Goldman Says "Good Opportunity To Buy Dip" In Obesity Drug Stocks

Image Source: Unsplash

Novo Nordisk (NVO) shares in Europe appear to be forming a base after a 5.5-month bottoming process, following a mid-2024 peak and a subsequent 71% collapse.

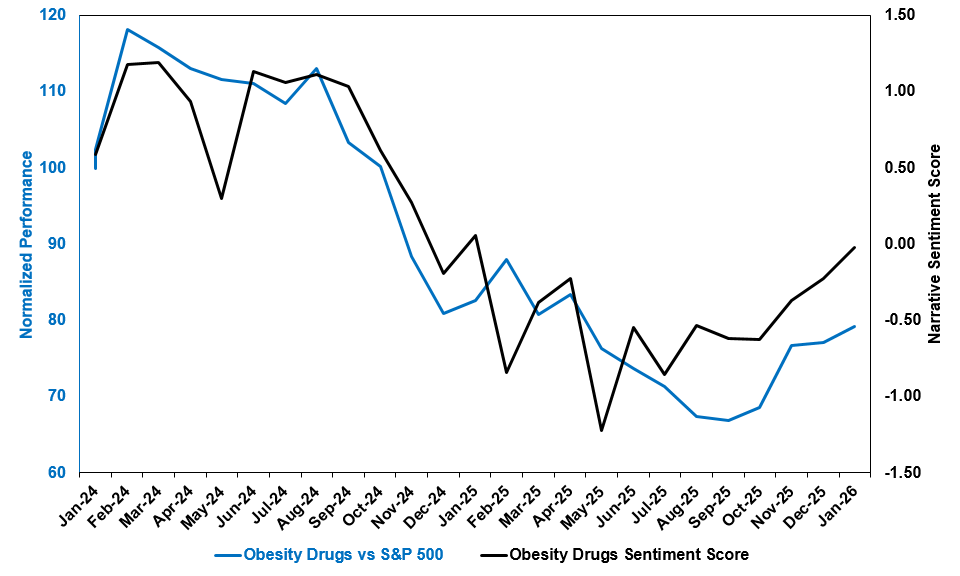

Goldman analyst Faris Mourad is telling clients this week that "obesity drugs narrative sentiment is on the rise" and "it's an opportunity to buy the dip."

Mourad explained:

The relative performance of the Obesity Drugs basket (GSHLCBMI) to the S&P 500 (SPX) is lagging its narrative sentiment. The basket is down -2 standard deviations today and we think it's a good opportunity to buy the dip.

We flagged the obesity drug theme yesterday: We like going long our global obesity drugs basket (GSHLCBMI) since it provides exposure to the leading companies (LLY and NVO) as well as potential emerging leaders in this space: market is moving beyond the dominance of a few key players, with new entrants and diverse therapeutic approaches intensifying competition. Large pharmaceutical companies are actively engaging in M&A and licensing deals to replenish pipelines and acquire next-generation obesity assets, as evidenced by Pfizer's acquisition of Metsera and Roche's deal with Zealand Pharma in late 2025.

We notice equity investors are also focused on the industries that could face challenges as obesity drugs become more popular. We consider a handful at risk: junk foods, alcohol, tobacco, and health care companies that may be impacted in the medical tech, tools, services, and managed care space. We created a basket that combines all: global unhealthy lifestyle (GSCBUHLT) that can trade $200m in one day at 10% of volume.

Our research team highlights 2026 as a pivotal year for the development of obesity market, with the launch of NVO's Wegovy pill (approved by the FDA in late Dec25 and expected commercial rollout in early 2026) and Lilly's Orforglipron (expected FDA approval in 2026), together with the initial unlock of the Medicare population, potentially significantly increasing the addressable population for obesity medications. We expect the focus in the first half of the year to be on the launch dynamics for the Wegovy pill and orforglipron, with sales estimates 25-35% ahead of company consensus for 2027-29. That being said: street consensus estimates show no changes to 2026 and 2027 revenues driven by Oral obesity drugs and the group traded below earnings expectations for the majority of the last year.

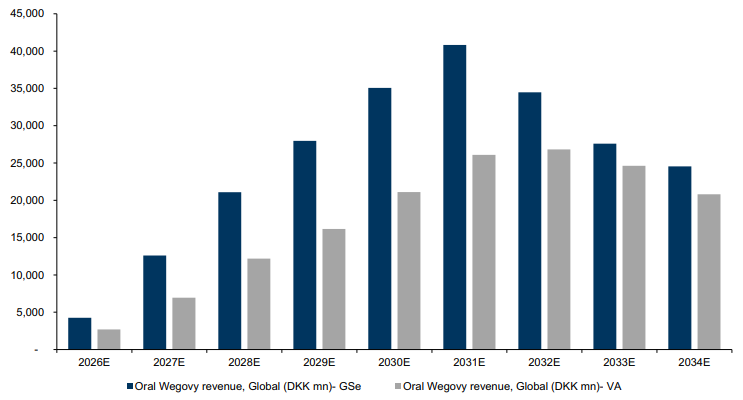

GS research is significantly ahead of consensus on the revenue potential of oral Wegovy:

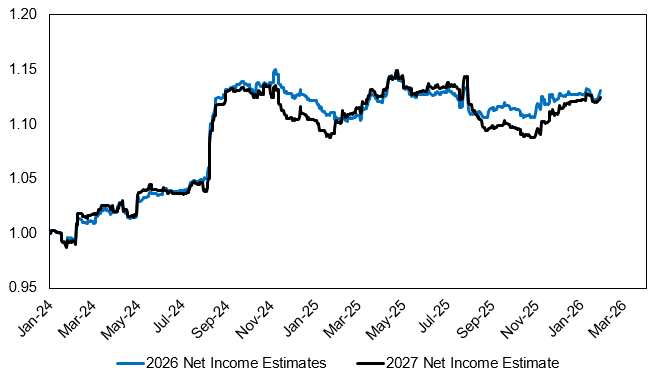

Meanwhile street consensus estimates show no changes to 2026 and 2027 revenues driven by Oral obesity drugs:

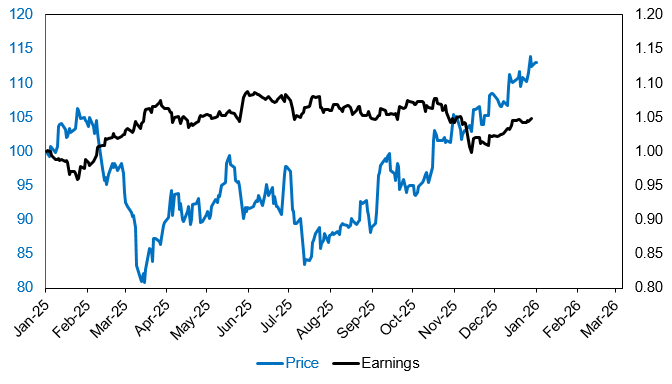

Obesity drugs traded below earnings expectations for the majority of the last year:

Will 2026 be a rebound here for Novo?

More By This Author:

'No Hire, No Fire' Economy Exposed As Continuing Jobless Claims At Lowest Since Sept 2024

GM CEO Warns Of 'Very Slippery Slope' As Canada To Import Cheap Chinese EVs

Meta Stock Jumps Despite Soaring Capex, Expense Forecast

Disclosure: Copyright ©2009-2026 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more