Wednesday, November 18, 2020 3:17 AM EST

|

Cohesive moves - are not what this stock market is about. For sure the logic of buying 'in-general', in-the-face of confronting the worst phases of COVID-19, as is clearly pending flat-out during this Holiday season, is counter-intuitive on the surface. At first. Then one realizes why the bifurcated sectors hold-up, in a few ways dating all the way back to our call for a low amidst March 'max-fear'.

And of course it's the rotational battles we've discussed for weeks. And some assist from the belated optimism from some major firms (like Goldman), who just upgraded their S&P goals within the last few days. Sure that can be near a short-term peak, but I know why they did that, besides the performance and peer-matching issues noted the other day. It's Tesla coming aboard, which of course combined with an handful of Apple and FANG stocks can pretty much dominate a market following S&P, struggles a bit more beneath the surface.

Of course the money managers are dominating those super-caps, not 'young or newbie' investors who get more credit than deserved for the big-cap rise. At the same time they absolutely helped the downtrodden and speculative small caps, and still contribute to interest in stocks that the institutions generally will not touch. (Some won't consider a stock under 5, which is why sometimes I'll note that. And when a small stock moves above that level expect it to gain the respect denied sooner, even if it wasn't 'really' under-the-radar of managers.)

|

|

|

Executive summary:

- Tuesday mini-washout and rebound but not tremendously, unfolded, as expected was essentially a favorable consolidation, for the moment.

- Judy Shelton failed to get the votes to a member for the Federal Reserve.

- President Trump ordered a drawdown of troops in both Afghanistan and Iraq, which probably wouldn't happen (?) if an attack on Iran's nuclear or other facilities was in the works, which came-up last week in a meeting.

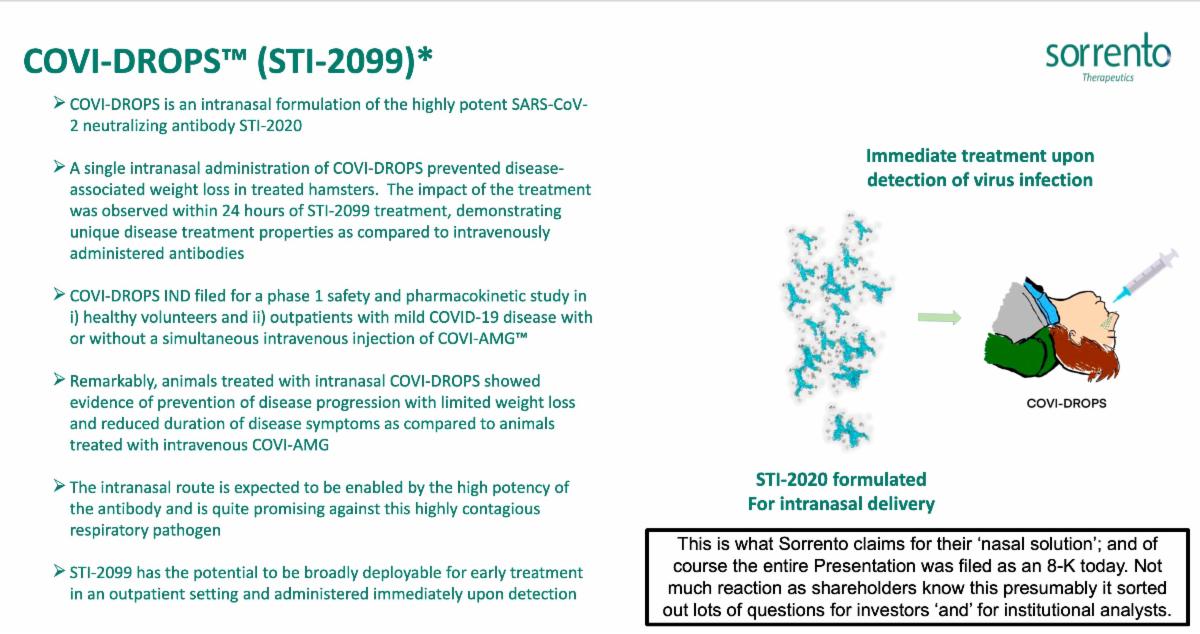

- Overconfidence prevails about the early roles of vaccines to fight spread of COVID, which is why we not only prefer a focus on therapeutic antibody treatments, but also part of why the post-COVID stock play is a bit robust.

- To-wit the S&P may be ahead of itself, but broad market's not overbought to the degree the most-liquid (high-volume) super-cap stocks are.

- Lots of talk about getting thru the 'dark winter' of COVID, and indeed that's a variable and impacts small business more than big component issues.

- Again, we think the biggest boost for the stock market would be approval (first has to be submitted) of a 'Pill' or 'nasal spray' COVID-killer (whether that's from Sorrento (SRNE), Merck (MRK) or anyone working in that direction).

