Market Briefing For Wednesday, March 23

Just because you're paranoid doesn't mean they're not out to get you. For sure that is probably my take-home message for today, with so many analysts and pundits consistently bearish into and coming-off the recent lows, and still not embracing the rally. I'd be more concerned if they became enthusiasts!

Seriously though, the Fed's policies loom as a threat to numerous sectors as they really try to impact demand, so they should be careful what they wish for in this still expensive environment for the mega-cap stocks. Regulators were late to the table with snugging-up policy, and history tells us there's a risk of going too far in the other direction (higher) once they finally embrace religion.

So religiously tightening rates and then draining the Fed Balance Sheet in the midst of a war, historically doesn't workout very well. So I can't disagree with the sentiments of 'not fighting the Fed', even as I properly called this recent S&P reversal from down-to-up. Certainly some analysts are understandably relieved at this, but my nature, as having caught the recent lows, is to be 'less' optimistic as S&P works higher. But the skeptics last week are still skeptics so to the extent that means anything, we probably see stocks grind a bit higher.

For sure there is some technical clearance about critical S&P support points, the VIX is pummeled again after technicians mistook what it was telegraphing as a risky market, when I pointed-out it related to the (then notable) Chinese restrictions and liquidations by certain funds in trouble, compelled to raise big funds, so that helped give us the low.

Today the U.S. and U.K. struck a deal to stop U.S. tariffs on British steel and aluminum, as the Brits end tariffs on American whiskey (which few drink over there, but fine), motorcycles and tobacco.

Upon further review of Chairman Powell's comments, strategists decided that Mr. Powell is a softie and won't carry-through. We don't know, but suspect he will be flexible as needed, and that's the odd reason the Fed wouldn't hike so much as 'they' talk about doing so, because the nation would be in a recession first.

Of course that's the Carl Icahn viewpoint, of recession or worse. I contend we already had that during early COVID, made a significant low on March 23rd of 2020, so that means we're 2 years into a secular bull market, not a decade+. However it's so split-up, the inflation is Oil-promulgated and predates the war, which only added to the upward impulse, and that continues. Of course Oil is going to break fast, 'if' a significant move toward peace negotiations occurs.

Do we have a new lease on life? Not exactly: the green IPO's were millstones to be sure, the Oil stocks were dynamite (and our number one sector last year as you know), and the small-cap specs have been trading around the lows for the most part barely showing signs of life, after the SPAC collapses. We have a sprinkling of those 'after' they plunged, as they may be interesting over time but generally are not surging higher on a dime.

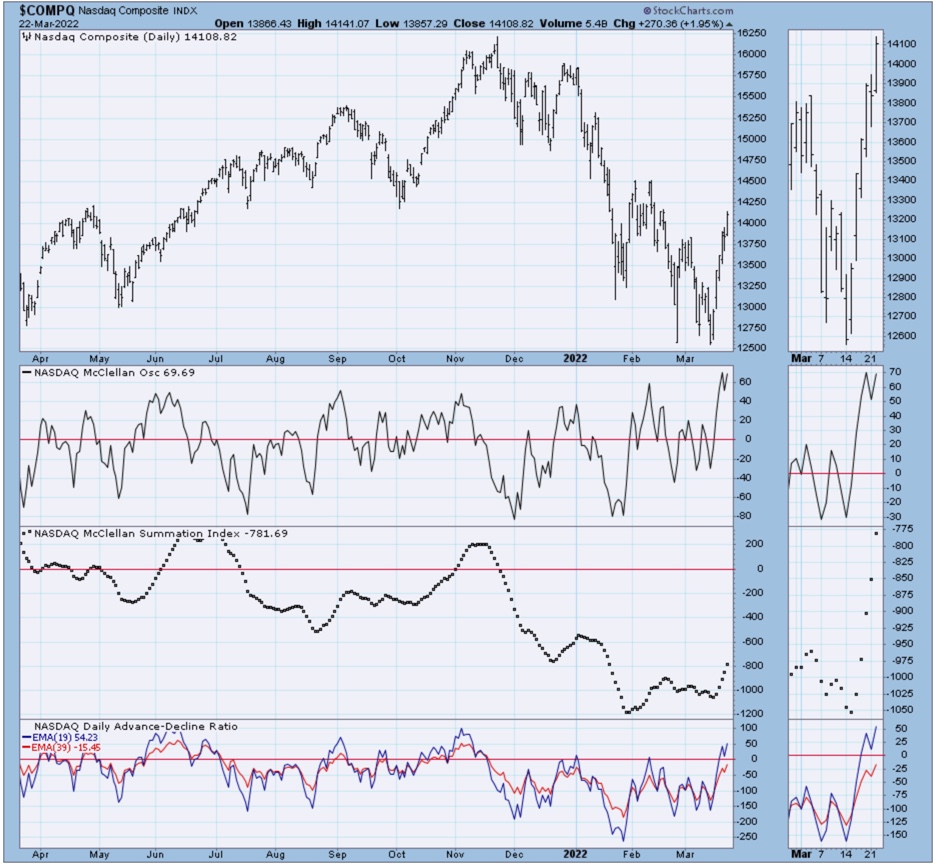

But they are a part of this very bifurcated market, which makes trying to label the broad market rather tricky. I guess we just did: it's really bifurcated and the internals are not as high as the S&P or other major Indexes. Some strategists have jumped onboard, but I sense they are dutifully belatedly trend-following, and not really enthusiastic about how this pans-out. They are a bit paranoid in that way, and I understand that. The bears... Russian bears... may be coming to get them, and on the other hand one has to ask: what if they don't?

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more