Mediocre 7Y Auction Tails Despite Solid Foreign Demand

Image Source: Pixabay

After a solid 2Y, and a dismal 5Y auction, moments ago the Treasury completed the sale of the week's final coupon, and today's sale of $44BN in 7Y paper was appropriately enough, mediocre at best, not terrible, not great, in the parlance of our times.

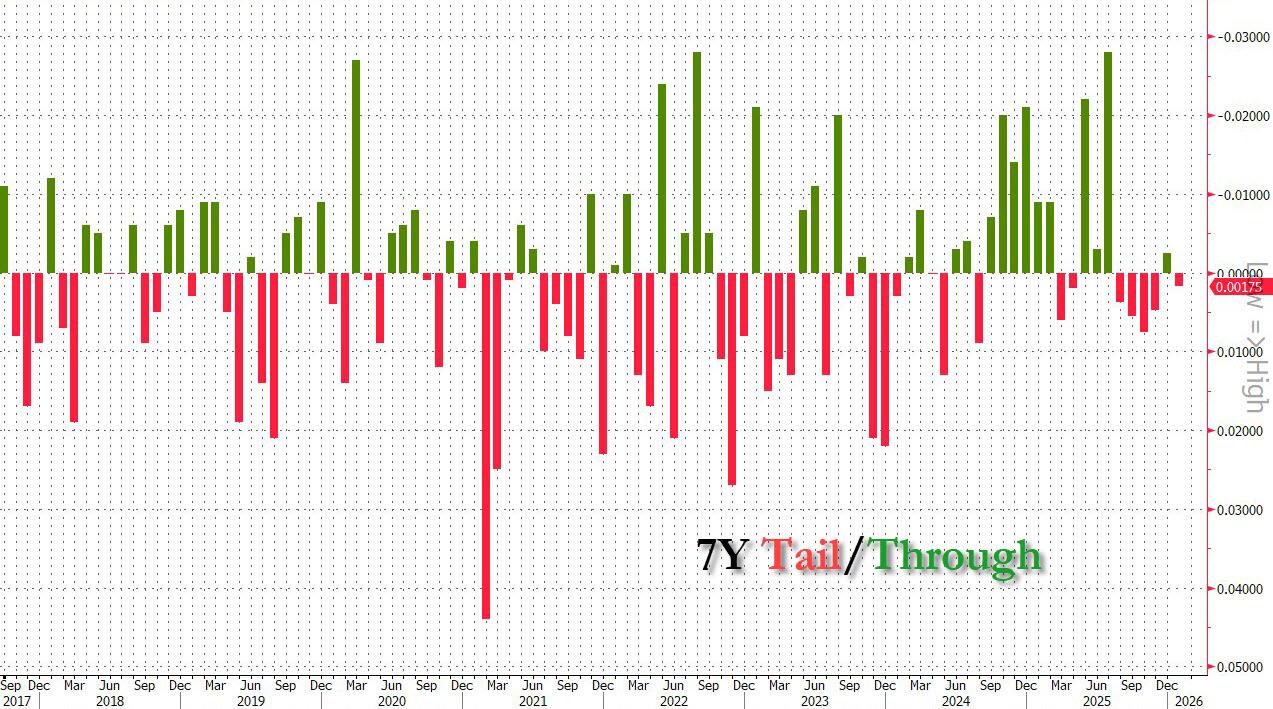

The auction priced at a high yield of 4.018%, the first 4%+ yield since July, and up from 3.930% in December. It also tailed then 4.014% When Issued by 0.4bps. This was the 5th tail in the last 6 auctions.