- I do believe there has been too much of extreme views, either the bears who tend to be seriously negative, or the superbulls with outlandish S&P targets (that are feasible down the road, but not on this phase of action).

|

|

|

Meanwhile . . the vaccine 'gold rush' persists, both parties clearly 'buying into it', but not the 'holy grail' of fighting this COVID devil. Frankly that's going to be including antibody therapeutics. I hasten to note that Trump got Regeneron's (REGN) version, and Chris Christie of NJ got the Lilly (LLY) MAB (monoclonal antibody). So here now is the forthcoming (hope it works!) Nasal variation of treatment.

|

|

|

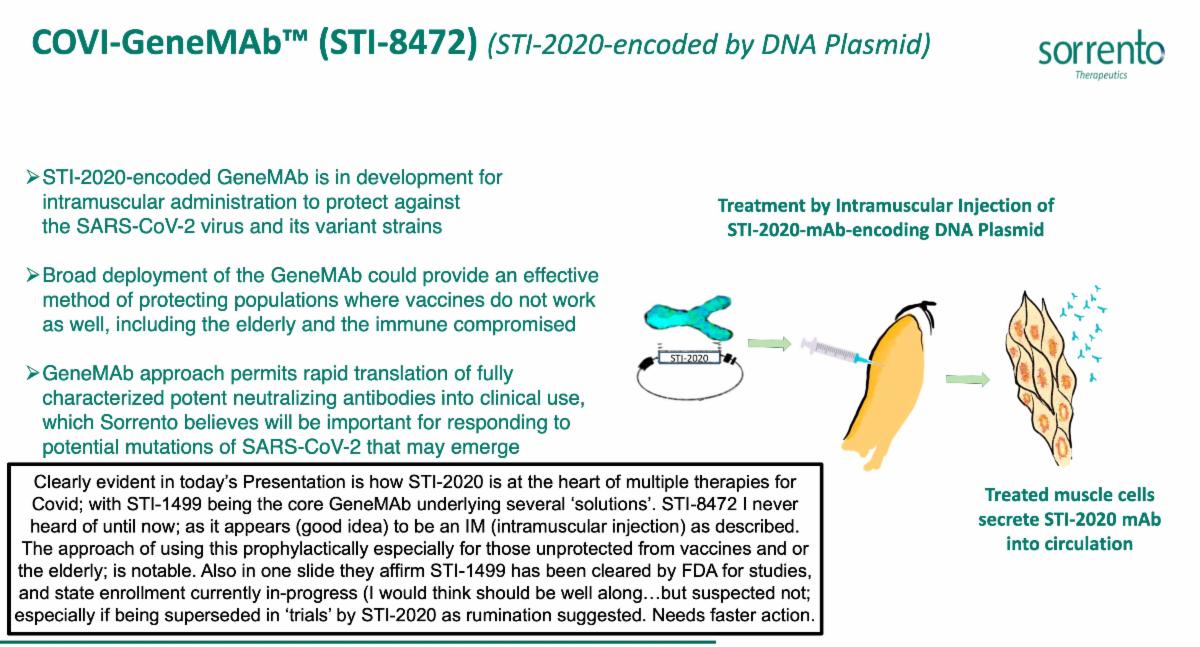

I note that Samsung and Lilly will work together. I also found the first indication of an 'injection' (single shot) from Sorrento that they are planning to test. That's the first of their slides below.

|

|

|

A couple slides from Sorrento's Presentation give an idea of what they are up too with regard to outlining no new 'approvals' yet' but where things stand. My suspicion is that the 8-K filing wasn't so much to deflect tons of questions from understandably anxious investors, or media that tends to ignore them for now, but perhaps to simplify their complex outlined research and activities for the increasing number of institutional investors coming on-board recently.

