Monitoring Investment Regime Trends With ETF Pairs

Markets move in waves and it’s valuable to keep an eye on the big-picture ebbs and flows for context with portfolio rebalancing, adjusting risk exposure, and much more. There are several ways to track these broad moves. One of the more useful methodologies is watching the ratio of prices for a given investment theme.

Using various pairs of ETFs is a useful approach and on that basis, this column marks the start of an ongoing periodic review of what I’m calling investment regime trends. There’s a long list of worthy ETF pairs to monitor, but as a start let’s limit the view to five in this debut. In future columns I’ll expand the vista, highlighting trends that are timely for one reason or another.

Portfolio Strategy

Here’s one way to quantify what might be called a measure of risk-on/risk-off at a high level for portfolio strategy via a pair of asset allocation ETFs. One is an aggressive portfolio mix (AOA), the other a conservatively run allocation (AOK). For this ratio, a rising trend implies a productive regime for risk-on strategies. By that measure, the strong rebound off the pandemic low has stalled in recent months and this trend appears to be at risk of rolling over and reversing.

US Stocks-US Bonds

Next up is the US stocks (SPY)/bonds (BND) regime. Here, too, the trend has stalled recently, although it hasn’t rolled over yet, largely because the loss for bonds has been greater than stocks in recent history, although this is starting to change. As a result, this indicator appears set for a downside reversal after an extended bull run.

Inflation/Reflation

The recent surge in inflation remains on the shortlist of risk factors that are driving market behavior this year and the price ratio for an inflation-indexed Treasuries ETF (TIP) and a nominal Treasuries ETF (IEF) suggests the inflation/reflation momentum remains strongly bullish.

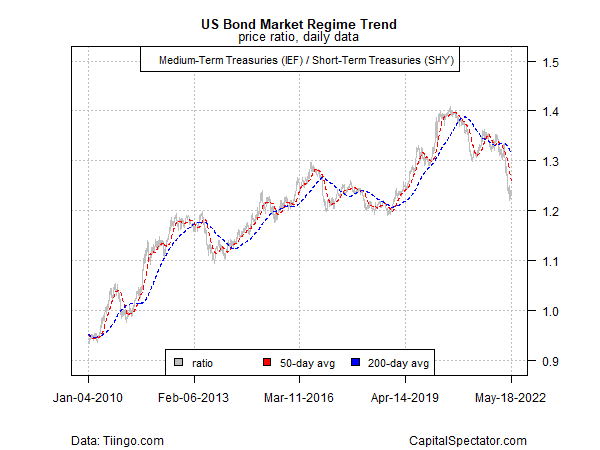

US Treasuries

Tracking the risk-on/risk-off trend for US Treasuries via a set of medium-term (IEF) and short-term (SHY) ETFs reminds us that staying defensive in this corner still looks timely.

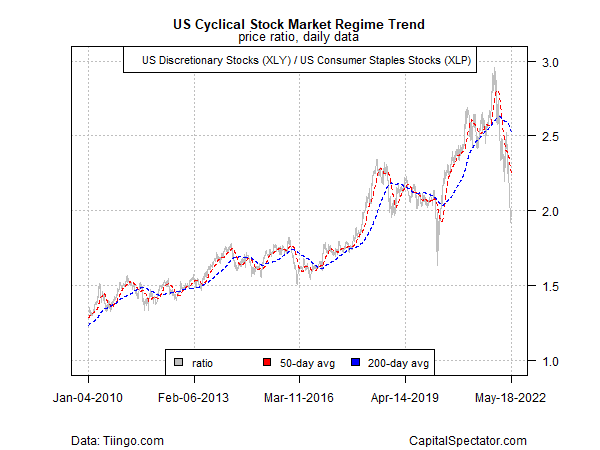

US Cyclical Equities

Staying defensive also has merit by favoring shares of consumer staples (XLP) over so-called discretionary names (XLY).

Disclosures: None.