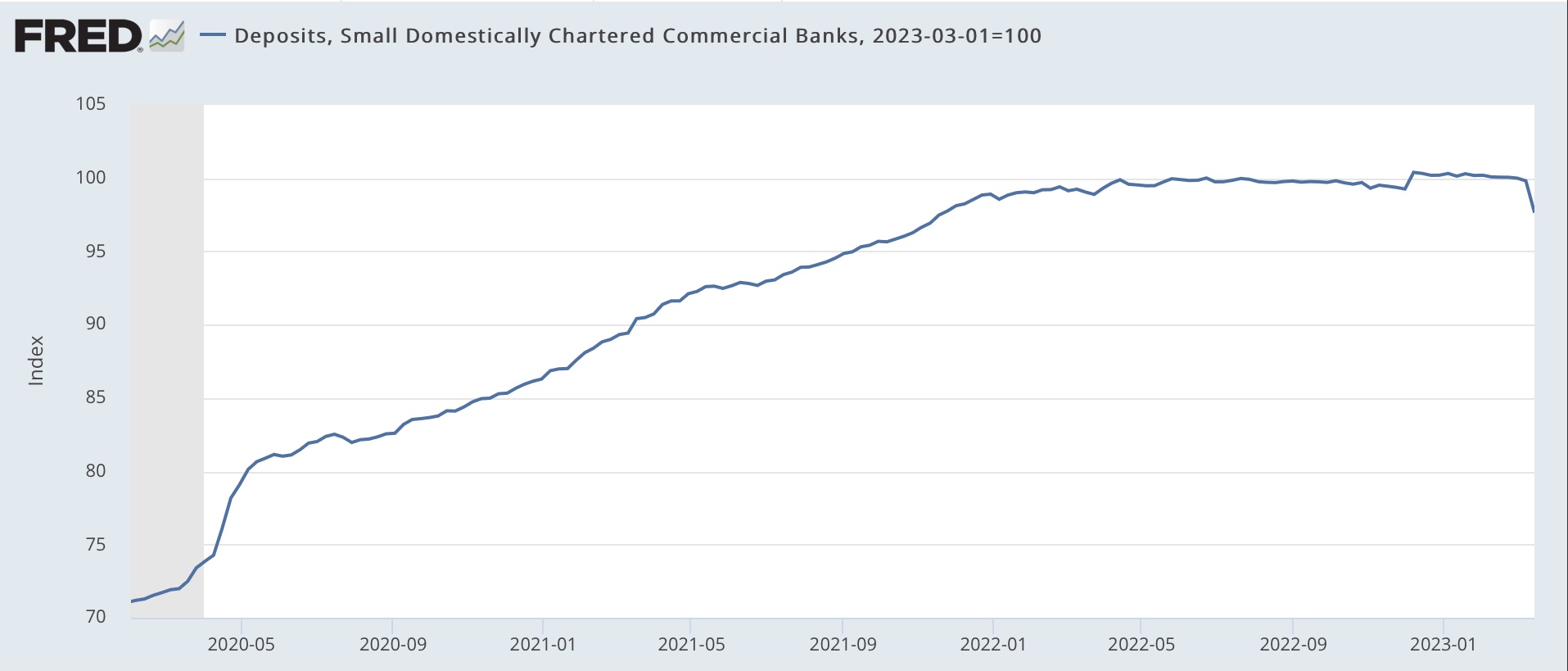

Third, in the past two weeks 2.3% of all deposits have been withdrawn from smaller commercial banks:

(Click on image to enlarge)

The only other time except for the past week that deposits YoY in commercial banks has been negative was in 1985-86:

(Click on image to enlarge)

If you have any significant money on deposit, whether in savings, checking, or money market accounts, you would do well to find out what the highest interest rate a bank in your area is paying for new money, and then march into your current bank and demand that they match that rate, or you will pull your money out. Especially if your bank has been piggish about continuing to pay almost non-existent interest, chances are very good you will get what you want.

It’s getting harder and harder to find any signs outside of employment that is not flashing warning signs of recession in the immediate future, if not already here.

More By This Author:

There Is Now Only One Significant Manufacturing Datapoint That Is Not Flat Or Down - But It’s The One The NBER Relies UponNope; Nobody Is Still Getting Laid Off

New Home Sales For February Increase; Likely Bottomed Last July

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.