|

|

|

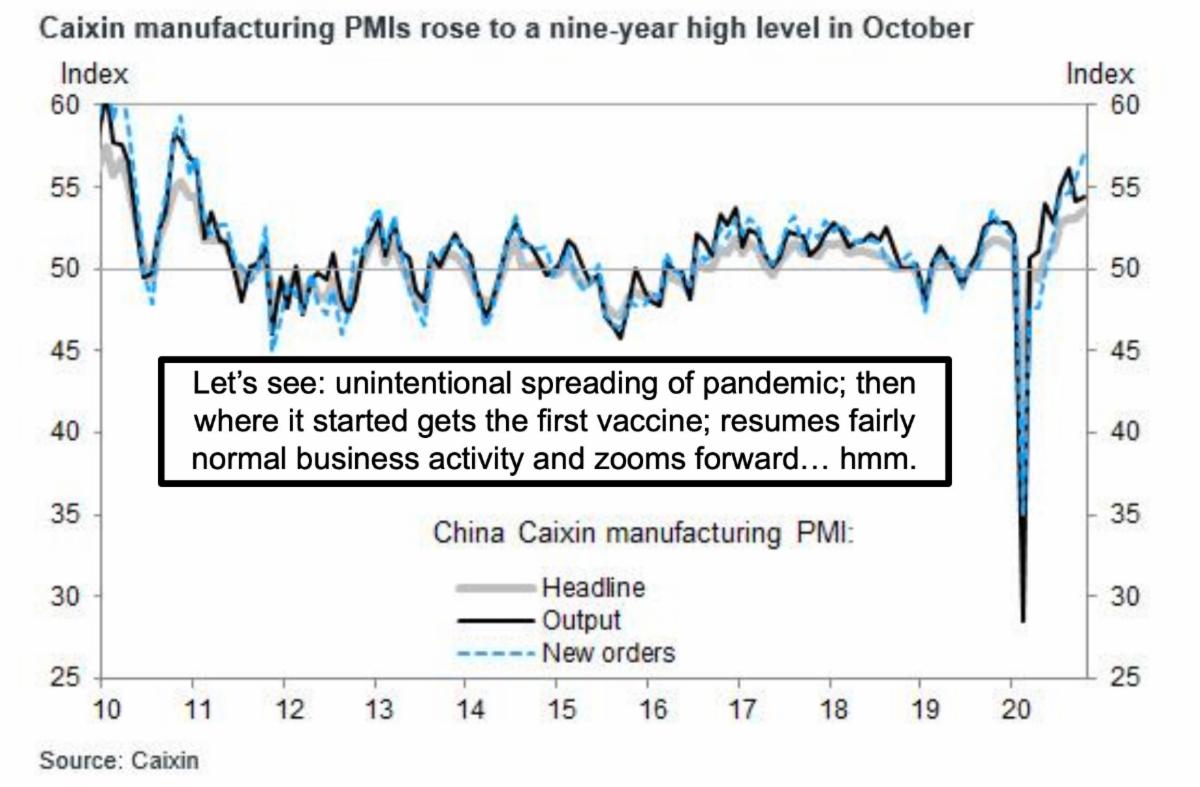

Tonight we have to give credit for candor to Chinese President Xi, he referred to China and the world as being in the worst 'recession' ever since the 1930's Great Depression (which incidentally facilitated the Chinese Communist Party coming to some semblance of recognition primarily in Shanghai at the time).

Xi made the remarks while urging BRICS countries to cooperate, maintaining multilateralism which he said is a greater guarantee to best 'safeguard world peace and stability' during tumultuous challenges of COVID-19. Xi also urged "openness and innovation to facilitate global economic recovery, as well as green and low-carbon development."

Well it's hard not to agree with most, of course he has in-mind trade, differing definitions of safeguarding, but at least he's candid with his people (it was a National TV Address in China) about what's at hand, and they (from whence this devil called WuFlu.... I mean COVID) came, is actually dealing with it better than Europe or the Americas. He signed a trade deal with ASEAN countries, it doesn't even get media coverage here in the States, and creates a trading or block of cooperation that was something the US developed and China walks into the vacuum as we pulled-out. If you want to see one trading mistake that could have been avoided, that would be this. The basic NAFTA deal is better, but the largest trading block is actually in Asia now. Do I endorse it? No. But I will not sweep this 'deal' under the rug as many are, even if they take notice.

|

|

|

Bottom-line: the S&P move has not been unrelenting, only the super-caps in technology have advanced and then meandered in a reasonably small trading range, but at high levels with really few decent prices available. Most pundits will not say it quite so candidly, because they know COVID's march has done that. They know the fast-paced crowd's primary focus there is for liquidity, not real investment, just-in-case something comes along (call it a systemic shock from an existential event) to rock-the-boat, in what otherwise should remain a fairly lame time to buy big-caps. Risk is worked-off by dips, but is still present.

As an investor comprehends the ongoing (or rotating) shuffles I've discussed, between big-cap technology-based (or online consumer sales and services as well as related) stocks versus the 'aspirational' recoveries, for what really are post-COVID recovery plays, it's straining the value relationships considerably.

|

|

|

In a sense many such stocks (beyond tech) are trying to discount the eventual return to life and profitability, and while that's out there it becomes daunting. A reason is simple: it's months away and although we absolutely believe in the stock market as a discounting mechanism, it's already discounted 2021-2022 for many issues, so why should the market discount 2022-2025... now?

While on the prowl for another shakeout, we've said not just yet and not very dramatic unless it somehow relates to an attack or some total new insanity in Washington. The only insanity should be fiscal conservatives not grasping the need for immediate and emergency stimulus for those struggling, and if you'd looked at the combinations of food lines and COVID-test lines around the U.S. today, and aren't moved by that, well then you'd be a heartless politician.

|

|

How did you like this article? Let us know so we can better customize your reading experience.

So some areas still do well, that is interesting.

And yet if a hundred trainloads of effective vaccine arrived this evening it would still be months before the health in general improved and the plague was beaten back.

Worse yet, the collection of fools who fear medication is growing, and promising to remain a vector of infection.