Market Briefing For Wednesday, May 11

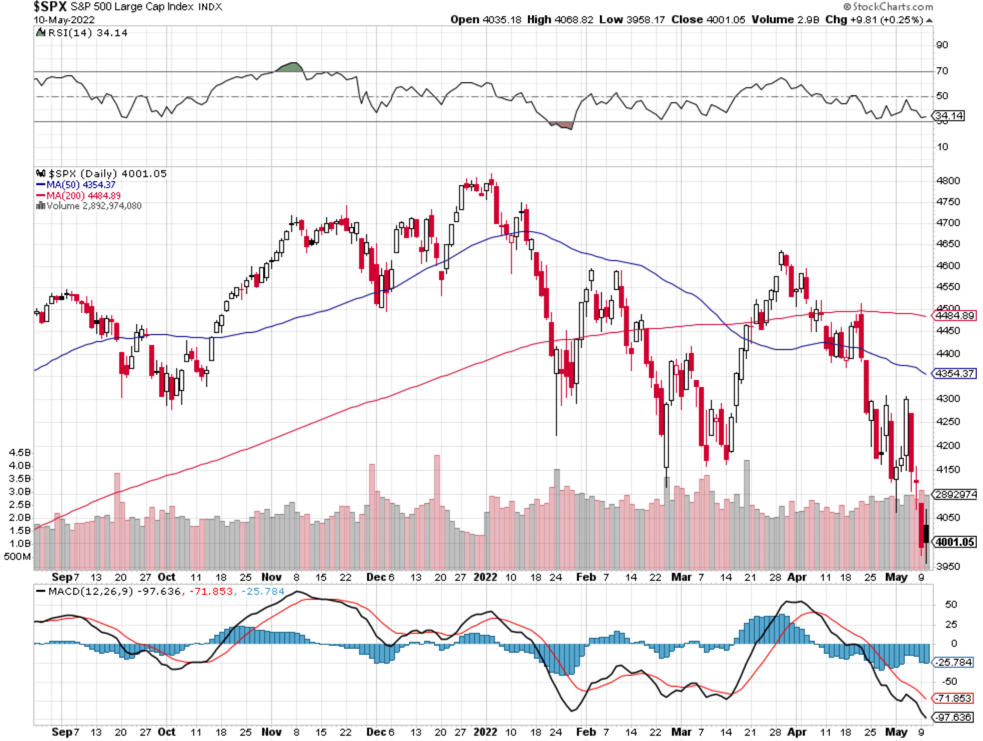

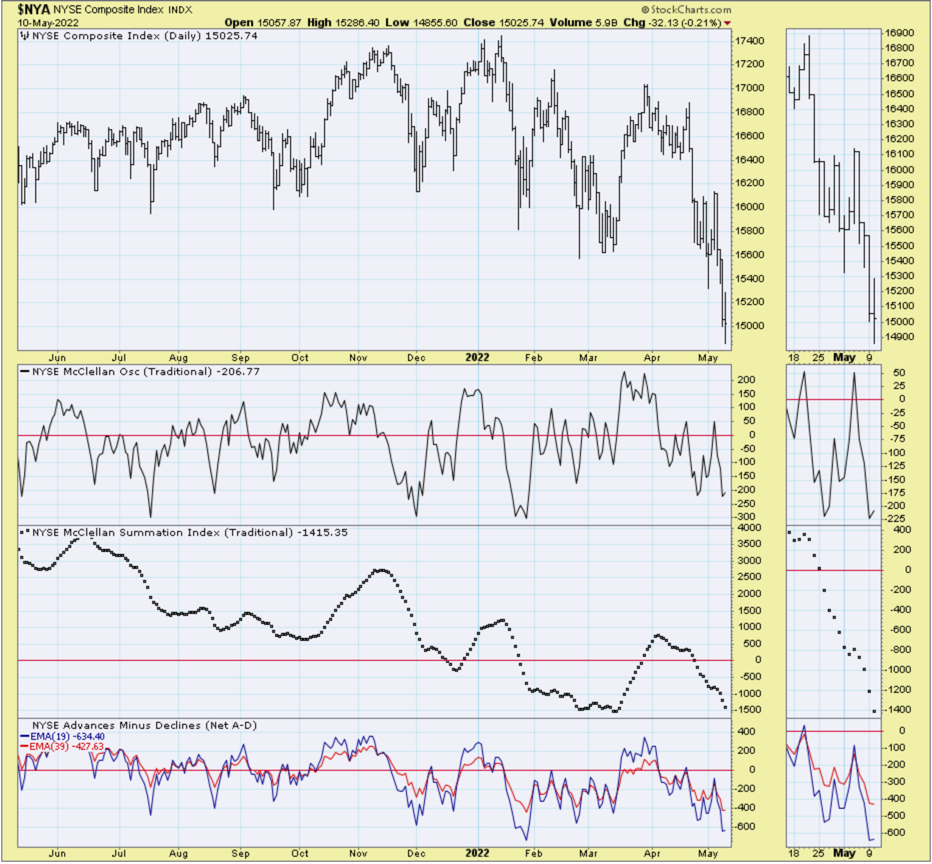

Variables lack clarity on a global basis, so that's an inhibiting factor for any rebounds. That backdrop contributes to what's called a 'lack of liquidity' or for that matter an 'absence of bids' in regular-way trading. In such a mix, it's not a stretch to get implosions followed by 'false start rallies' such as Tuesday saw, a couple times, and then a jittery slight fade ahead of tomorrow's CPI data.