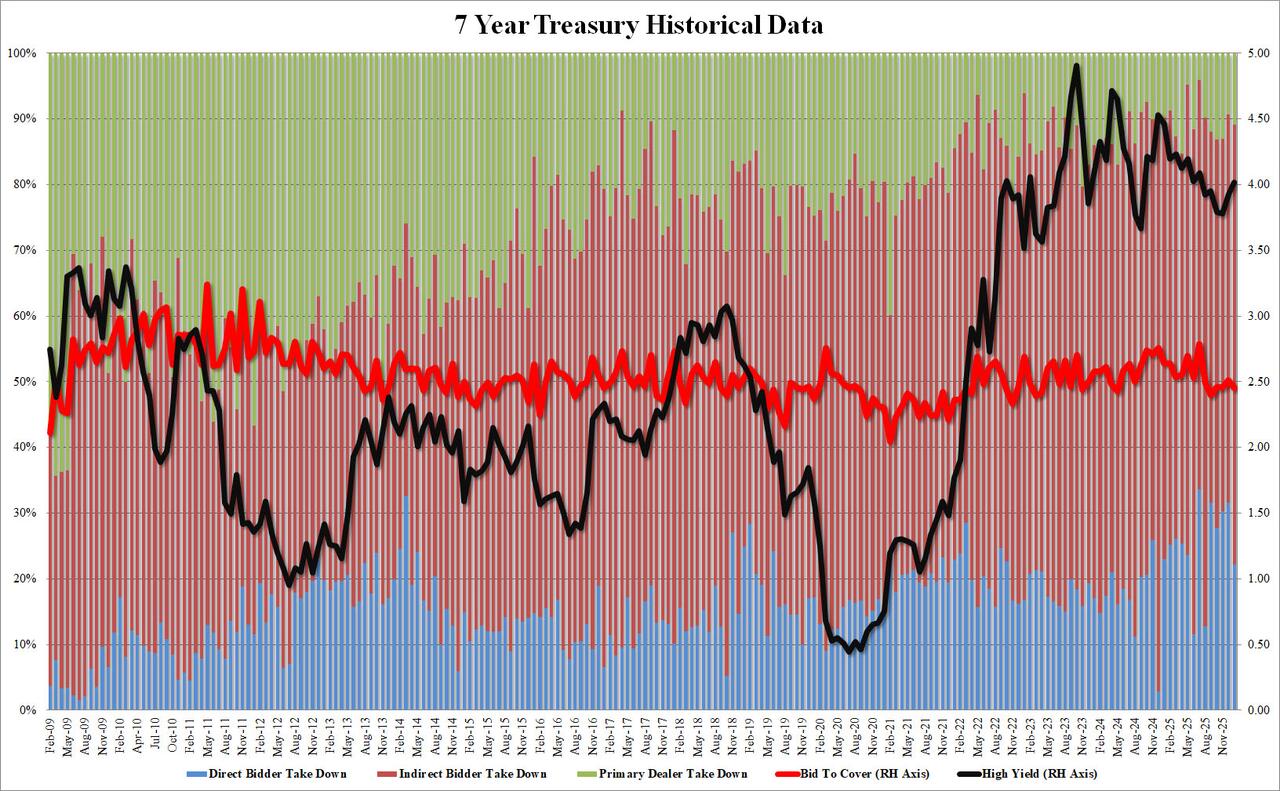

The bid to cover of 2.454 dropped from 2.509 in December, and was the lowest since September; it was also well below the six auction average of 2.516.

The internals were a fraction better: Indirects took down 66.9%, up from 59.04% and above the six auction average of 61.8%. And with Directs awarded 22.2%, down sharply from 31.6% last month, Dealers were left holding 10.9%, up from 9.3% last month and above the recent average of 10.2%.

Overall this was a mediocre, tailing auction and while it could have been worse (foreign demand for example was still quite solid), it certainly could have been better.

More By This Author:

Goldman Says "Good Opportunity To Buy Dip" In Obesity Drug Stocks

'No Hire, No Fire' Economy Exposed As Continuing Jobless Claims At Lowest Since Sept 2024

GM CEO Warns Of 'Very Slippery Slope' As Canada To Import Cheap Chinese EVs

Disclosure: Copyright ©2009-2026 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more