Market Briefing For Wednesday, May 17

Market's holding it's 'breadth' just a bit ahead of Debt Ceiling decisions, at the same time as others are mesmerized by issues like AI regulatory ideas.

For instance, I conversed with a young doc as I queried Chat GPT about a cardiovascular treatment approach, to which I got a clear response (surprisingly), which the 'actual' MD found frustrating to read, after such a long time in medical school to be able to do .. just that.

In a subsequent test while watching (rare for me) CSPAN's Senate Hearings on AI, I decided to ask 'Chat' a theoretical outcome: 'how did Ukraine defeat Russia'. Well, AI gave me a 5 paragraph answer and explained how Russia's defeat allowed Ukraine to be at the helm of European unity against adversity.

Well o.k., but that story hasn't happened fully 'yet', so alone is reason for care.

What has happened is 'slight' progress in the Debt negotiations, given White House appointment of someone to negotiate on-behalf of the President with McCarthy's team. We presume some sort of 'agreement' will be constructed.

Earlier, the time spent listening to Sam Altman (Open AI), the IBM VP and an NYU Professor, found a bit of unexpected awareness from Senators too. So perhaps it's their frustration of how tardy they were regarding 'social media', that has them trying to be ahead of the rush to AI. They may already be late.

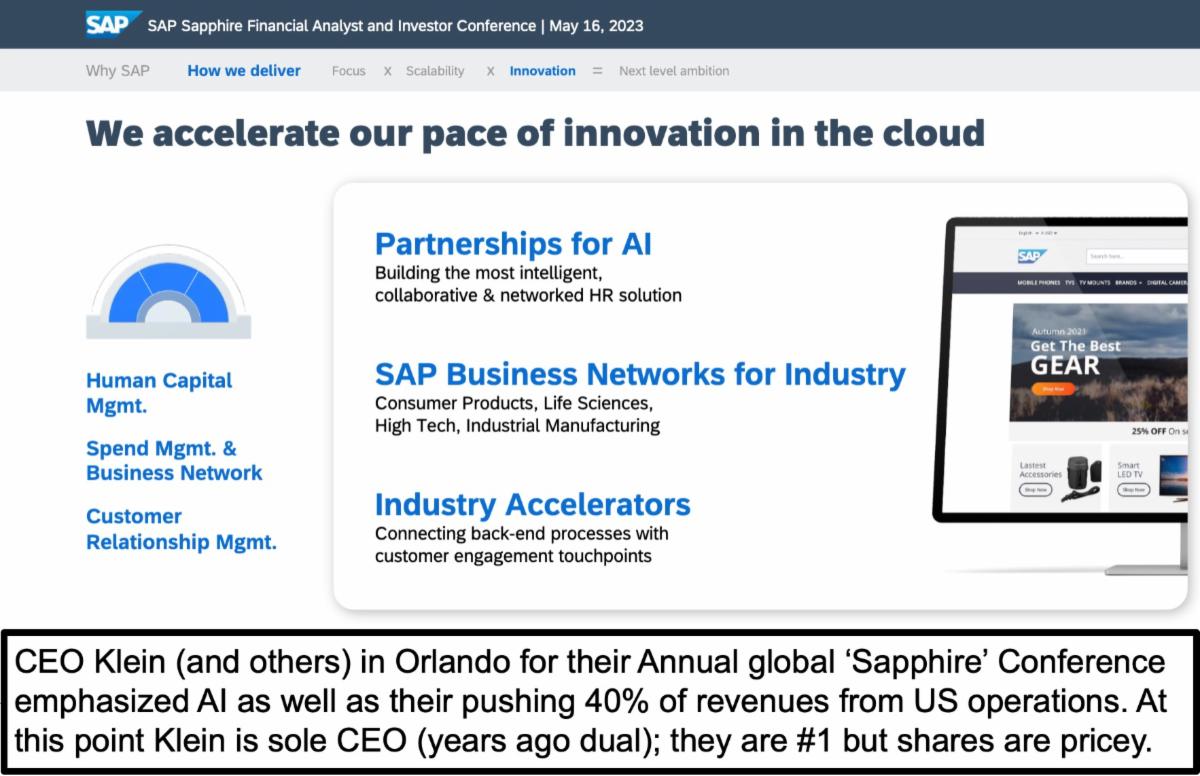

Government normally doesn't comprehend what's needed to regulate most technological areas properly. That's probably the case with health (FDA and COVID being an example) or monetary policy (let's not start with the Fed lag in both directions). AI is 'not yet' actually a bubble, even if it feels that way some times. I say that because some companies merely figured-out or are trying to attach AI to their persona, others find it at the core of 'who they are'... even for years already, if you think of online shopping, stock charting, or cellphones.