Thinking about such behavioral conditions, I speculated Tuesday might see a 'false start' rally, then dive to lower lows (ideally with VIX even higher), only to then see another rally effort, contributing to alternating battles to find any sort of interim stabilization, even if it's not more. In other words: more wrangling.

Now to that more-immediate issue to contend with. The CPI and inflation. Lots of pundits are aware of the upcoming report, and require that this CPI reading must show 'peaking inflation'. That would be great, but I suspect it's unlikely. I mentioned this last week because the data is 'before' mortgages hit 5.5% on conventional 30 year home loans, and 'before' used car auto prices tumbled, and before Housing 'inventory' started to rise, as it is in many cities now.

All that (peaking inflation) is expected, but barely evident now, and hardly part of the report we're about to get, again 'trailing data'. So if the market swoons a good bit more on that, you'll immediately hear just what I said (trailing data) so the expectation will be of another rebound effort after the on-news purging. It's not unlikely that Wednesday's market goes that way either (weak then relief).

Volume precedes price, and while the broad market has been kicked for some time, I'd still prefer to see a volume surge and Volatility spike concurrently. We don't have that yet, we might not even get it because of the bifurcation, but I'd feel more comfortable talking about prospects of a meaningful turn if we get it.

Meanwhile equity investors who failed to get out of 'theme' pandemic stocks, or a slew of big caps, are essentially trapped pending meaningful recovery. It is actually 'almost' a typical 'don't fight the Fed' decline, except that it's a year old in smaller cap stocks, and you can see the pressure on investors broadly, as they tend to sell other assets now, including the oft-warned-about crypto. I will be watching to see how much of a crack we get in Housing, and suspect it is something the Fed wants to see before they even contemplate easing-off.

In-sum: consumers are stuck spending, whether they like it or not, as they're not 'flush with cash' as some analysts or Fed-heads mistakenly characterize them as. Rather they have no choice. Same with (poor souls) who bought any housing more recently, contrasted to friends who did so at least 6 months or more ago, and got better pricing 'and' sub-3% mortgage rates (one pal got a 15 year mortgage for only 2.3% with no points, and that's about the best I heard).

S&P is fishing for a low, but uncomfortably hanging around the ~4000 level. It is not a given that we'll see ~3800 more or less, but clearly risk is reduced as prices decline. The trouble is most analysts continue to 'push' very expensive stocks, that were 'uber-pricey' and are not just extremely pricey, not bargains. I understand the argument that they may never get to be bargains, but rather see some evidence of building bases, because most such mega-caps are just notable down from previous highs, but aren't yet really clear value-buys.

One key concern limiting the ability of stocks to stabilize 'much' Tuesday, for sure relates to Wednesday's revelations from the CPI number. Despite having remarked about the 'rear-view mirror' aspect of the number, traders probably will react anyway, and in that regard having it out of the way ironically might be helpful, 'if' it contributes to yet-another washout effort and rebound.

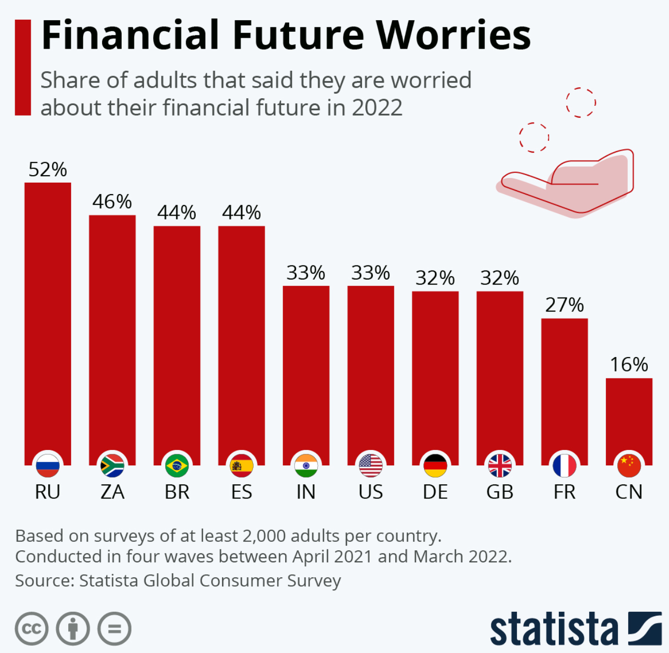

The world is sobering to the stagflation that's growing in Europe, continuing in the 'old-age' home as some refer to Japan, stagnant in China due to stubborn reticence to import vaccines or drugs to effectively treat COVID, and just chaos in the U.S. markets, where many investors have continued 'fighting the Fed' in a sense for many months after the bulk of stocks began adjusting to a tighter monetary policy, which was telegraphed by Chairman Powell for months too.

Overall . . there's little more to be gleaned from this day's two distinct efforts to rebound, more or less like speculated last night (a false start, sell-off and another rally, but all with dubious sustainability). And precautionary defense ahead of jitters around the CPI number,.

Wednesday of course CPI will affirm continuity of inflation, and even as it may be plateauing now, it likely won't be reflected in these numbers. We'll see how well 'the Street' recognizes that prospect in reflecting on the morning's data.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more