Interestingly even big companies like AMD and Cisco or even Microsoft, are attaching (or funding) AI development, as they recognize it's essential going forward as a component. Others have merely expanded existing AI, Apple or Google being part of that. It's the 'generative' aspect that creates 'verticals' or niche segmentation of AI that hasn't been prevalent before. Or it's been in a 'ring-fenced' (boxed-in limitations) role, like voice command in autos or Siri, which (for-instance) isn't offended by Alexa, but neither has much depth.

That is a challenge for the layers of 'code' such companies have to navigate if they're going to try to 'update' their voice assistants sufficiently, or some think, it may alternatively be preferable to have stand-alone new Ai products. Fluid.

In-sum:

The market was an 'absence-of-bids' understandably, with nominal progress (but key) towards 'debt ceiling resolution' inhibiting any excitement.

Meanwhile there's a troubling report that a barrage of Russian guided missiles hit Kyiv tonight, and took-out an American (Raytheon-built) Patriot battery. For sure the Russians would make a big deal out of that, but the report suggests it was 18 missiles fired at the same Ukrainian target, so sure, any huge 'swarm' attack can often overwhelm defenders, no matter how superior the technology that the defense has. So Moscow will crow that they took-out 150 million or so of missiles (30 Patriots at 5 million each approximately), but that's war if so. In everything I've seen, the Patriot is a good weapon, it did intercept hypersonic intruders just last week, but again if numerous were fired it it, that outcome is sad, but might just have to be absorbed and not question the weapon quality.

Something is going on in Ukraine .. notice my comment last night about what is a military alert in neighboring Belarus, where the dictator seemed to vanish, and from where Russian jet fighters intercepted French and Polish NATO jets near the border, which is normally routine, but incites more angina just now.

After the sagging Close Tuesday, we moved toward the Tesla Annual Meeting and Elon Musk's interview with CNBC's David Faber.

"Too much latency" . . was Elon Musk's description of the Fed, totally agree of course, as that's what we've said for 3 years now, too slow to respond to the pandemic, then they correctly reversed (and so did we from bear to bull in March of 2020), then too low for too long, and now too high for too long.

That is the key comment he made about markets and economics, as well as a rather basic guideline about how higher prices and rates impact everyone, no credit being used or lots of credit utilized. I know some media thought him to be 'wishy washy', I say not. I thought there was some deep thought and just a couple clever references to business, especially justifying 'verifying charges' by Twitter, so as to compel some charge and avoid a million or more 'bots'.

In that regard I was pleased to hear him clarify that he never thought Open AI 'Generational chat' would be delayed, just had to express the sentiment. And he suggested we have a 'normal person' as President (CEO of the USA, not so much a politician). Actually the Nation thought it tried that a couple times, I will leave that topic there for now, but get the sentiments. And Musk threaded a fine line about China, emphatic that they are serious about Taiwan.. and yes of course that carries tremendous ramifications for the entire world.

Bottom-line:

Most are enamored by the Home Depot (HD) 'miss' today, whereas I think Tesla (TSLA) is the key at the moment, as well as the Debt issue. I have looked at rising 'credit card' and 'revolving debt' in this Country, and think consumers are or need to consolidate spending, and the HD report would align with that.

A couple days (minimum) of pending White House debt-dealing negotiations are ahead, so we'll possibly not get an outcome before the President returns Sunday from G-7. However, both sides make it clear we must not default, and that's been my presumption throughout this Debt 'ordeal', and contributes to a degree to the continued 'range-bound' S&P 'neutrality' as continues evolving.

More By This Author:

Market Briefing For Tuesday, May 16Market Briefing For Monday, May 15 '23

Market Briefing For Thursday, May 11 '23

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more